TPG Inc. (TPG): Price and Financial Metrics

TPG Price/Volume Stats

| Current price | $49.45 | 52-week high | $49.75 |

| Prev. close | $48.83 | 52-week low | $26.03 |

| Day low | $48.54 | Volume | 795,000 |

| Day high | $49.66 | Avg. volume | 825,356 |

| 50-day MA | $42.94 | Dividend yield | 3.35% |

| 200-day MA | $40.54 | Market Cap | 18.03B |

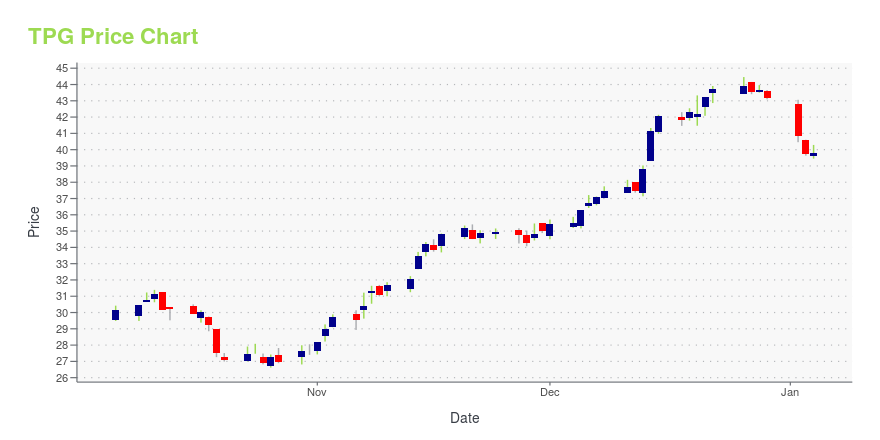

TPG Stock Price Chart Interactive Chart >

TPG Inc. (TPG) Company Bio

TPG Inc. operates as an alternative asset manager worldwide. It offers investment management services to unconsolidated funds, collateralized loan obligations, and other vehicles; monitoring services to portfolio companies; advisory services, debt and equity arrangements, and underwriting and placement services; and capital structuring and other advisory services to portfolio companies. The company invests in private equity funds, real estate funds, fund of hedge funds, and credit funds. TPG Inc. was founded in 1992 and is based in Fort Worth, Texas.

Latest TPG News From Around the Web

Below are the latest news stories about TPG INC that investors may wish to consider to help them evaluate TPG as an investment opportunity.

Should You Add TPG (TPG)?TimesSquare Capital Management, an equity investment management company, released its “U.S. SMID Cap Growth Strategy” third-quarter investor letter. The same can be downloaded here. In the third quarter, the U.S. SMID Cap Growth Composite fell -2.65% (gross) and -2.89% (net) compared to the Russell 2500 Growth Index’s -6.84% decline. This quarter, the small-to-mid-cap growth stocks […] |

TPG Expands Board of DirectorsSAN FRANCISCO & FORT WORTH, Texas, December 15, 2023--TPG Inc. (NASDAQ: TPG), a leading global alternative asset management firm, announced today that Nehal Raj, Jeffrey Rhodes, and Josh Baumgarten have joined the firm’s Board of Directors. Raj and Rhodes serve as Co-Managing Partners of TPG Capital, the firm’s U.S. and European private equity business, and Baumgarten, as Co-Managing Partner of TPG Angelo Gordon, the firm’s diversified credit and real estate investing platform. |

ALTÉRRA Commits US$1.5 Billion to TPG Rise Climate’s US$10 Billion Next Generation Private Equity Funds Including New Global South Initiative and TPG Rise Climate IIDUBAI, United Arab Emirates & SAN FRANCISCO & FORT WORTH, Texas, December 01, 2023--TPG, a leading global alternative asset management firm, and ALTÉRRA, the world’s largest private investment vehicle for climate change action launched at the World Climate Action Summit at COP28, today announced an aggregate US$1.5 billion commitment to the next generation of TPG Rise Climate private equity funds, including its new Global South Initiative. |

TPG to Present at the Goldman Sachs 2023 U.S. Financial Services ConferenceSAN FRANCISCO & FORT WORTH, Texas, November 21, 2023--TPG Inc. (NASDAQ: TPG), a leading global alternative asset management firm, announced today that Jon Winkelried, Chief Executive Officer, is scheduled to present at the Goldman Sachs 2023 U.S. Financial Services Conference on Tuesday, December 5, 2023 at 3:00 p.m. ET. |

Potential Upside For TPG Inc. (NASDAQ:TPG) Not Without RiskWith a price-to-sales (or "P/S") ratio of 1.4x TPG Inc. ( NASDAQ:TPG ) may be sending bullish signals at the moment... |

TPG Price Returns

| 1-mo | 18.10% |

| 3-mo | 13.79% |

| 6-mo | 19.53% |

| 1-year | 71.40% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 16.82% |

| 2023 | 62.37% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

TPG Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...