TOMI Environmental Solutions Inc. (TOMZ): Price and Financial Metrics

TOMZ Price/Volume Stats

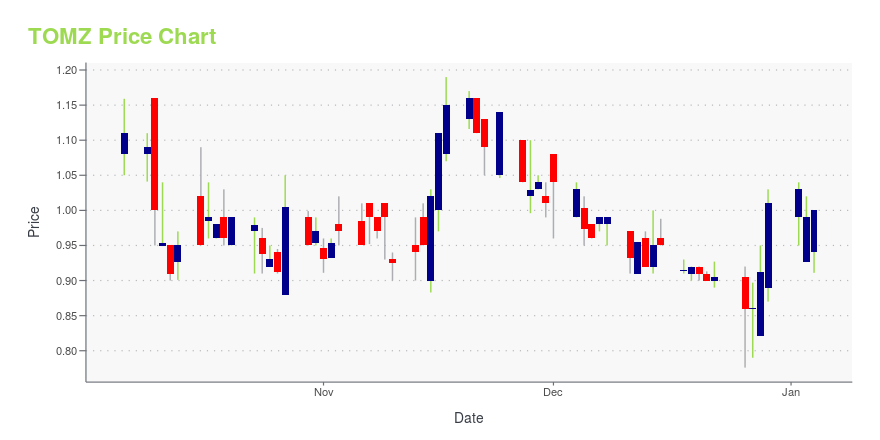

| Current price | $1.13 | 52-week high | $1.17 |

| Prev. close | $1.10 | 52-week low | $0.52 |

| Day low | $1.08 | Volume | 10,700 |

| Day high | $1.13 | Avg. volume | 83,727 |

| 50-day MA | $0.85 | Dividend yield | N/A |

| 200-day MA | $0.80 | Market Cap | 22.57M |

TOMZ Stock Price Chart Interactive Chart >

TOMI Environmental Solutions Inc. (TOMZ) Company Bio

TOMI Environmental Solutions Inc. offers bacteria decontamination and infectious disease control products. The Company provides green energy efficient environmental solutions for indoor surface contamination through the manufacturing, servicing, selling and licensing of its products. TOMI offers products to customers including hospitals, schools, restaurants and hotels.

TOMZ Price Returns

| 1-mo | 45.77% |

| 3-mo | 33.10% |

| 6-mo | 56.73% |

| 1-year | 36.14% |

| 3-year | 7.62% |

| 5-year | 15.78% |

| YTD | 7.62% |

| 2024 | 3.96% |

| 2023 | 105.28% |

| 2022 | -70.18% |

| 2021 | -63.89% |

| 2020 | 406.43% |

Loading social stream, please wait...