TotalEnergies SE ADR (TTE): Price and Financial Metrics

TTE Price/Volume Stats

| Current price | $67.85 | 52-week high | $74.97 |

| Prev. close | $67.63 | 52-week low | $57.97 |

| Day low | $67.35 | Volume | 696,878 |

| Day high | $68.05 | Avg. volume | 1,500,465 |

| 50-day MA | $69.21 | Dividend yield | 3.72% |

| 200-day MA | $68.00 | Market Cap | 160.22B |

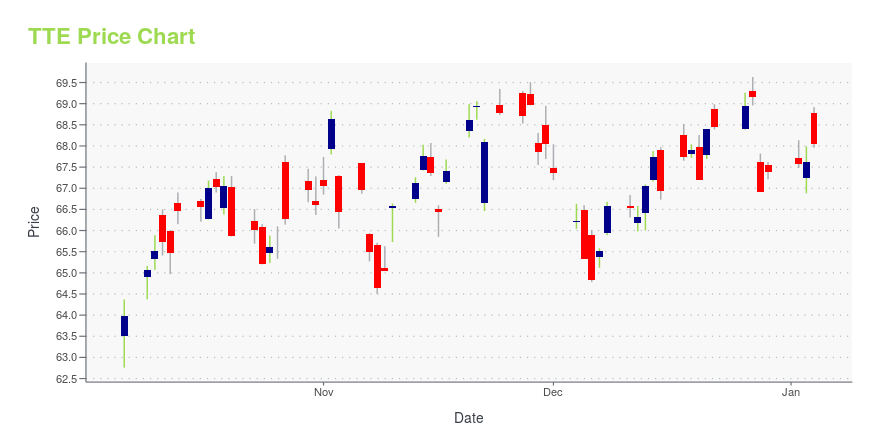

TTE Stock Price Chart Interactive Chart >

TotalEnergies SE ADR (TTE) Company Bio

TotalEnergies SE is a French multinational integrated oil and gas company founded in 1924 and one of the seven "supermajor" oil companies. Its businesses cover the entire oil and gas chain, from crude oil and natural gas exploration and production to power generation, transportation, refining, petroleum product marketing, and international crude oil and product trading. TotalEnergies is also a large-scale chemicals manufacturer.

Latest TTE News From Around the Web

Below are the latest news stories about TOTALENERGIES SE that investors may wish to consider to help them evaluate TTE as an investment opportunity.

TotalEnergies closes deals with Alimentation Couche-Tard for €3.4BMore on TotalEnergies |

TotalEnergies: Disclosure of Transactions in Own SharesPARIS, December 27, 2023-- In accordance with the authorization given by the ordinary shareholders’ general meeting on May 26, 2023, to trade on its shares and pursuant to applicable law on share repurchase, TotalEnergies SE (LEI: 529900S21EQ1BO4ESM68) (Paris:TTE) (LSE:TTE) (NYSE:TTE) declares the following purchases of its own shares (FR0000120271) from December 18 to December 22, 2023: |

The Last Fallen Angel For 2024BP p.l.c. is the quintessential oil and gas company that has taken good care of shareholders but has fallen 26.71% over the past 10 years. |

Danger Zone: 3 Companies That Could Declare Bankruptcy in 2024Despite a strong economy and stock market rally, 2023 saw its fair share of bankruptcy filings. |

Scotland: TotalEnergies Farms Down 25.5% of the Seagreen Offshore Wind Farm to PTTEPPARIS, December 21, 2023-- TotalEnergies (Paris:TTE) (LSE:TTE) (NYSE:TTE): |

TTE Price Returns

| 1-mo | 2.46% |

| 3-mo | -8.14% |

| 6-mo | 5.42% |

| 1-year | 18.81% |

| 3-year | 78.68% |

| 5-year | 60.94% |

| YTD | 2.54% |

| 2023 | 12.66% |

| 2022 | 32.03% |

| 2021 | 23.64% |

| 2020 | -18.19% |

| 2019 | 9.53% |

TTE Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...