TOR Minerals International Inc (TORM): Price and Financial Metrics

TORM Price/Volume Stats

| Current price | $1.53 | 52-week high | $2.30 |

| Prev. close | $1.85 | 52-week low | $0.56 |

| Day low | $1.45 | Volume | 8,500 |

| Day high | $1.85 | Avg. volume | 1,999 |

| 50-day MA | $1.88 | Dividend yield | N/A |

| 200-day MA | $2.07 | Market Cap | 5.42M |

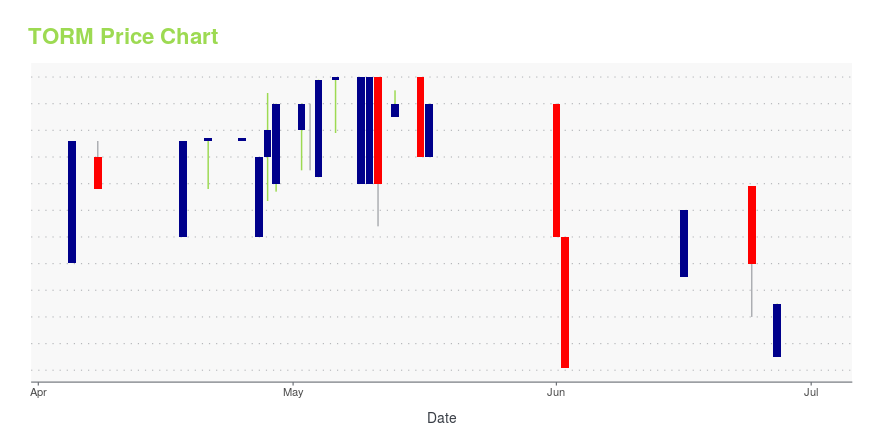

TORM Stock Price Chart Interactive Chart >

Latest TORM News From Around the Web

Below are the latest news stories about TOR MINERALS INTERNATIONAL INC that investors may wish to consider to help them evaluate TORM as an investment opportunity.

TOR Minerals International (OTCMKTS:TORM) Share Price Crosses Below Two Hundred Day Moving Average of $2.48TOR Minerals International, Inc. (OTCMKTS:TORM)s share price crossed below its 200-day moving average during trading on Monday . The stock has a 200-day moving average of $2.48 and traded as low as $2.36. TOR Minerals International shares last traded at $2.89, with a volume of 1,906 shares. The business has a 50 day moving average [] |

TORM Price Returns

| 1-mo | -15.93% |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | -23.50% |

| YTD | -12.57% |

| 2023 | -26.78% |

| 2022 | 9.63% |

| 2021 | 77.24% |

| 2020 | -19.08% |

| 2019 | -40.39% |

Loading social stream, please wait...