Tetra Technologies, Inc. (TTI): Price and Financial Metrics

TTI Price/Volume Stats

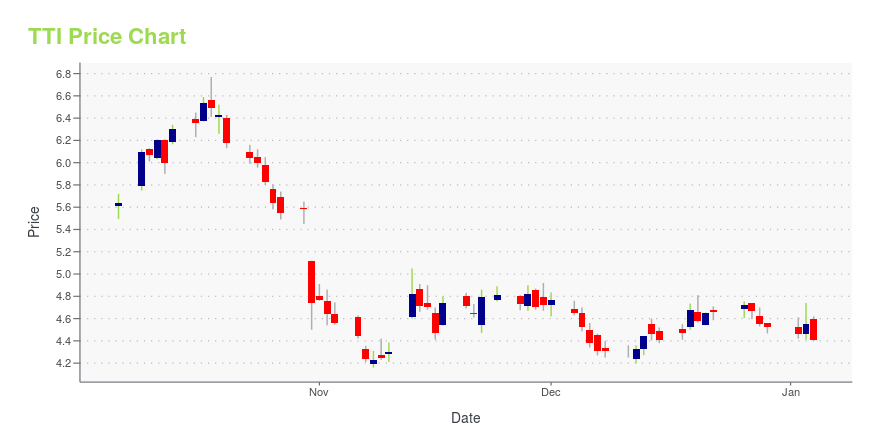

| Current price | $3.75 | 52-week high | $6.77 |

| Prev. close | $3.76 | 52-week low | $3.11 |

| Day low | $3.67 | Volume | 719,274 |

| Day high | $3.85 | Avg. volume | 1,344,410 |

| 50-day MA | $3.56 | Dividend yield | N/A |

| 200-day MA | $4.27 | Market Cap | 491.77M |

TTI Stock Price Chart Interactive Chart >

Tetra Technologies, Inc. (TTI) Company Bio

Tetra Technologies operates as a diversified oil and gas services company. It operates through four divisions: Fluids, Production Testing, Compression, and Offshore. The company was founded in 1981 and is based in The Woodlands, Texas.

Latest TTI News From Around the Web

Below are the latest news stories about TETRA TECHNOLOGIES INC that investors may wish to consider to help them evaluate TTI as an investment opportunity.

Hedge Funds Say These Penny Stocks Are Poised to ExplodeIn this article, we will take a detailed look at hedge funds say these penny stocks are poised to explode. To see more such stocks, click Hedge Funds Say These 5 Penny Stocks are Poised to Explode. Despite common belief, not all penny stocks are inherently risky and suitable only for short-term gains. Some penny stocks […] |

TETRA Technologies (NYSE:TTI) Shareholders Will Want The ROCE Trajectory To ContinueIf we want to find a potential multi-bagger, often there are underlying trends that can provide clues. One common... |

Investors in TETRA Technologies (NYSE:TTI) have seen incredible returns of 440% over the past three yearsWhile TETRA Technologies, Inc. ( NYSE:TTI ) shareholders are probably generally happy, the stock hasn't had... |

Do Options Traders Know Something About TETRA Technologies (TTI) Stock We Don't?Investors need to pay close attention to TETRA Technologies (TTI) stock based on the movements in the options market lately. |

With 72% ownership of the shares, TETRA Technologies, Inc. (NYSE:TTI) is heavily dominated by institutional ownersKey Insights Significantly high institutional ownership implies TETRA Technologies' stock price is sensitive to their... |

TTI Price Returns

| 1-mo | 10.62% |

| 3-mo | -17.76% |

| 6-mo | -18.30% |

| 1-year | -10.07% |

| 3-year | 19.43% |

| 5-year | 153.38% |

| YTD | -17.04% |

| 2023 | 30.64% |

| 2022 | 21.83% |

| 2021 | 229.66% |

| 2020 | -56.05% |

| 2019 | 16.67% |

Continue Researching TTI

Want to do more research on Tetra Technologies Inc's stock and its price? Try the links below:Tetra Technologies Inc (TTI) Stock Price | Nasdaq

Tetra Technologies Inc (TTI) Stock Quote, History and News - Yahoo Finance

Tetra Technologies Inc (TTI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...