UDR Inc. (UDR): Price and Financial Metrics

UDR Price/Volume Stats

| Current price | $41.27 | 52-week high | $42.54 |

| Prev. close | $40.67 | 52-week low | $30.95 |

| Day low | $40.73 | Volume | 1,361,300 |

| Day high | $41.50 | Avg. volume | 2,632,760 |

| 50-day MA | $40.22 | Dividend yield | 4.05% |

| 200-day MA | $37.16 | Market Cap | 13.59B |

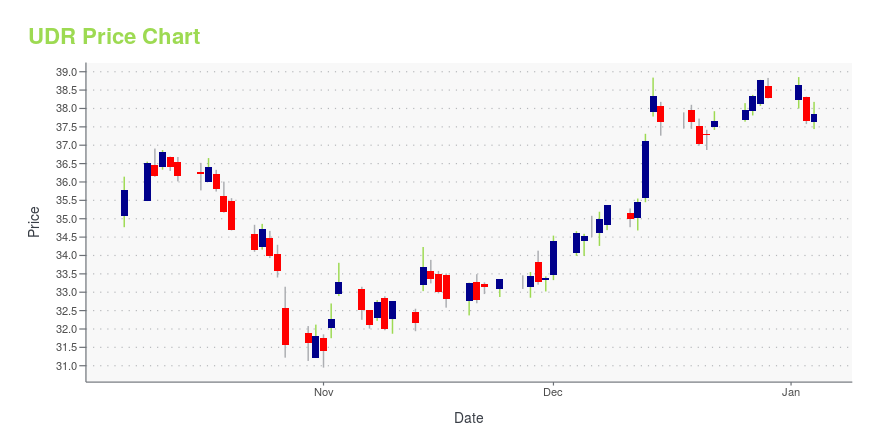

UDR Stock Price Chart Interactive Chart >

UDR Inc. (UDR) Company Bio

UDR Inc. (formerly United Dominion Realty) is a publicly traded real estate investment trust that invests in apartments. The company is organized in Maryland with its headquarters in Highlands Ranch, Colorado. As of December 31, 2020, the company owned interests in 149 apartment communities containing 48,283 apartment units. (Source:Wikipedia)

Latest UDR News From Around the Web

Below are the latest news stories about UDR INC that investors may wish to consider to help them evaluate UDR as an investment opportunity.

UDR Inc Chairman and CEO Thomas Toomey Sells 45,000 SharesOn December 26, 2023, Thomas Toomey, Chairman and CEO of UDR Inc (NYSE:UDR), executed a sale of 45,000 shares of the company, according to a recent SEC Filing. |

This Landlord Thinks Improving the Customer Experience Is a Huge OpportunityUDR has looked at a decade of data and thinks it can reduce the hit from customers moving out of its properties. |

UDR Declares Quarterly DividendsDENVER, December 14, 2023--UDR, Inc. (NYSE: UDR), a leading multifamily real estate investment trust, today announced that its Board of Directors declared a regular quarterly dividend on its common stock for the fourth quarter of 2023 in the amount of $0.42 per share, payable in cash on January 31, 2024 to UDR common stock shareholders of record as of January 10, 2024. The January 31, 2024 dividend will be the 205th consecutive quarterly dividend paid by the Company on its common stock. |

UDR Named to Newsweek’s 2024 List of America’s Most Responsible CompaniesDENVER, December 13, 2023--UDR, Inc. (the "Company") (NYSE: UDR), a leading multifamily real estate investment trust and GRESB Sector Leader for its sustainability leadership, announced today that it has been named one of America’s Most Responsible Companies by Newsweek. |

This High-Yield Stock Is Experiencing an Unprecedented Environment ChangeA 4.8% yield might attract dividend investors to apartment landlord UDR. Just go in knowing that the business environment is changing fast. |

UDR Price Returns

| 1-mo | 2.29% |

| 3-mo | 10.01% |

| 6-mo | 14.81% |

| 1-year | 7.24% |

| 3-year | -16.18% |

| 5-year | 6.33% |

| YTD | 11.37% |

| 2023 | 3.12% |

| 2022 | -33.44% |

| 2021 | 61.12% |

| 2020 | -14.54% |

| 2019 | 21.48% |

UDR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching UDR

Want to see what other sources are saying about UDR Inc's financials and stock price? Try the links below:UDR Inc (UDR) Stock Price | Nasdaq

UDR Inc (UDR) Stock Quote, History and News - Yahoo Finance

UDR Inc (UDR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...