Tower Semiconductor Ltd. (TSEM): Price and Financial Metrics

TSEM Price/Volume Stats

| Current price | $42.88 | 52-week high | $44.18 |

| Prev. close | $41.72 | 52-week low | $21.43 |

| Day low | $41.75 | Volume | 545,560 |

| Day high | $43.22 | Avg. volume | 562,431 |

| 50-day MA | $39.14 | Dividend yield | N/A |

| 200-day MA | $32.08 | Market Cap | 4.69B |

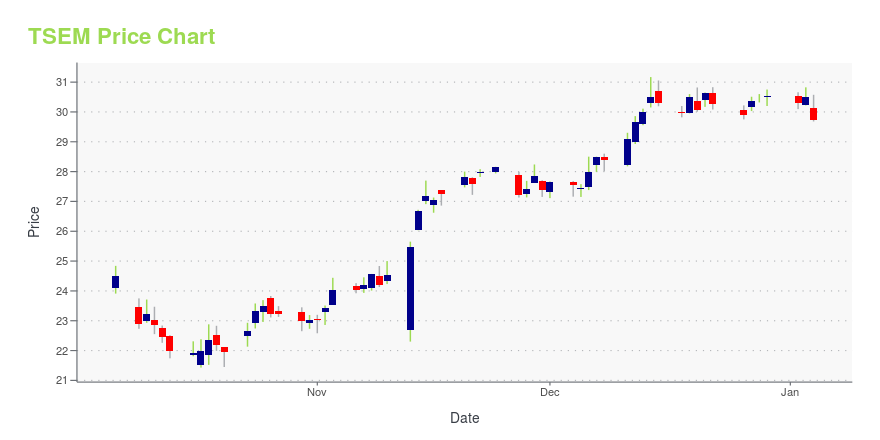

TSEM Stock Price Chart Interactive Chart >

Tower Semiconductor Ltd. (TSEM) Company Bio

Tower Semiconductor manufactures analog intensive mixed-signal semiconductor devices in the United States, Asia, and Europe. The company was founded in 1993 and is based in Migdal Haemek, Israel.

Latest TSEM News From Around the Web

Below are the latest news stories about TOWER SEMICONDUCTOR LTD that investors may wish to consider to help them evaluate TSEM as an investment opportunity.

7 Compelling Tech Stocks to Snag From the Discount BinYou don’t need to be a Wall Street expert to realize that innovators dominated the equities space in 2023. |

Tower Semiconductor to Present at the 26th Annual Needham Growth Conference in New YorkMIGDAL HAEMEK, Israel, Dec. 11, 2023 (GLOBE NEWSWIRE) – Tower Semiconductor (NASDAQ: TSEM & TASE: TSEM), the leading foundry of high-value analog semiconductor solutions, today announced that its President, Dr. Marco Racanelli, will present at the 26th Annual Needham Growth Conference. The conference will take place at the Lotte New York Palace Hotel in New York. Tower Semiconductor is scheduled to present at 3:45pm Eastern Time on Thursday, January 18, 2024. The presentation will be simultaneou |

The Cost of Doing Business With China? A $40,000 Dinner With Xi Jinping Might Be Just the StartBroadcom Chief Executive Hock Tan shelled out $40,000 to sit at Xi Jinping’s table for the Chinese leader’s recent dinner in San Francisco with the heads of American businesses. Tan had a lot more at stake—a $69 billion deal he was waiting on China to approve. For months, Chinese regulators wouldn’t clear the U.S. chipmaker’s bid to buy enterprise-software developer VMware, leading Broadcom to put off its date for completion of the deal—first announced in May 2022—three times. |

Japan’s Favorite AI Stocks: 3 Companies the Country LovesJapan is betting big on semiconductors and AI with an aid package to advance the country's capabilities. |

15 Stocks George Soros Just Bought and SoldIn this piece, we will take a look at the 15 stocks George Soros just bought and sold. If you want to see more stocks in this selection, then read 5 Stocks George Soros Just Bought and Sold. Billionaire George Soros is one of the most famous investors of our time. Soros has been around long […] |

TSEM Price Returns

| 1-mo | 10.43% |

| 3-mo | 32.51% |

| 6-mo | 48.07% |

| 1-year | 18.75% |

| 3-year | 63.66% |

| 5-year | 134.06% |

| YTD | 40.50% |

| 2023 | -29.35% |

| 2022 | 8.87% |

| 2021 | 53.68% |

| 2020 | 7.32% |

| 2019 | 63.23% |

Continue Researching TSEM

Here are a few links from around the web to help you further your research on Tower Semiconductor Ltd's stock as an investment opportunity:Tower Semiconductor Ltd (TSEM) Stock Price | Nasdaq

Tower Semiconductor Ltd (TSEM) Stock Quote, History and News - Yahoo Finance

Tower Semiconductor Ltd (TSEM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...