TJX Cos. (TJX): Price and Financial Metrics

TJX Price/Volume Stats

| Current price | $111.83 | 52-week high | $115.35 |

| Prev. close | $111.27 | 52-week low | $85.27 |

| Day low | $111.51 | Volume | 4,958,740 |

| Day high | $112.52 | Avg. volume | 5,432,924 |

| 50-day MA | $108.19 | Dividend yield | 1.32% |

| 200-day MA | $97.59 | Market Cap | 126.38B |

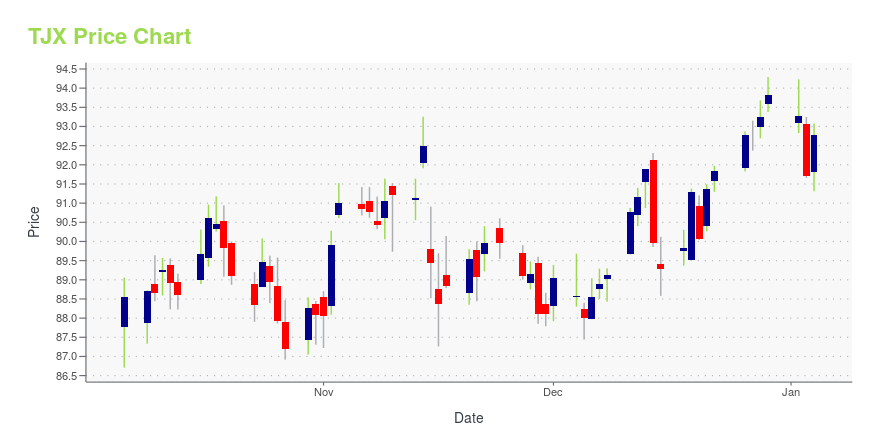

TJX Stock Price Chart Interactive Chart >

TJX Cos. (TJX) Company Bio

The TJX Companies, Inc. (abbreviated TJX) is an American multinational off-price department store corporation, headquartered in Framingham, Massachusetts. It was formed as a subsidiary of Zayre Corp. in 1987, and became the legal successor to Zayre Corp. following a company reorganization in 1989. (Source:Wikipedia)

Latest TJX News From Around the Web

Below are the latest news stories about TJX COMPANIES INC that investors may wish to consider to help them evaluate TJX as an investment opportunity.

The 500 Top Stocks to Buy for 2024, Ranked by AIThese are the very best stocks to buy for 2024 for any investor, according to Tom Yeung's MarketMasterAI system. |

Retailers Look To Tighten Rules as Fraudulent Returns GrowReturns are declining as a percentage of sales, a new report shows, but retailers are hardening up refund policies as fraud and abuse are on the rise. |

The Zacks Analyst Blog Highlights NVIDIA, Oracle, The TJX Companies, Chubb and XylemNVIDIA, Oracle, The TJX Companies, Chubb and Xylem are part of the Zacks top Analyst Blog . |

Top Stock Reports for NVIDIA, Oracle & The TJX CompaniesToda's Research Daily features new research reports on 16 major stocks, including NVIDIA Corporation (NVDA), Oracle Corporation (ORCL) and The TJX Companies, Inc. (TJX). |

Here's How The TJX Companies (TJX) Is Placed Ahead of 2024The TJX Companies' (TJX) off-price model, strategic store locations, impressive brands and fashion products keep it well-placed amid high costs. |

TJX Price Returns

| 1-mo | 1.17% |

| 3-mo | 16.50% |

| 6-mo | 16.87% |

| 1-year | 31.28% |

| 3-year | 71.38% |

| 5-year | 114.50% |

| YTD | 20.07% |

| 2023 | 19.69% |

| 2022 | 6.73% |

| 2021 | 12.83% |

| 2020 | 12.25% |

| 2019 | 38.76% |

TJX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TJX

Want to see what other sources are saying about Tjx Companies Inc's financials and stock price? Try the links below:Tjx Companies Inc (TJX) Stock Price | Nasdaq

Tjx Companies Inc (TJX) Stock Quote, History and News - Yahoo Finance

Tjx Companies Inc (TJX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...