Trex Company, Inc. (TREX): Price and Financial Metrics

TREX Price/Volume Stats

| Current price | $82.50 | 52-week high | $101.91 |

| Prev. close | $78.48 | 52-week low | $53.59 |

| Day low | $80.41 | Volume | 1,012,600 |

| Day high | $83.73 | Avg. volume | 853,530 |

| 50-day MA | $81.36 | Dividend yield | N/A |

| 200-day MA | $81.24 | Market Cap | 8.97B |

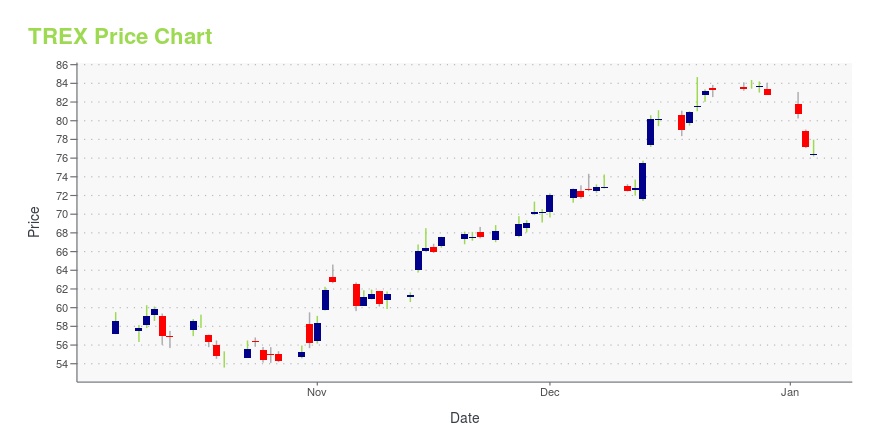

TREX Stock Price Chart Interactive Chart >

Trex Company, Inc. (TREX) Company Bio

Trex Company manufactures and distributes wood/plastic composite products, and related accessories primarily for the residential and commercial decking, and railing applications in the United States. The company was founded in 1996 and is based in Winchester, Virginia.

Latest TREX News From Around the Web

Below are the latest news stories about TREX CO INC that investors may wish to consider to help them evaluate TREX as an investment opportunity.

Trex (TREX) Upgraded to Buy: Here's WhyTrex (TREX) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

5 Top-Ranked Construction Stocks That More Than Doubled the S&PImproving inflation and stable interest rates are likely to contribute to the construction sector, going forward. Let's check why investors are more inclined to DFH, STRL, BLD, IBP and TREX this year. |

Trex Company, Inc. (TREX) Soars to 52-Week High, Time to Cash Out?Trex (TREX) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues. |

Trex Stock Keeps Climbing After 300% Profit GrowthTrex stock hit a buy point as it continues its post-earnings rally. The decking materials company has made significant profit improvement. |

Trex Awarded Three Prestigious Accolades for SustainabilityWINCHESTER, Va., December 07, 2023--Trex Company [NYSE:TREX], the world’s largest manufacturer of wood-alternative composite decking and railing, and a leader in high-performance, low-maintenance outdoor living products, recently earned three high-profile accolades for its ongoing commitment to sustainability. Lowe’s honored Trex with its 2023 Sustainability Award, the company earned recognition as one of the 100 Best ESG Companies for 2023 by Investor’s Business Daily and, yesterday, Trex was r |

TREX Price Returns

| 1-mo | 10.68% |

| 3-mo | -8.87% |

| 6-mo | 1.56% |

| 1-year | 21.27% |

| 3-year | -13.54% |

| 5-year | 132.66% |

| YTD | -0.35% |

| 2023 | 95.58% |

| 2022 | -68.65% |

| 2021 | 61.29% |

| 2020 | 86.29% |

| 2019 | 51.42% |

Continue Researching TREX

Here are a few links from around the web to help you further your research on Trex Co Inc's stock as an investment opportunity:Trex Co Inc (TREX) Stock Price | Nasdaq

Trex Co Inc (TREX) Stock Quote, History and News - Yahoo Finance

Trex Co Inc (TREX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...