T2 Biosystems, Inc. (TTOO): Price and Financial Metrics

TTOO Price/Volume Stats

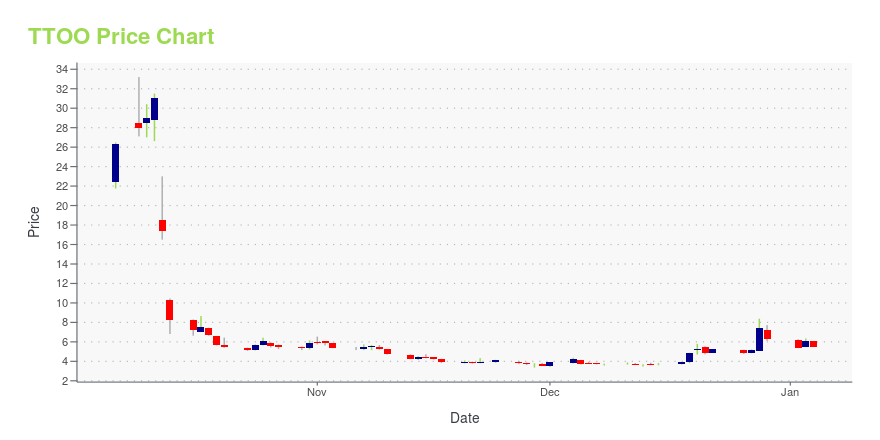

| Current price | $5.09 | 52-week high | $70.00 |

| Prev. close | $4.83 | 52-week low | $2.60 |

| Day low | $4.75 | Volume | 78,416 |

| Day high | $5.14 | Avg. volume | 273,537 |

| 50-day MA | $5.19 | Dividend yield | N/A |

| 200-day MA | $4.94 | Market Cap | 44.76M |

TTOO Stock Price Chart Interactive Chart >

T2 Biosystems, Inc. (TTOO) Company Bio

T2 Biosystems develops diagnostic products and product candidates for the detection of pathogens, biomarkers, and other abnormalities in various unpurified patient sample types. The company was founded in 2006 and is based in Lexington, Massachusetts.

Latest TTOO News From Around the Web

Below are the latest news stories about T2 BIOSYSTEMS INC that investors may wish to consider to help them evaluate TTOO as an investment opportunity.

Get Out Now! 7 Stocks That Are Destined to DieLooking to optimize your portfolio? |

T2 Biosystems to Participate in the Canaccord Genuity MedTech, Diagnostics and Digital Health & Services ForumLEXINGTON, Mass., Nov. 03, 2023 (GLOBE NEWSWIRE) -- T2 Biosystems, Inc. (NASDAQ:TTOO) (the “Company”), a leader in the rapid detection of sepsis-causing pathogens and antibiotic resistance genes, today announced plans to participate in the upcoming Canaccord Genuity MedTech, Diagnostics and Digital Health & Services Forum in New York, NY. Management is scheduled to present on Thursday, November 16, 2023, at 8:00am ET. Interested parties may access a live and recorded webcast of the presentation |

TTOO Stock Alert: T2 Biosystems Regains Nasdaq ComplianceTTOO stock is back above $1 and is now officially in compliance with Nasdaq's minimum bid price requirement of $1. |

T2 Biosystems Regains Compliance with Nasdaq Listing RequirementsLEXINGTON, Mass., Nov. 01, 2023 (GLOBE NEWSWIRE) -- T2 Biosystems, Inc. (NASDAQ:TTOO) (the “Company”), a leader in the rapid detection of sepsis-causing pathogens and antibiotic resistance genes, today announced that on October 31, 2023 it received written notice from the Nasdaq Listing Qualifications Staff of the Nasdaq Stock Market LLC (“Nasdaq”) stating that the Company regained compliance with the minimum bid price requirement (the “Minimum Bid Price Requirement”), as set forth in Nasdaq Lis |

T2 Biosystems Highlights New Clinical Data Presented at IDWeek 2023 ConferenceData demonstrates speed, accuracy, and clinical benefits of the T2Dx Instrument and T2 Biosystems’ sepsis panels, including encouraging early detection data for T2Resistance PanelLEXINGTON, Mass., Oct. 24, 2023 (GLOBE NEWSWIRE) -- T2 Biosystems, Inc. (NASDAQ:TTOO), a leader in the rapid detection of sepsis-causing pathogens and antibiotic resistance genes, today highlighted four new studies supporting the T2Bacteria® Panel, the T2Candida® Panel and the T2Resistance® Panel that were recently pres |

TTOO Price Returns

| 1-mo | -5.04% |

| 3-mo | 79.23% |

| 6-mo | 20.62% |

| 1-year | -56.38% |

| 3-year | -99.90% |

| 5-year | -99.93% |

| YTD | -18.88% |

| 2023 | -95.58% |

| 2022 | -94.50% |

| 2021 | -58.37% |

| 2020 | 5.98% |

| 2019 | -61.13% |

Continue Researching TTOO

Want to see what other sources are saying about T2 Biosystems Inc's financials and stock price? Try the links below:T2 Biosystems Inc (TTOO) Stock Price | Nasdaq

T2 Biosystems Inc (TTOO) Stock Quote, History and News - Yahoo Finance

T2 Biosystems Inc (TTOO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...