TOP Ships Inc. (TOPS): Price and Financial Metrics

TOPS Price/Volume Stats

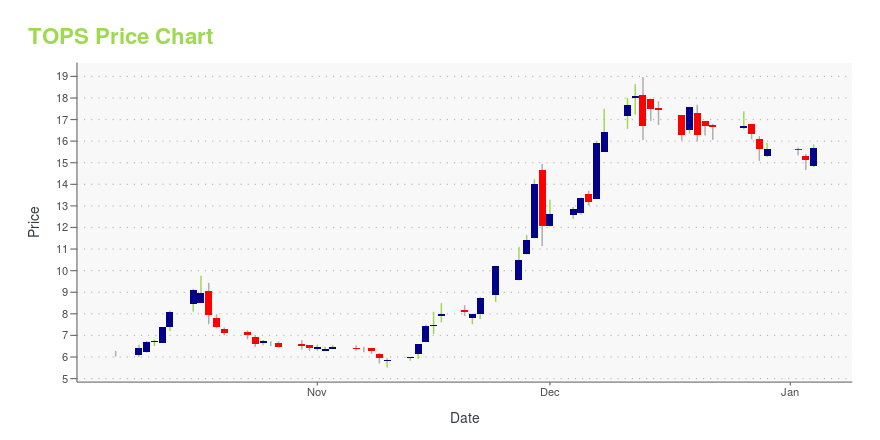

| Current price | $10.77 | 52-week high | $18.97 |

| Prev. close | $10.67 | 52-week low | $5.51 |

| Day low | $10.24 | Volume | 3,400 |

| Day high | $11.07 | Avg. volume | 14,915 |

| 50-day MA | $11.90 | Dividend yield | N/A |

| 200-day MA | $12.32 | Market Cap | 49.82M |

TOPS Stock Price Chart Interactive Chart >

TOP Ships Inc. (TOPS) Company Bio

Top Ships, Inc. offers marine shipping services. The Company owns ships and transports petroleum products and crude oil internationally.

Latest TOPS News From Around the Web

Below are the latest news stories about TOP SHIPS INC that investors may wish to consider to help them evaluate TOPS as an investment opportunity.

Returns On Capital Are Showing Encouraging Signs At Top Ships (NASDAQ:TOPS)If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for... |

TOP Ships Announces Share Repurchase ProgramATHENS, Greece, Dec. 14, 2023 (GLOBE NEWSWIRE) -- TOP Ships Inc. (the “Company” or “Top Ships”) (NASDAQ:TOPS), an international owner and operator of modern, fuel efficient “ECO” tanker vessels, announced today a share repurchase program. The Company’s Board of Directors (the “Board”) today authorized a share repurchase program under which the Company may repurchase up to $4 million of its outstanding common shares, representing approximately 5.2% of the Company’s market capitalization as of Dec |

Top Ships Announces Increase From Previously Announced Management Estimate of Net Asset Value to $344 Million and Contracted Revenue Backlog of $400 MillionATHENS, Greece, Dec. 12, 2023 (GLOBE NEWSWIRE) -- TOP Ships Inc. (the “Company” or “Top Ships”) (NASDAQ:TOPS), an international owner and operator of modern, fuel efficient “ECO” tanker vessels, announced today that after taking into account the most recent charter free vessel value estimates from a third party international broker, debt outstanding and cash, management estimates the Company’s net asset value (“NAV”) as of December 12, 2023 to be $344 million, increased from the previously-annou |

TOP Ships Announces Increase in Shareholding by Pistiolis Family to 73% Via Full Conversion of Preferred Shares and Open-Market Purchases Demonstrating the CEO’S Commitment to the CompanyATHENS, Greece, Dec. 07, 2023 (GLOBE NEWSWIRE) -- TOP Ships Inc. (the “Company” or “Top Ships”) (NASDAQ:TOPS), an international owner and operator of modern, fuel efficient “ECO” tanker vessels, announced today that it has issued 2,930,718 common shares pursuant to an exercise notice for the conversion of 100% of the Series E preferred shares held by a trust for the benefit of family members of the Company’s CEO. Following this issuance, as of the date hereof, the total number of common shares o |

TOP Ships Inc. Announces Extension of Time Charter Employment for Two VLCC TankersATHENS, Greece, Nov. 22, 2023 (GLOBE NEWSWIRE) -- TOP Ships Inc. (NASDAQ: TOPS) (the “Company”), an international owner and operator of modern, fuel efficient "ECO" tanker vessels, announced today that it has agreed to extend the time charter employment contracts of its two VLCC vessels, M/T Julius Caesar and M/T Legio X Equestris, at an increased rate. Specifically, the firm period will be extended for approximately 3 years at a daily rate of $41,500 per vessel with two additional years at the |

TOPS Price Returns

| 1-mo | -3.58% |

| 3-mo | -13.22% |

| 6-mo | -21.96% |

| 1-year | 30.07% |

| 3-year | -96.57% |

| 5-year | -99.98% |

| YTD | -31.05% |

| 2023 | 2.49% |

| 2022 | -92.40% |

| 2021 | -30.99% |

| 2020 | -93.95% |

| 2019 | -95.12% |

Continue Researching TOPS

Here are a few links from around the web to help you further your research on Top Ships Inc's stock as an investment opportunity:Top Ships Inc (TOPS) Stock Price | Nasdaq

Top Ships Inc (TOPS) Stock Quote, History and News - Yahoo Finance

Top Ships Inc (TOPS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...