Thorne Healthtech, Inc. (THRN): Price and Financial Metrics

THRN Price/Volume Stats

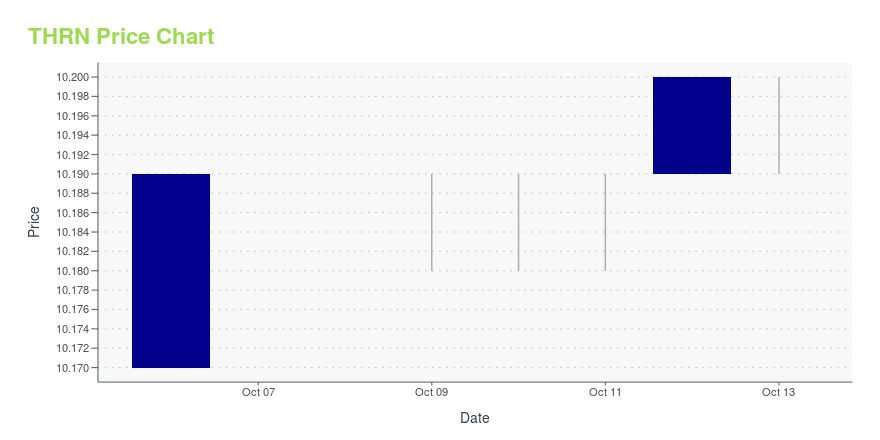

| Current price | $10.19 | 52-week high | $10.20 |

| Prev. close | $10.20 | 52-week low | $3.41 |

| Day low | $10.19 | Volume | 84,600 |

| Day high | $10.20 | Avg. volume | 110,986 |

| 50-day MA | $9.16 | Dividend yield | N/A |

| 200-day MA | $5.75 | Market Cap | 549.44M |

THRN Stock Price Chart Interactive Chart >

Thorne Healthtech, Inc. (THRN) Company Bio

Thorne HealthTech, Inc., a science-driven wellness company, provides solutions and personalized approaches to health and wellness in the United States and internationally. It offers various health tests, such as sleep, stress, weight management, gut health, heavy metals, biological age, and other health tests that generate molecular portraits for its customers, as well as develops nutritional supplements and offers wellness education solutions. The company uses the Onegevity platform to map, integrate, and understand the biological features that describe the state of an individual's health, as well as provide actionable insights and personalized data, products, and services that help individuals to take a proactive approach to improve and maintain their health. It serves healthcare professionals, professional athletes, and professional sports and Olympic teams. Thorne HealthTech, Inc. was founded in 1984 and is headquartered in New York, New York.

Latest THRN News From Around the Web

Below are the latest news stories about THORNE HEALTHTECH INC that investors may wish to consider to help them evaluate THRN as an investment opportunity.

L Catterton Completes Acquisition of Thorne HealthTech, Inc.L Catterton, a leading global consumer-focused investment firm, today announced the successful completion of its acquisition of Thorne HealthTech, Inc. ("Thorne") (NASDAQ: THRN), a leader in delivering innovative solutions for a personalized approach to health and wellness. |

L Catterton and Thorne HealthTech, Inc. Announce Expiration of Tender OfferL Catterton and Thorne HealthTech, Inc. ("Thorne") (NASDAQ: THRN) today announced that the tender offer to purchase all of the issued and outstanding shares of Thorne's common stock ("Shares") for $10.20 per Share, net to the seller in cash, without interest and less any required withholding taxes (the "Offer"), expired as scheduled at one minute past 11:59 p.m., Eastern Time, on October 12, 2023 and was not extended (such date and time, the "Expiration Time"). |

Should You Be Adding Thorne HealthTech (NASDAQ:THRN) To Your Watchlist Today?For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to... |

Thorne HealthTech, Inc. Enters into Definitive Agreement to be Acquired by L Catterton for $10.20 Per Share in CashThorne HealthTech, Inc. ("Thorne" or the "Company") (NASDAQ: THRN), a leader in delivering innovative solutions for a personalized approach to health and wellness, announced today that it has entered into a definitive agreement under which L Catterton, a leading global consumer-focused investment firm, will commence a tender offer to acquire all outstanding shares of common stock of Thorne for $10.20 per share in cash. The transaction value of approximately $680 million represents a 94% premium |

Investing in Thorne HealthTech (NASDAQ:THRN) a year ago would have delivered you a 46% gainThe simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you... |

THRN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 75.39% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -41.55% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...