Tapestry Inc. (TPR): Price and Financial Metrics

TPR Price/Volume Stats

| Current price | $40.82 | 52-week high | $48.80 |

| Prev. close | $39.65 | 52-week low | $25.99 |

| Day low | $40.03 | Volume | 2,380,000 |

| Day high | $41.01 | Avg. volume | 3,336,481 |

| 50-day MA | $42.10 | Dividend yield | 3.4% |

| 200-day MA | $39.06 | Market Cap | 9.38B |

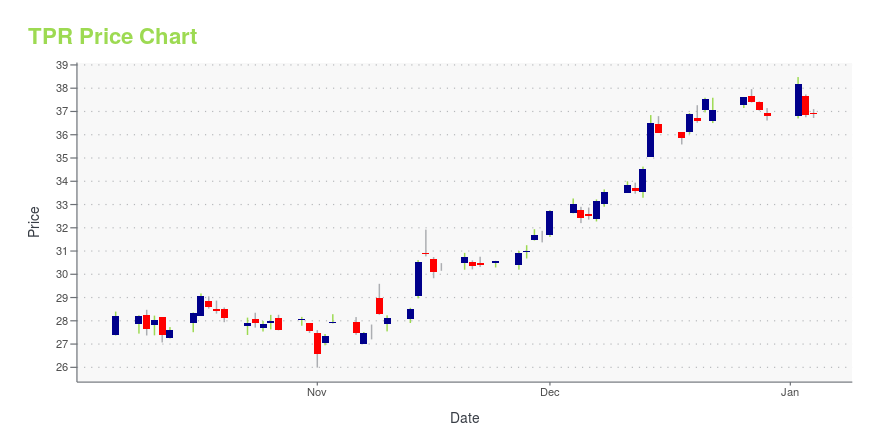

TPR Stock Price Chart Interactive Chart >

Tapestry Inc. (TPR) Company Bio

Tapestry, Inc. is an American multinational luxury fashion holding company. It is based in New York City and is the parent company of three major brands: Coach New York, Kate Spade New York and Stuart Weitzman. Originally named Coach, Inc., the business changed its name to Tapestry on October 31, 2017. (Source:Wikipedia)

Latest TPR News From Around the Web

Below are the latest news stories about TAPESTRY INC that investors may wish to consider to help them evaluate TPR as an investment opportunity.

12 of the Top M&A Deals in Footwear, Fashion and Retail in 2023This year brought a flurry of deals both big and small, including a blockbuster merger between Tapestry and Capri. |

40 Luxury Gifts for Men Who Have EverythingIn this article, we’ll take a look at the 40 Luxury Gifts for Men Who Have Everything, with insights into the recent developments in the luxury goods market. For a quick overview of the top 10 luxury gifts, read 10 Luxury Gifts for Men Who Have Everything. The luxury goods market is a multi-billion-dollar industry […] |

Tapestry's (TPR) Growth Strategies Appear EncouragingTapestry (TPR) is constantly making great moves to offer a seamless customer experience. |

The pandemic CEO: How executives who came to power forged the blueprint for a new kind of leaderThe Fortune 500 companies that appointed new CEOs in the pandemic outperformed their peers. These 5 traits help explain why. |

Why Is Tapestry Selling Coach Bags on Amazon?Tapestry is trying to build a high-end fashion powerhouse, but it has also started selling bags from its most successful business on Amazon. |

TPR Price Returns

| 1-mo | -2.11% |

| 3-mo | 2.75% |

| 6-mo | 6.39% |

| 1-year | 0.94% |

| 3-year | 9.33% |

| 5-year | 52.92% |

| YTD | 12.63% |

| 2023 | 0.16% |

| 2022 | -3.32% |

| 2021 | 32.29% |

| 2020 | 16.86% |

| 2019 | -15.97% |

TPR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching TPR

Here are a few links from around the web to help you further your research on Tapestry Inc's stock as an investment opportunity:Tapestry Inc (TPR) Stock Price | Nasdaq

Tapestry Inc (TPR) Stock Quote, History and News - Yahoo Finance

Tapestry Inc (TPR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...