TRI Pointe Group, Inc. (TPH): Price and Financial Metrics

TPH Price/Volume Stats

| Current price | $46.12 | 52-week high | $47.78 |

| Prev. close | $45.32 | 52-week low | $24.18 |

| Day low | $46.11 | Volume | 1,213,797 |

| Day high | $47.78 | Avg. volume | 965,135 |

| 50-day MA | $39.32 | Dividend yield | N/A |

| 200-day MA | $34.84 | Market Cap | 4.38B |

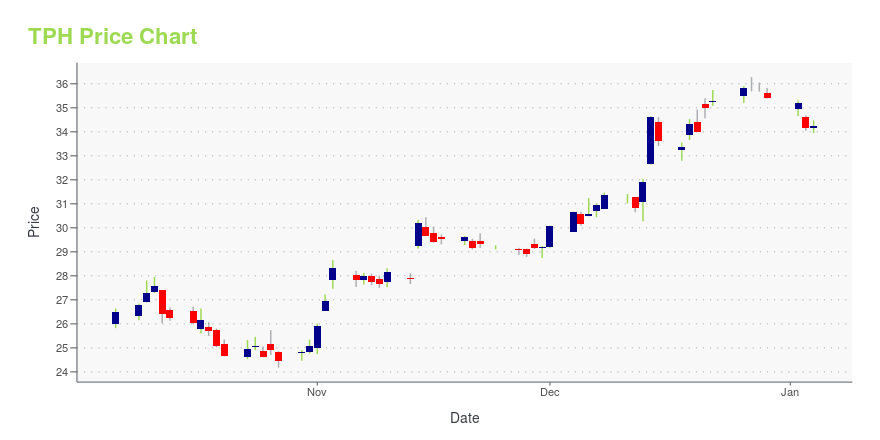

TPH Stock Price Chart Interactive Chart >

TRI Pointe Group, Inc. (TPH) Company Bio

Tri Pointe Homes Inc. designs, constructs, and sells single-family homes across eight states, including Maracay Homes in Arizona, Pardee Homes in California and Nevada, Quadrant Homes in Washington, Trendmaker Homes in Texas, TRI Pointe Homes in California and Colorado, and Winchester Homes in Maryland and Virginia. The company was founded in 2009 and is based in Irvine, California.

Latest TPH News From Around the Web

Below are the latest news stories about TRI POINTE HOMES INC that investors may wish to consider to help them evaluate TPH as an investment opportunity.

Tri Pointe Homes, Inc. Announces $250 Million Stock Repurchase ProgramINCLINE VILLAGE, Nev., Dec. 21, 2023 (GLOBE NEWSWIRE) -- Tri Pointe Homes, Inc. (the “Company”) (NYSE:TPH) today announced that its Board of Directors has approved a new stock repurchase program authorizing the repurchase of up to $250 million of common stock through December 31, 2024 (the “Repurchase Program”), which replaces the stock repurchase program that the Board of Directors authorized in February 2023 (the “2023 Repurchase Program”). For the fourth quarter through December 19, 2023, und |

Tri Pointe Homes' (NYSE:TPH) five-year earnings growth trails the 25% YoY shareholder returnsThe most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a... |

Tri Pointe (TPH) Upgraded to Strong Buy: Here's WhyTri Pointe (TPH) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy). |

The Tri Pointe Homes Inc (TPH) Company: A Short SWOT AnalysisUnveiling the Strengths, Weaknesses, Opportunities, and Threats of Tri Pointe Homes Inc |

Tri Pointe Homes, Inc. (NYSE:TPH) Q3 2023 Earnings Call TranscriptTri Pointe Homes, Inc. (NYSE:TPH) Q3 2023 Earnings Call Transcript October 26, 2023 Tri Pointe Homes, Inc. beats earnings expectations. Reported EPS is $0.76, expectations were $0.54. Operator: Greetings and welcome to the Tri Pointe Homes Third Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer […] |

TPH Price Returns

| 1-mo | 25.77% |

| 3-mo | 21.75% |

| 6-mo | 32.57% |

| 1-year | 54.09% |

| 3-year | 98.45% |

| 5-year | 239.37% |

| YTD | 30.28% |

| 2023 | 90.42% |

| 2022 | -33.35% |

| 2021 | 61.68% |

| 2020 | 10.72% |

| 2019 | 42.54% |

Continue Researching TPH

Want to see what other sources are saying about TRI Pointe Group Inc's financials and stock price? Try the links below:TRI Pointe Group Inc (TPH) Stock Price | Nasdaq

TRI Pointe Group Inc (TPH) Stock Quote, History and News - Yahoo Finance

TRI Pointe Group Inc (TPH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...