Tecogen Inc. (TGEN): Price and Financial Metrics

TGEN Price/Volume Stats

| Current price | $0.71 | 52-week high | $1.23 |

| Prev. close | $0.71 | 52-week low | $0.59 |

| Day low | $0.71 | Volume | 4,957 |

| Day high | $0.72 | Avg. volume | 14,683 |

| 50-day MA | $0.73 | Dividend yield | N/A |

| 200-day MA | $0.78 | Market Cap | 17.52M |

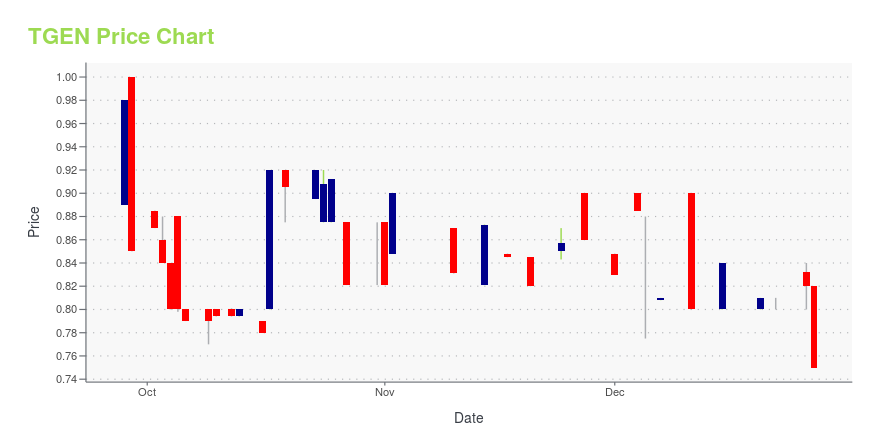

TGEN Stock Price Chart Interactive Chart >

Tecogen Inc. (TGEN) Company Bio

Company designs, manufactures, and sells industrial and commercial cogeneration systems that produce combinations of electricity, hot water, and air conditioning in the United States, the United Kingdom, Mexico, Ireland, and internationally. The company was founded n 2000 and is based in Waltham, Massachusetts.

Latest TGEN News From Around the Web

Below are the latest news stories about TECOGEN INC that investors may wish to consider to help them evaluate TGEN as an investment opportunity.

Tecogen Announces Chiller Order From a Large Educational Institution in ConnecticutWALTHAM, MA, Nov. 29, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire – Tecogen Inc. (OTCQX: TGEN), a clean energy company providing ultra-efficient and clean on-site power, heating and cooling equipment, is pleased to announce an order for a 400-ton Tecochill unit from a large educational institution in Connecticut, facilitated by Clover Corp., a long-standing Manufacturers’ Representative for Tecogen. “Connecticut has some of the highest electric rates in the Northeast due to grid congestion in the |

Tecogen Inc. (PNK:TGEN) Q3 2023 Earnings Call TranscriptTecogen Inc. (PNK:TGEN) Q3 2023 Earnings Call Transcript November 10, 2023 Operator: Greetings, and welcome to Tecogen’s Third Quarter 2023 Conference Call. At this time, all participants are in listen-only mode. A question-and-answer session will follow the formal presentation. [Operator Instructions] Please note this conference is being recorded. At this time, I’ll turn the conference […] |

Q3 2023 Tecogen Inc Earnings CallQ3 2023 Tecogen Inc Earnings Call |

Tecogen Announces Third Quarter 2023 ResultsQ3 2023 Revenue of $7.1 Million, an Increase of 7.5% QoQ WALTHAM, MA, Nov. 08, 2023 (GLOBE NEWSWIRE) -- via NewMediaWire - Tecogen Inc. (OTCQX:TGEN), a leading manufacturer of clean energy products, reported revenues of $7.1 million and a net loss of $0.5 million for the quarter ended September 30, 2023 compared to revenues of $6.6 million, and a net loss of $0.3 million in 2022. For the nine months ended September 30, 2023 revenues were $19.2 million and the net loss was $2.8 million compared t |

Lennox International (LII) Tops Q3 Earnings and Revenue EstimatesLennox (LII) delivered earnings and revenue surprises of 13.53% and 6.75%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

TGEN Price Returns

| 1-mo | 2.75% |

| 3-mo | -10.94% |

| 6-mo | -10.64% |

| 1-year | -38.26% |

| 3-year | -67.58% |

| 5-year | -78.81% |

| YTD | -12.35% |

| 2023 | -35.20% |

| 2022 | 4.17% |

| 2021 | -1.64% |

| 2020 | -42.45% |

| 2019 | -41.60% |

Continue Researching TGEN

Want to see what other sources are saying about Tecogen Inc's financials and stock price? Try the links below:Tecogen Inc (TGEN) Stock Price | Nasdaq

Tecogen Inc (TGEN) Stock Quote, History and News - Yahoo Finance

Tecogen Inc (TGEN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...