Taylor Morrison Home Corporation (TMHC): Price and Financial Metrics

TMHC Price/Volume Stats

| Current price | $67.29 | 52-week high | $68.92 |

| Prev. close | $65.52 | 52-week low | $37.23 |

| Day low | $66.79 | Volume | 933,600 |

| Day high | $68.92 | Avg. volume | 783,874 |

| 50-day MA | $58.23 | Dividend yield | N/A |

| 200-day MA | $53.38 | Market Cap | 7.12B |

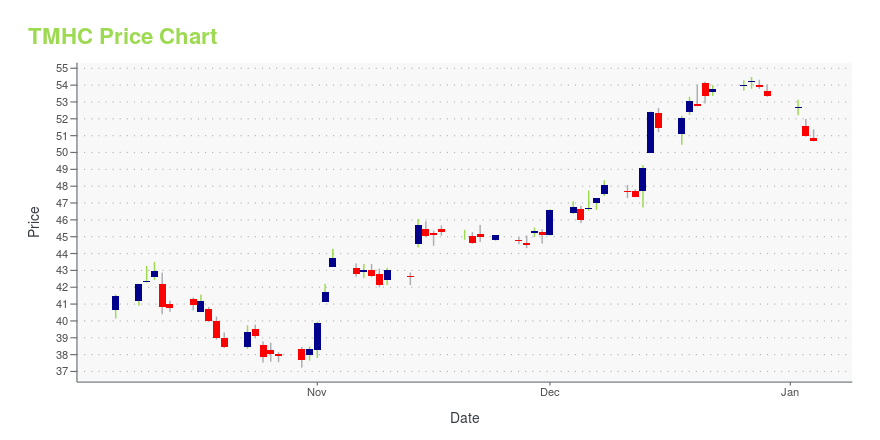

TMHC Stock Price Chart Interactive Chart >

Taylor Morrison Home Corporation (TMHC) Company Bio

Taylor Morrison Home Corporation operates as a public homebuilder in Houston, Austin, Dallas, north Florida, west Florida, Phoenix, northern California, southern California, and Denver, the United States. The company was founded in 1936 and is based in Scottsdale, Arizona.

Latest TMHC News From Around the Web

Below are the latest news stories about TAYLOR MORRISON HOME CORP that investors may wish to consider to help them evaluate TMHC as an investment opportunity.

13 Most Profitable Real Estate Stocks NowIn this piece, we will take a look at the 13 most profitable real estate stocks now. If you want to skip our overview of the real estate sector and the latest news, then take a look at the 5 Most Profitable Real Estate Stocks Now. In today’s high interest rate environment, the real estate […] |

Taylor Morrison Renews Stock Repurchase AuthorizationTaylor Morrison Home Corporation (NYSE: TMHC) today announced that its Board of Directors authorized a renewal of its stock repurchase program through December 31, 2025. The program permits the repurchase of up to $500 million of the Company's Common Stock and replaces the Company's prior repurchase authorization that was scheduled to expire on December 31, 2023. |

Taylor Morrison Home Corporation's (NYSE:TMHC) Stock Is Going Strong: Is the Market Following Fundamentals?Taylor Morrison Home (NYSE:TMHC) has had a great run on the share market with its stock up by a significant 15% over... |

Taylor Morrison Celebrates 100,000 Home Closings by Gifting First-Time Homebuyer with First Year's Mortgage Payments and 100,000 Household EssentialsTo celebrate 100,000 home closings since Taylor Morrison (NYSE: TMHC) became a publicly traded company in 2013, America's Most Trusted® Home Builder gifted a first-time homebuyer with their first-year's principal and interest mortgage payments. Nneoma Alfred was surprised with the gift at the closing of her new home. |

Taylor Morrison 'Builds Joy' Across the Country this Holiday SeasonFor the seventh consecutive year, America's Most Trusted® Home Builder Taylor Morrison (NYSE: TMHC) is putting the power of giving in the hands of its team members with its annual philanthropic program, Build Joy. This year, 10 team members were each awarded $1,000 to make a difference in their communities by supporting causes that are meaningful to them. |

TMHC Price Returns

| 1-mo | 21.81% |

| 3-mo | 16.90% |

| 6-mo | 26.99% |

| 1-year | 39.03% |

| 3-year | 166.71% |

| 5-year | 206.70% |

| YTD | 26.13% |

| 2023 | 75.78% |

| 2022 | -13.19% |

| 2021 | 36.30% |

| 2020 | 17.34% |

| 2019 | 37.48% |

Continue Researching TMHC

Here are a few links from around the web to help you further your research on Taylor Morrison Home Corp's stock as an investment opportunity:Taylor Morrison Home Corp (TMHC) Stock Price | Nasdaq

Taylor Morrison Home Corp (TMHC) Stock Quote, History and News - Yahoo Finance

Taylor Morrison Home Corp (TMHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...