Triumph Group, Inc. (TGI): Price and Financial Metrics

TGI Price/Volume Stats

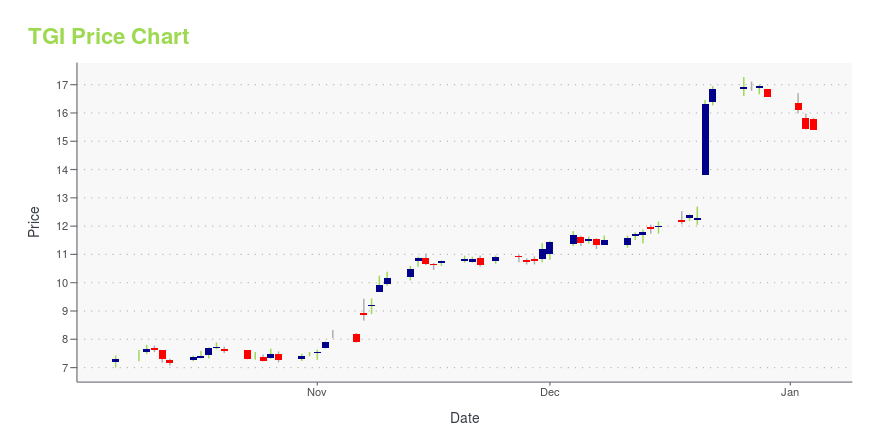

| Current price | $16.67 | 52-week high | $17.87 |

| Prev. close | $16.38 | 52-week low | $7.00 |

| Day low | $16.57 | Volume | 950,367 |

| Day high | $16.91 | Avg. volume | 812,224 |

| 50-day MA | $15.28 | Dividend yield | N/A |

| 200-day MA | $13.55 | Market Cap | 1.28B |

TGI Stock Price Chart Interactive Chart >

Triumph Group, Inc. (TGI) Company Bio

Triumph Group designs, engineers, manufactures, repairs and overhauls a broad portfolio of aerostructures, aircraft components, accessories, subassemblies and systems. The company was founded in 1979 and is based in Hamilton, Bermuda.

Latest TGI News From Around the Web

Below are the latest news stories about TRIUMPH GROUP INC that investors may wish to consider to help them evaluate TGI as an investment opportunity.

Triumph Group (TGI)'s Technical Outlook is Bright After Key Golden CrossIs it a good or bad thing when a stock experiences a golden cross technical event? |

5 Defense Stocks That Could Keep Winning Streaks Alive in 2024Companies in the Zacks Aerospace sector, which houses the defense stocks, are expected to record annual earnings growth of 32.3% on 8.2% sales growth in 2024. You may buy ACHR, AVAV, RYCEY, TDG and TGI. |

Triumph Group (TGI) to Sell Product-Support Business for $725MTriumph Group (TGI) is set to benefit from the divestiture of its Product Support business through debt reduction and better capital allocation. |

Triumph Group (TGI) Soars 32.9%: Is Further Upside Left in the Stock?Triumph Group (TGI) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. |

Company News for Dec 22, 2023Companies In The Article Are:TGI,AIR,CCL,CTAS,APOG |

TGI Price Returns

| 1-mo | 9.82% |

| 3-mo | 22.04% |

| 6-mo | 5.31% |

| 1-year | 40.08% |

| 3-year | -13.45% |

| 5-year | -25.00% |

| YTD | 0.54% |

| 2023 | 57.60% |

| 2022 | -43.23% |

| 2021 | 47.53% |

| 2020 | -50.19% |

| 2019 | 121.29% |

Continue Researching TGI

Want to see what other sources are saying about Triumph Group Inc's financials and stock price? Try the links below:Triumph Group Inc (TGI) Stock Price | Nasdaq

Triumph Group Inc (TGI) Stock Quote, History and News - Yahoo Finance

Triumph Group Inc (TGI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...