TripAdvisor, Inc. (TRIP): Price and Financial Metrics

TRIP Price/Volume Stats

| Current price | $18.16 | 52-week high | $18.66 |

| Prev. close | $18.00 | 52-week low | $10.43 |

| Day low | $17.63 | Volume | 4,078,200 |

| Day high | $18.20 | Avg. volume | 3,259,600 |

| 50-day MA | $14.50 | Dividend yield | N/A |

| 200-day MA | $14.65 | Market Cap | 2.58B |

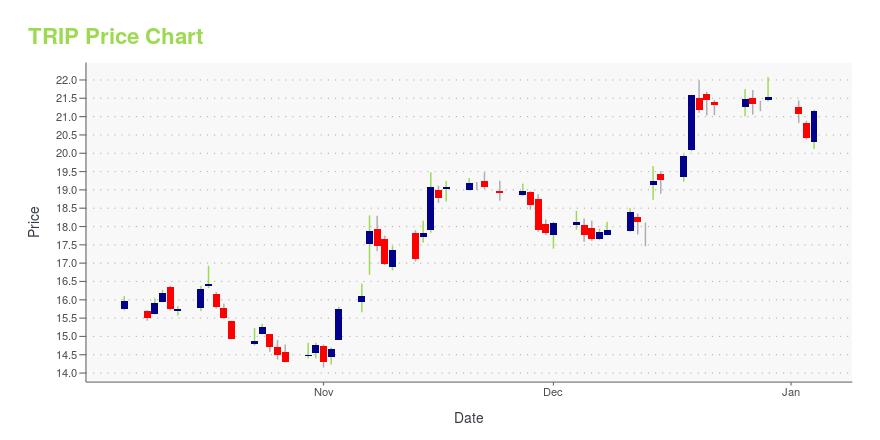

TRIP Stock Price Chart Interactive Chart >

TripAdvisor, Inc. (TRIP) Company Bio

TripAdvisor operates as an online travel company. The company operates through two segments, Hotel and Other. Its travel research platform aggregates reviews and opinions about accommodations, destinations, activities and attractions, and restaurants that enable consumers to plan and book hotels, vacation rentals, flights, activities and attractions, and restaurants. The company was founded in 2000 and is based in Newton, Massachusetts.

TRIP Price Returns

| 1-mo | 36.54% |

| 3-mo | 54.29% |

| 6-mo | 15.96% |

| 1-year | 0.83% |

| 3-year | 4.73% |

| 5-year | -7.56% |

| YTD | 22.95% |

| 2024 | -31.40% |

| 2023 | 19.74% |

| 2022 | -34.04% |

| 2021 | -5.28% |

| 2020 | -5.27% |

Continue Researching TRIP

Here are a few links from around the web to help you further your research on TripAdvisor Inc's stock as an investment opportunity:TripAdvisor Inc (TRIP) Stock Price | Nasdaq

TripAdvisor Inc (TRIP) Stock Quote, History and News - Yahoo Finance

TripAdvisor Inc (TRIP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...