Trinity Biotech plc each representing 4 A Ordinary Shares (TRIB): Price and Financial Metrics

TRIB Price/Volume Stats

| Current price | $0.73 | 52-week high | $3.44 |

| Prev. close | $0.74 | 52-week low | $0.48 |

| Day low | $0.71 | Volume | 34,600 |

| Day high | $0.74 | Avg. volume | 1,365,417 |

| 50-day MA | $0.70 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 13.18M |

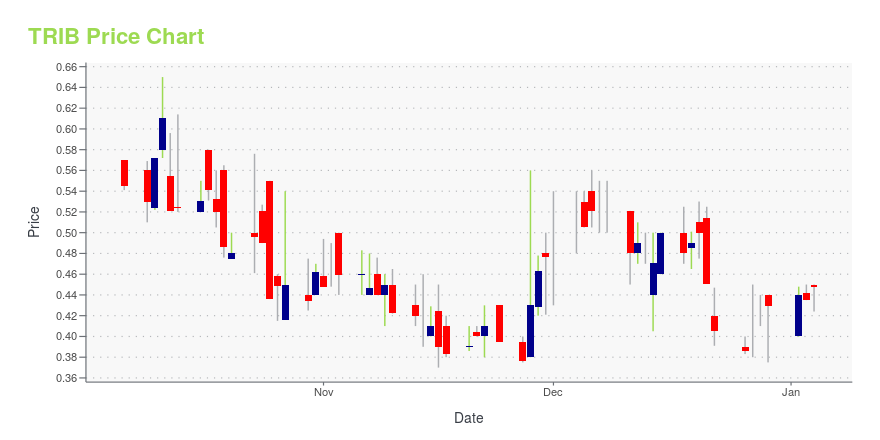

TRIB Stock Price Chart Interactive Chart >

Trinity Biotech plc each representing 4 A Ordinary Shares (TRIB) Company Bio

Trinity Biotech plc develops, acquires, manufactures and markets diagnostic systems, including both reagents and instrumentation, for the point-of-care and clinical laboratory segments of the diagnostic market. The products are used to detect infectious diseases and to quantify the level of Haemoglobin A1c and other chemistry parameters in serum, plasma and whole blood. The company was founded in 1992 and is based in Bray, Ireland.

TRIB Price Returns

| 1-mo | 19.67% |

| 3-mo | N/A |

| 6-mo | -11.62% |

| 1-year | -75.00% |

| 3-year | -89.26% |

| 5-year | -95.12% |

| YTD | -17.06% |

| 2024 | -58.97% |

| 2023 | -56.67% |

| 2022 | -30.77% |

| 2021 | -62.47% |

| 2020 | 268.69% |

Continue Researching TRIB

Want to do more research on Trinity Biotech Plc's stock and its price? Try the links below:Trinity Biotech Plc (TRIB) Stock Price | Nasdaq

Trinity Biotech Plc (TRIB) Stock Quote, History and News - Yahoo Finance

Trinity Biotech Plc (TRIB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...