AgEagle Aerial Systems, Inc. (UAVS): Price and Financial Metrics

UAVS Price/Volume Stats

| Current price | $0.45 | 52-week high | $5.24 |

| Prev. close | $0.47 | 52-week low | $0.40 |

| Day low | $0.43 | Volume | 283,100 |

| Day high | $0.48 | Avg. volume | 385,765 |

| 50-day MA | $0.55 | Dividend yield | N/A |

| 200-day MA | $1.37 | Market Cap | 5.35M |

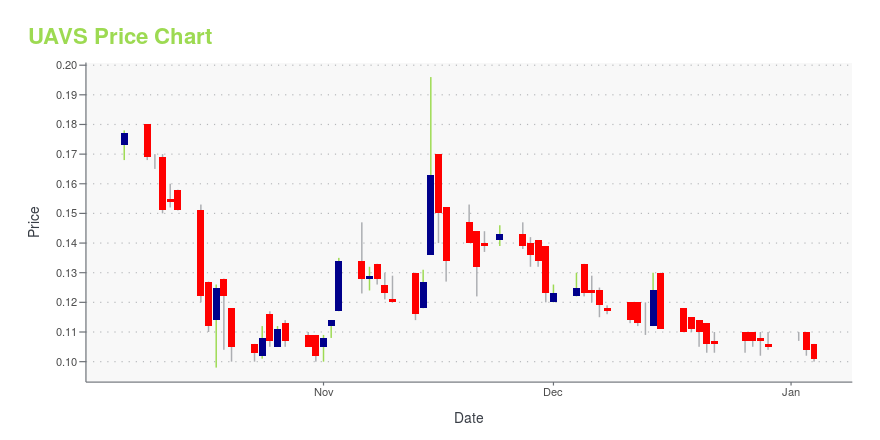

UAVS Stock Price Chart Interactive Chart >

AgEagle Aerial Systems, Inc. (UAVS) Company Bio

AgEagle Aerial Systems, Inc. operates as a commercial agricultural drone company. The Company designs, develops, distributes, and supports technologically advanced small unmanned aerial vehicles and drones for precision agriculture industry. AgEagle Aerial Systems serves agriculture industry worldwide.

Latest UAVS News From Around the Web

Below are the latest news stories about AGEAGLE AERIAL SYSTEMS INC that investors may wish to consider to help them evaluate UAVS as an investment opportunity.

AgEagle to Provide Secure Drones Using SEALSQ Certified Secure Element for Defense and Public Safety ApplicationsWICHITA (Kan.), Nov. 20, 2023 (GLOBE NEWSWIRE) -- AgEagle Aerial Systems Inc. (NYSE: UAVS) a leading provider of full stack drone, sensors and software solutions for customers worldwide in the commercial and government verticals, and SEALSQ Corp (Nasdaq: LAES) (“SEALSQ”) a company that focuses on developing and selling Semiconductors, PKI and Post-Quantum technology hardware and software products, today announced their partnership to provide secure surveillance drones for public safety, governme |

AgEagle Announces Third Quarter 2023 ResultsWICHITA, Kan., Nov. 14, 2023 (GLOBE NEWSWIRE) -- AgEagle Aerial Systems Inc. (NYSE American: UAVS) (“AgEagle” or the “Company”), an industry-leading provider of full stack flight hardware, sensors and software for commercial and government use, today announces its financial results for the three and nine months ended September 30, 2023. Third Quarter 2023 Financial Highlights Revenues totaled $3.48 million for the three months ended September 30, 2023, decreasing 37% from $5.49 million reporte |

AgEagle to Showcase Its Drone Innovations at Renowned Milipol Homeland Security Event and Modern Warfare WeekWICHITA, Kan., Nov. 09, 2023 (GLOBE NEWSWIRE) -- AgEagle Aerials Systems Inc. (NYSE American: UAVS) (“AgEagle” or the “Company”), an industry-leading provider of full stack flight hardware, sensors and software for commercial and government use, announces that the Company will be exhibiting at the Milipol Homeland Security and Safety event in Paris from November 14-17, 2023, and during Modern Warfare Week November 13-16, 2023 in the Fayetteville, NC area. “These international industry events hel |

AgEagle Aerial Systems Engages CORE IR for Investor Relations and Shareholder Communications ServicesCORE IR to Support Strategic Communications in Conjunction with Corporate Development Activities WICHITA, Kan., Nov. 08, 2023 (GLOBE NEWSWIRE) -- AgEagle Aerial Systems Inc. (NYSE American: UAVS) (“AgEagle” or the “Company”), an industry-leading provider of full stack flight hardware, sensors and software for commercial and government use, today announces it has retained CORE IR, a leading investor relations, public relations and strategic advisory firm, to assist the Company with investor relat |

AgEagle Announces Key Leadership ChangesAppoints New Chairman of the Board and Welcomes New Interim Chief Financial Officer WICHITA, Kan., Oct. 19, 2023 (GLOBE NEWSWIRE) -- AgEagle Aerial Systems Inc. (NYSE American: UAVS) (“AgEagle” or the “Company”), an industry-leading provider of full stack flight hardware, sensors and software for commercial and government use, today announced key leadership changes to propel the Company’s strategic growth initiatives forward more rapidly, with emphasis on perpetuating deeper penetration of globa |

UAVS Price Returns

| 1-mo | -10.73% |

| 3-mo | -33.33% |

| 6-mo | -75.86% |

| 1-year | -89.87% |

| 3-year | -99.40% |

| 5-year | -92.07% |

| YTD | -78.55% |

| 2023 | -70.03% |

| 2022 | -77.71% |

| 2021 | -73.83% |

| 2020 | 1,233.33% |

| 2019 | -20.35% |

Continue Researching UAVS

Want to do more research on AgEagle Aerial Systems Inc's stock and its price? Try the links below:AgEagle Aerial Systems Inc (UAVS) Stock Price | Nasdaq

AgEagle Aerial Systems Inc (UAVS) Stock Quote, History and News - Yahoo Finance

AgEagle Aerial Systems Inc (UAVS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...