Thermon Group Holdings, Inc. (THR): Price and Financial Metrics

THR Price/Volume Stats

| Current price | $33.32 | 52-week high | $35.93 |

| Prev. close | $32.83 | 52-week low | $23.76 |

| Day low | $32.70 | Volume | 126,100 |

| Day high | $33.74 | Avg. volume | 225,392 |

| 50-day MA | $31.74 | Dividend yield | N/A |

| 200-day MA | $30.62 | Market Cap | 1.13B |

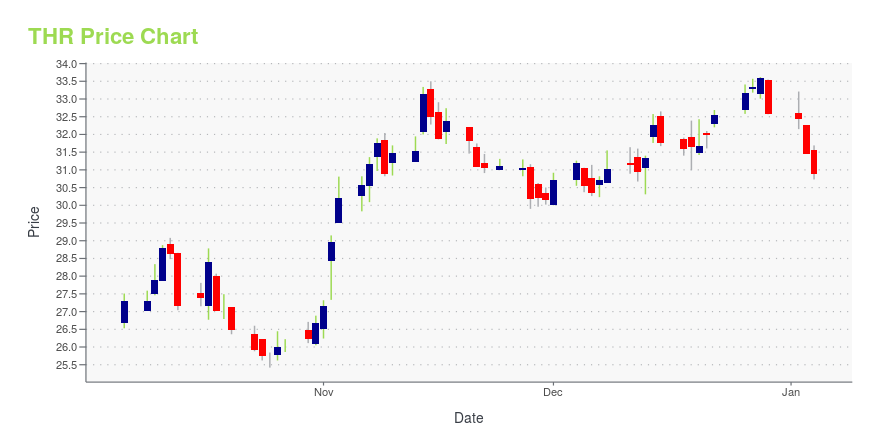

THR Stock Price Chart Interactive Chart >

Thermon Group Holdings, Inc. (THR) Company Bio

Thermon Group Holdings provides highly engineered thermal solutions, known as heat tracing, for process industries, including energy, chemical processing and power generation. Thermon's products provide an external heat source to pipes, vessels and instruments for the purposes of freeze protection, temperature maintenance, environmental monitoring and surface snow and ice melting. The company was founded in 1954 and is based in San Marcos, Texas.

Latest THR News From Around the Web

Below are the latest news stories about THERMON GROUP HOLDINGS INC that investors may wish to consider to help them evaluate THR as an investment opportunity.

Thermon Group Holdings, Inc.'s (NYSE:THR) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?Thermon Group Holdings (NYSE:THR) has had a great run on the share market with its stock up by a significant 22% over... |

Thermon Appoints Victor L. Richey to Board of DirectorsAUSTIN, TX / ACCESSWIRE / December 7, 2023 / Thermon Group Holdings, Inc. (NYSE:THR) ("Thermon"), a global leader in industrial process heating solutions, today announced the appointment of Mr. Victor L. Richey, retired Chairman and Chief Executive ... |

Zacks Industry Outlook Highlights Woodward, Badger Meter and Thermon GroupWoodward, Badger Meter and Thermon Group have been highlighted in this Industry Outlook article. |

Zacks.com featured highlights Axonics, Bel Fuse and ThermonAxonics, Bel Fuse and Thermon have been highlighted in this Screen of The Week article. |

3 Stocks Backed by High Efficiency to Increase Portfolio ReturnsInvest in stocks of Axonics (AXNX), Bel Fuse (BELFB) and Thermon (THR) to tap their high-efficiency levels. |

THR Price Returns

| 1-mo | 10.81% |

| 3-mo | 4.68% |

| 6-mo | 3.03% |

| 1-year | 18.49% |

| 3-year | 98.81% |

| 5-year | 28.75% |

| YTD | 2.30% |

| 2023 | 62.20% |

| 2022 | 18.61% |

| 2021 | 8.32% |

| 2020 | -41.68% |

| 2019 | 32.15% |

Continue Researching THR

Here are a few links from around the web to help you further your research on Thermon Group Holdings Inc's stock as an investment opportunity:Thermon Group Holdings Inc (THR) Stock Price | Nasdaq

Thermon Group Holdings Inc (THR) Stock Quote, History and News - Yahoo Finance

Thermon Group Holdings Inc (THR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...