two (TWOA): Price and Financial Metrics

TWOA Price/Volume Stats

| Current price | $10.70 | 52-week high | $12.97 |

| Prev. close | $6.24 | 52-week low | $5.59 |

| Day low | $5.59 | Volume | 66,000 |

| Day high | $12.97 | Avg. volume | 24,587 |

| 50-day MA | $10.35 | Dividend yield | N/A |

| 200-day MA | $10.34 | Market Cap | 102.20M |

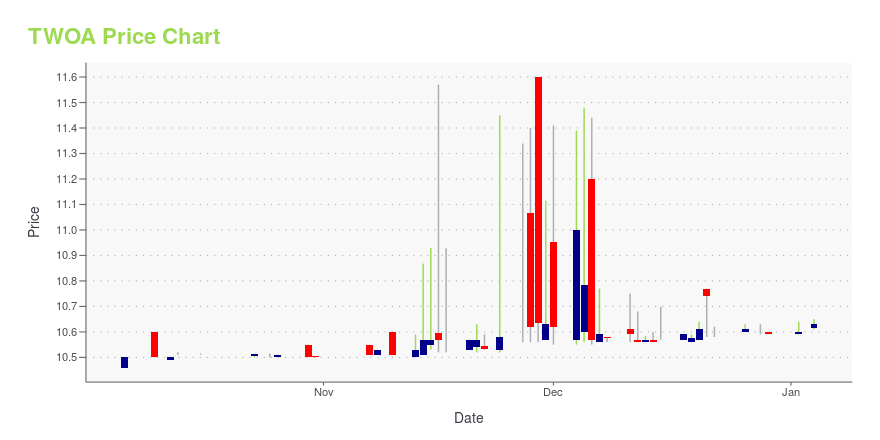

TWOA Stock Price Chart Interactive Chart >

two (TWOA) Company Bio

two is a blank check company. The company was incorporated in 2021 and is based in San Francisco, California.

Latest TWOA News From Around the Web

Below are the latest news stories about TWO that investors may wish to consider to help them evaluate TWOA as an investment opportunity.

LatAm Logistic Properties S.A. Announces Sale of Colombia Warehouse FacilitySAN JOSÉ, Costa Rica, Dec. 14, 2023 (GLOBE NEWSWIRE) -- LatAm Logistic Properties S.A. (d/b/a LatAm Logistic Properties) (“LLP”), a leading developer, owner, and manager of institutional quality, Class A industrial and logistics real estate in Central and South America, today announced the sale of an industrial building near Bogotá, Colombia, to Bancolombia S.A. The property, known as Warehouse 500A, is located within LatAm Logistic Park Calle 80 in Colombia’s Tenjo municipality and consists of |

LatAm Logistic Properties S.A. and two Announce Public Filing of Registration Statement on Form F-4 in Connection with Proposed Business CombinationZEPHYR COVE, Nev. and SAN JOSÉ, Costa Rica, Dec. 12, 2023 (GLOBE NEWSWIRE) -- two (NYSE: TWOA) (“TWOA”), a special purpose acquisition company, and LatAm Logistic Properties S.A. (d/b/a LatAm Logistic Properties) (“LLP”), a leading developer, owner, and manager of institutional quality, class A industrial and logistics real estate in Central and South America, announced today the public filing of a registration statement on Form F-4 with the U.S. Securities and Exchange Commission (the “SEC”). T |

two (NYSE:TWOA) is definitely on the radar of institutional investors who own 48% of the companyKey Insights Significantly high institutional ownership implies two's stock price is sensitive to their trading actions... |

LatAm Logistic Properties S.A. Announces New Leases for Facilities in Peru and Costa RicaProminent tenants sign new leases for a total of 417,365 square feetSAN JOSÉ, Costa Rica, Oct. 06, 2023 (GLOBE NEWSWIRE) -- LatAm Logistic Properties S.A. (d/b/a LatAm Logistic Properties) (“LLP”), a leading developer, owner, and manager of institutional quality, Class A industrial and logistics real estate in Central and South America, today announced the signing of lease agreements in three of its new logistic facilities, including two properties in Peru and one in Costa Rica. Given the new le |

two and LatAm Logistic Properties S.A. Agree to Combine, Creating a Leading Publicly Traded Developer, Owner, and Manager of Modern Logistics Real Estate in Central and South AmericaLatAm Logistic Properties is one of the only Institutional Industrial Platforms operating across the region, bringing the development of class A warehouses to undersupplied marketsEstimated post-transaction enterprise value of $578 Million based on a minimum of $25 Million in net cash proceeds to fund growth (assuming 70% redemptions from two’s trust account)LatAm Logistic Properties’ management will roll 100% of their existing shares into equity of the combined company ZEPHYR COVE, Nev. and SAN |

TWOA Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 0.47% |

| 1-year | 4.09% |

| 3-year | 9.74% |

| 5-year | N/A |

| YTD | 1.04% |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...