Telekomunikasi Indonesia ADR (TLK): Price and Financial Metrics

TLK Price/Volume Stats

| Current price | $19.18 | 52-week high | $26.85 |

| Prev. close | $19.10 | 52-week low | $16.62 |

| Day low | $19.04 | Volume | 201,400 |

| Day high | $19.22 | Avg. volume | 345,741 |

| 50-day MA | $18.56 | Dividend yield | 4.31% |

| 200-day MA | $22.41 | Market Cap | 17.27B |

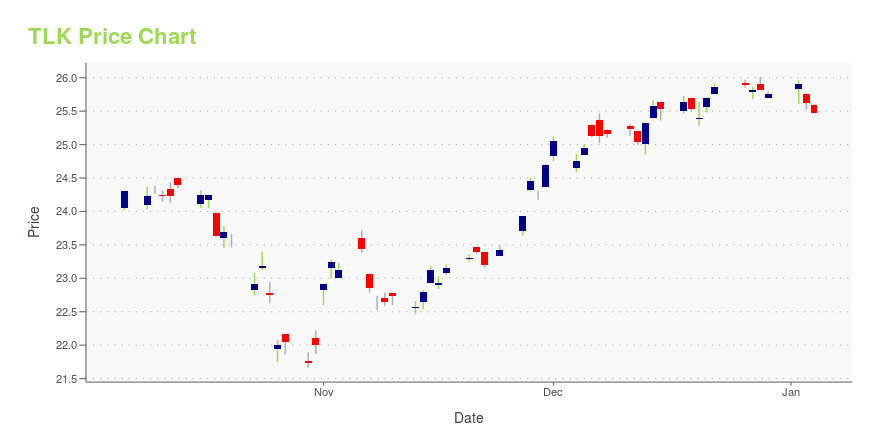

TLK Stock Price Chart Interactive Chart >

Telekomunikasi Indonesia ADR (TLK) Company Bio

PT Telkom Indonesia (Persero) Tbk, also simply known as Telkom, is an Indonesian multinational telecommunications conglomerate. Telkom is listed on the Indonesia Stock Exchange and has a secondary listing on the New York Stock Exchange. The government of Indonesia owns over half of Telkom's shares outstanding. (Source:Wikipedia)

Latest TLK News From Around the Web

Below are the latest news stories about PERUSAHAAN PERSEROAN PERSERO PT TELEKOMUNIKASI INDONESIA TBK that investors may wish to consider to help them evaluate TLK as an investment opportunity.

PT Telkom Indonesia (Persero) Tbk 2022 Annual Report on Form 20-FAs required by Section 203.01 of the New York Stock Exchange Listed Company Manual, Telkom Indonesia (IDX: TLKM) (NYSE: TLK) confirms that it has filed its annual report on Form 20-F for the year 2022 with the U.S. Securities and Exchange Commission. |

TLK Price Returns

| 1-mo | 5.67% |

| 3-mo | 5.47% |

| 6-mo | -21.36% |

| 1-year | -18.35% |

| 3-year | -4.73% |

| 5-year | -23.17% |

| YTD | -22.25% |

| 2023 | 11.39% |

| 2022 | -15.46% |

| 2021 | 27.67% |

| 2020 | -14.41% |

| 2019 | 12.53% |

TLK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TLK

Want to do more research on Perusahaan Perseroan Persero Pt Telekomunikasi Indonesia Tbk's stock and its price? Try the links below:Perusahaan Perseroan Persero Pt Telekomunikasi Indonesia Tbk (TLK) Stock Price | Nasdaq

Perusahaan Perseroan Persero Pt Telekomunikasi Indonesia Tbk (TLK) Stock Quote, History and News - Yahoo Finance

Perusahaan Perseroan Persero Pt Telekomunikasi Indonesia Tbk (TLK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...