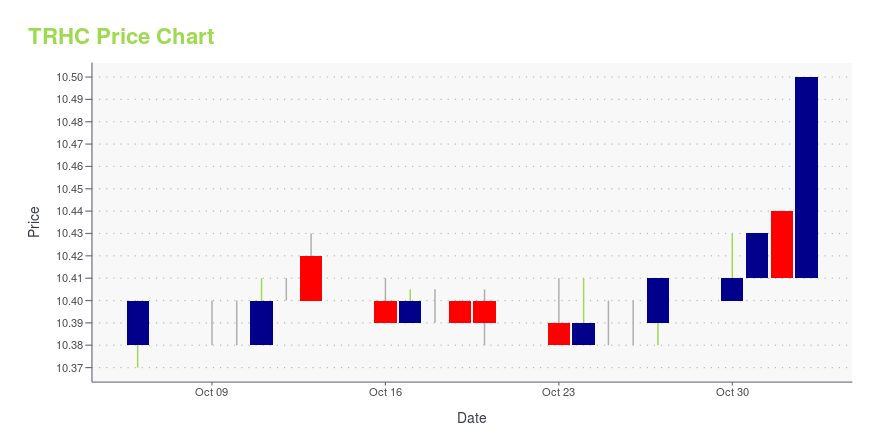

Tabula Rasa HealthCare, Inc. (TRHC): Price and Financial Metrics

TRHC Price/Volume Stats

| Current price | $10.50 | 52-week high | $10.50 |

| Prev. close | $10.41 | 52-week low | $3.15 |

| Day low | $10.41 | Volume | 1,306,700 |

| Day high | $10.50 | Avg. volume | 225,500 |

| 50-day MA | $10.34 | Dividend yield | N/A |

| 200-day MA | $7.60 | Market Cap | 284.08M |

TRHC Stock Price Chart Interactive Chart >

Tabula Rasa HealthCare, Inc. (TRHC) Company Bio

Tabula Rasa HealthCare, Inc. provides patient-specific, data-driven technology and solutions that enable healthcare organizations to optimize medication regimens to enhance patient outcomes, reduce hospitalizations, lower healthcare costs, and manage risk. The company was founded in 2009 and is based in Moorestown, New Jersey.

Latest TRHC News From Around the Web

Below are the latest news stories about TABULA RASA HEALTHCARE INC that investors may wish to consider to help them evaluate TRHC as an investment opportunity.

With 46% ownership, Tabula Rasa HealthCare, Inc. (NASDAQ:TRHC) has piqued the interest of institutional investorsKey Insights Given the large stake in the stock by institutions, Tabula Rasa HealthCare's stock price might be... |

Why Shares of Tabula Rasa HealthCare Are Soaring MondayThe company announced it was entering into a merger agreement to be acquired by Nautic Partners and will combine with ExactCare Pharmacy, a portfolio company of Nautic. |

Tabula Rasa agrees to be acquired in $570M all-cash deal, less than a year after pushing out its founderThe proposed deal would result in the merger of Tabula Rasa and ExactCare Pharmacy, a portfolio company of Rhode Island-based Nautic Partners. |

Compared to Estimates, Tabula Rasa Healthcare (TRHC) Q2 Earnings: A Look at Key MetricsAlthough the revenue and EPS for Tabula Rasa Healthcare (TRHC) give a sense of how its business performed in the quarter ended June 2023, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers. |

Tabula Rasa Healthcare (TRHC) Q2 Earnings and Revenues Surpass EstimatesTabula Rasa Healthcare (TRHC) delivered earnings and revenue surprises of 135.71% and 1.37%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock? |

TRHC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 37.08% |

| 3-year | -74.22% |

| 5-year | -81.75% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -67.00% |

| 2021 | -64.99% |

| 2020 | -12.00% |

| 2019 | -23.65% |

Continue Researching TRHC

Want to see what other sources are saying about Tabula Rasa HealthCare Inc's financials and stock price? Try the links below:Tabula Rasa HealthCare Inc (TRHC) Stock Price | Nasdaq

Tabula Rasa HealthCare Inc (TRHC) Stock Quote, History and News - Yahoo Finance

Tabula Rasa HealthCare Inc (TRHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...