Trinity Capital Inc. (TRIN): Price and Financial Metrics

TRIN Price/Volume Stats

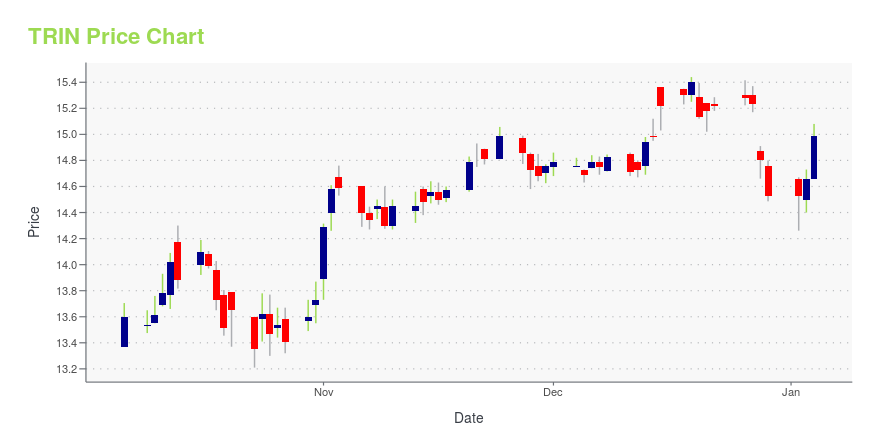

| Current price | $14.68 | 52-week high | $15.44 |

| Prev. close | $14.42 | 52-week low | $13.21 |

| Day low | $14.45 | Volume | 496,461 |

| Day high | $14.68 | Avg. volume | 475,782 |

| 50-day MA | $14.57 | Dividend yield | 14.28% |

| 200-day MA | $14.51 | Market Cap | 726.35M |

TRIN Stock Price Chart Interactive Chart >

Trinity Capital Inc. (TRIN) Company Bio

Trinity Capital, Inc. engages in operation of an internally managed specialty lending company. It offers equipment lease line of credit, senior venture loan, subordinated term loan, and refinance existing venture debt. The company's financial products include equipment financing, senior venture loan, subordinated term loan and refinance existing venture debt. Trinity Capital was founded in January 2008 by Steven L. Brown and is headquartered in Phoenix, AZ.

Latest TRIN News From Around the Web

Below are the latest news stories about TRINITY CAPITAL INC that investors may wish to consider to help them evaluate TRIN as an investment opportunity.

Trinity Capital Inc. Provides $30 Million Growth Capital to Cart.comTrinity Capital Inc. (NASDAQ: TRIN) ("Trinity"), a leading provider of diversified financial solutions to growth-stage companies, today announced the commitment of $30 million in growth capital to Cart.com, a provider of unified commerce and logistics solutions that enable merchants to sell and fulfill anywhere. |

Trinity Capital Inc. Announces Phoenix Headquarters Expansion, Highlighting Company's Continued Growth and SuccessTrinity Capital Inc. (Nasdaq: TRIN) ("Trinity" or the "Company"), a leading provider of diversified financial solutions to growth-stage companies, today announced the expansion of its Phoenix headquarters, reaffirming Trinity's longstanding commitment to the region as it continues to scale its business. |

Trinity Capital Inc. Provides $40 Million Term Loan to Taysha Gene TherapiesTrinity Capital Inc. (NASDAQ: TRIN) ("Trinity"), a leading provider of diversified financial solutions to growth-stage companies, today announced the commitment of $40 million in term loans to Taysha Gene Therapies, Inc. (NASDAQ: TSHA) ("Taysha"), a clinical-stage gene therapy company, pursuant to a Loan and Security Agreement dated November 13, 2023, by and among Taysha, the lenders party thereto from time to time (the "Lenders"), and Trinity, as administrative agent and collateral agent for th |

Trinity Capital Inc. Continues Life Sciences Growth, Hires Industry Veteran Ryan Kaeding as Managing DirectorTrinity Capital Inc. (NASDAQ: TRIN) ("Trinity" or the "Company"), a leading provider of diversified financial solutions to growth-stage companies, today announced the appointment of Ryan Kaeding as Managing Director, Life Sciences in San Diego, California. Mr. Kaeding, a veteran in the venture ecosystem, has been supporting venture capital-backed growth-stage companies for 20+ years. |

Trinity Capital Inc. Declares Cash Dividend of $0.50 per Share for the Fourth Quarter of 2023Trinity Capital Inc. (Nasdaq: TRIN) ("Trinity Capital" or the "Company"), a leading provider of diversified financial solutions to growth stage companies, today announced that on December 14, 2023, its Board of Directors declared a cash dividend of $0.50 per share with respect to the quarter ending December 31, 2023. This dividend represents an increase of 2.0% over the regular dividend declared in the prior quarter. |

TRIN Price Returns

| 1-mo | 3.92% |

| 3-mo | 0.22% |

| 6-mo | 12.39% |

| 1-year | 15.70% |

| 3-year | 55.14% |

| 5-year | N/A |

| YTD | 8.37% |

| 2023 | 53.97% |

| 2022 | -26.60% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

TRIN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...