Hostess Brands, Inc. - (TWNK): Price and Financial Metrics

TWNK Price/Volume Stats

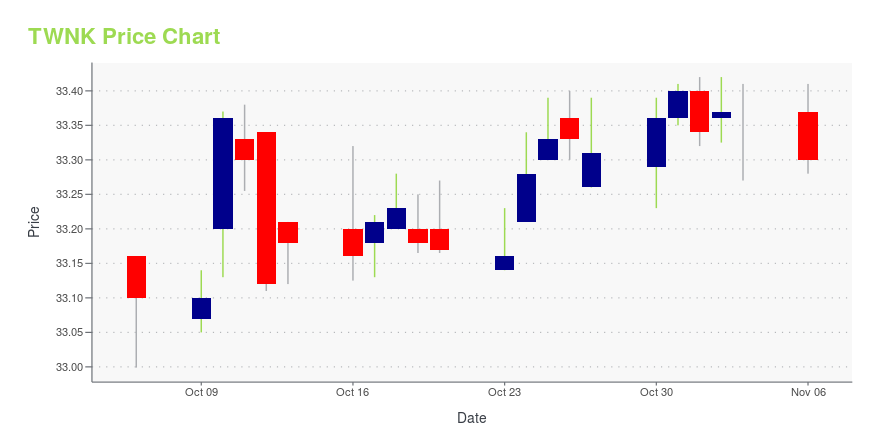

| Current price | $33.30 | 52-week high | $33.74 |

| Prev. close | $33.35 | 52-week low | $21.59 |

| Day low | $33.28 | Volume | 52,740,300 |

| Day high | $33.41 | Avg. volume | 1,856,092 |

| 50-day MA | $32.36 | Dividend yield | N/A |

| 200-day MA | $26.53 | Market Cap | 4.42B |

TWNK Stock Price Chart Interactive Chart >

Hostess Brands, Inc. - (TWNK) Company Bio

Hostess Brands, Inc. produces bakery products. It produces breads, cakes, cup cakes, and snack cakes, mini muffins, fruit pies, donut products, and zingers. The company is based in Kansas City, Missouri. Hostess Brands, Inc. operates as a subsidiary of Old HB, Inc.

Latest TWNK News From Around the Web

Below are the latest news stories about HOSTESS BRANDS INC that investors may wish to consider to help them evaluate TWNK as an investment opportunity.

Hershey (HSY) Beats Q3 Earnings and Revenue EstimatesHershey (HSY) delivered earnings and revenue surprises of 5.26% and 2.24%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

Billionaire Ray Dalio’s 15 Best Stock PicksIn this article, we discuss billionaire Ray Dalio’s 15 best stock picks. If you want to see more stocks in this selection, check out Billionaire Ray Dalio’s 5 Best Stock Picks. While Ray Dalio gave up active leadership position of his hedge fund Bridgewater Associates to a new generation of fund managers, he still has a […] |

Hostess Brands' (NASDAQ:TWNK) investors will be pleased with their strong 233% return over the last five yearsWhen you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose... |

Stocks to Sell: 7 Overbought Companies You Ought to Dump Right NowOverbought stocks are an early indication of a potential correction on a stock; act now if you hold these stocks. |

Food and Beverage Stocks Look Appetizing After Ozempic SelloffInvestors should brush off Ozempic selloff fears and dive into tasty food and beverage stocks that have been oversold in 2023. |

TWNK Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 38.46% |

| 3-year | 106.19% |

| 5-year | 134.18% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 9.89% |

| 2021 | 39.48% |

| 2020 | 0.69% |

| 2019 | 32.91% |

Continue Researching TWNK

Want to do more research on Hostess Brands Inc's stock and its price? Try the links below:Hostess Brands Inc (TWNK) Stock Price | Nasdaq

Hostess Brands Inc (TWNK) Stock Quote, History and News - Yahoo Finance

Hostess Brands Inc (TWNK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...