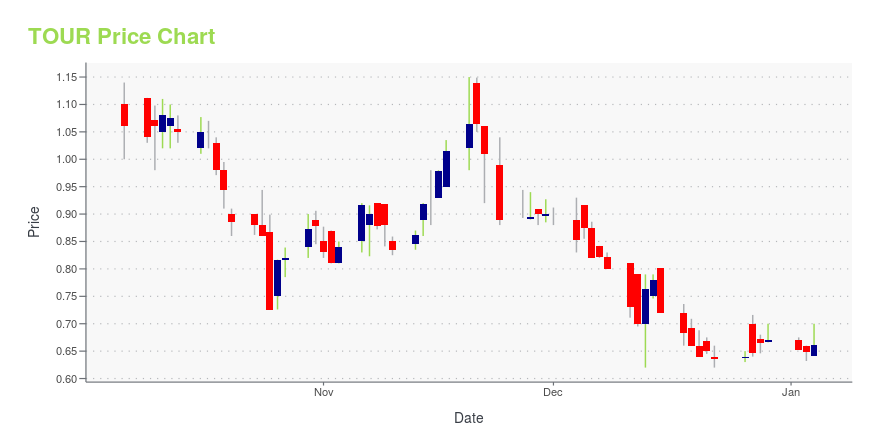

Tuniu Corporation (TOUR): Price and Financial Metrics

TOUR Price/Volume Stats

| Current price | $0.93 | 52-week high | $1.60 |

| Prev. close | $0.90 | 52-week low | $0.59 |

| Day low | $0.88 | Volume | 88,200 |

| Day high | $0.93 | Avg. volume | 277,920 |

| 50-day MA | $0.98 | Dividend yield | N/A |

| 200-day MA | $0.83 | Market Cap | 120.18M |

TOUR Stock Price Chart Interactive Chart >

Tuniu Corporation (TOUR) Company Bio

Tuniu Corporation provides online leisure travel services in China. The company was founded in 2006 and is based in Nanjing, China.

Latest TOUR News From Around the Web

Below are the latest news stories about TUNIU CORP that investors may wish to consider to help them evaluate TOUR as an investment opportunity.

Tuniu (NASDAQ:TOUR) Shareholders Will Want The ROCE Trajectory To ContinueWhat are the early trends we should look for to identify a stock that could multiply in value over the long term... |

Tuniu Corporation (NASDAQ:TOUR) Q3 2023 Earnings Call TranscriptTuniu Corporation (NASDAQ:TOUR) Q3 2023 Earnings Call Transcript November 21, 2023 Operator: Hello, and thank you for standing by for Tuniu’s 2023 Third Quarter Earnings Conference Call [Operator Instructions]. Today’s conference is being recorded. If you have any objections, you may disconnect at this time. I would now like to turn the meeting over to […] |

Tuniu Announces Unaudited Third Quarter 2023 Financial ResultsTuniu Corporation (NASDAQ: TOUR) ("Tuniu" or the "Company"), a leading online leisure travel company in China, today announced its unaudited financial results for the third quarter ended September 30, 2023. |

Tuniu to Report Third Quarter 2023 Financial Results on November 21, 2023Tuniu Corporation (NASDAQ:TOUR) ("Tuniu" or the "Company"), a leading online leisure travel company in China, today announced that it plans to release its unaudited financial results for the third quarter ended September 30, 2023, before the market opens on November 21, 2023. |

When Will Tuniu Corporation (NASDAQ:TOUR) Turn A Profit?With the business potentially at an important milestone, we thought we'd take a closer look at Tuniu Corporation's... |

TOUR Price Returns

| 1-mo | 4.46% |

| 3-mo | 9.72% |

| 6-mo | 40.27% |

| 1-year | -36.73% |

| 3-year | -52.06% |

| 5-year | -72.24% |

| YTD | 38.60% |

| 2023 | -55.56% |

| 2022 | 55.67% |

| 2021 | -44.89% |

| 2020 | -30.16% |

| 2019 | -48.15% |

Continue Researching TOUR

Want to do more research on Tuniu Corp's stock and its price? Try the links below:Tuniu Corp (TOUR) Stock Price | Nasdaq

Tuniu Corp (TOUR) Stock Quote, History and News - Yahoo Finance

Tuniu Corp (TOUR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...