Unilever PLC ADR (UL): Price and Financial Metrics

UL Price/Volume Stats

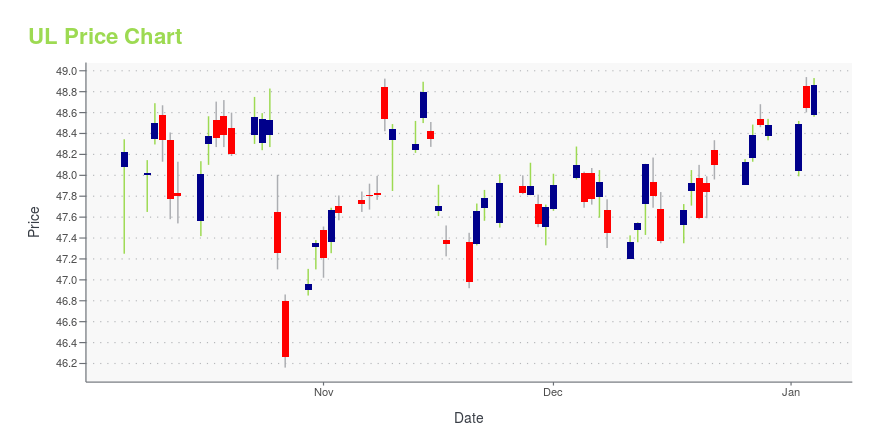

| Current price | $60.73 | 52-week high | $60.89 |

| Prev. close | $59.08 | 52-week low | $46.16 |

| Day low | $60.21 | Volume | 8,462,574 |

| Day high | $60.89 | Avg. volume | 2,792,740 |

| 50-day MA | $55.91 | Dividend yield | 3.15% |

| 200-day MA | $50.63 | Market Cap | 152.02B |

UL Stock Price Chart Interactive Chart >

Unilever PLC ADR (UL) Company Bio

Unilever Plc is a multinational consumer goods company that provides fast moving consumer goods. Its product categories include savoury, dressings and spread; ice cream and beverages; personal care, and home care. The company's brands include Axe & Lynx, Blue Band, Dove, Becel & Flora, Heartbrand ice creams, Hellmann's, Knorr, Lipton, Lux, Omo, Rexona and Sunsilk. It operates in three regions: Asia, Africa and Central and Eastern Europe, the Americas and Western Europe. The company's product areas are Personal Care, Foods, Refreshment and Home Care. Its Personal Care products include skin care and hair care products, deodorants and oral care products. The company Food products include soups, bouillons, sauces, snacks, mayonnaise, salad dressings, margarines and spreads, and cooking products such as liquid margarines. Its Refreshment products include ice cream, tea-based beverages, weight-management products, and nutritionally enhanced staples sold in developing markets. The company Home Care products include laundry tablets, powders and liquids, soap bars and a range of cleaning products. Unilever was founded by Antonius Johannes Jurgens, Samuel van den Bergh and William Hulme Lever on January 1, 1930 and is headquartered in London, the United Kingdom.

Latest UL News From Around the Web

Below are the latest news stories about UNILEVER PLC that investors may wish to consider to help them evaluate UL as an investment opportunity.

Nelson Peltz Resigns From Wiesenthal Board Over Its Ben & Jerry’s TweetThe Jewish organization called for consumers to shun the ice-cream maker following pro-Palestinian posts from its chairman. |

Unilever to acquire K18The hair care brand, which was founded in 2020, takes a scientific approach to developing products. |

Unilever sells beauty brands amid investor pressure over poor performanceUnilever is offloading a handful of its beauty brands as pressure on the Dove and Marmite maker grows over its poor performance. |

Unilever sells slow-growing brands like Q-tips to private equity groupUnilever has announced it will sell a group of more than 20 brands including Q-tips, Timotei shampoo and Impulse body spray to private equity group Yellow Wood Partners, the latest in a series of sales of its slower-growth labels. The disposal of the brands, which were grouped together under the name Elida Beauty in 2021 and generate approximately £700mn in annual turnover, is the first under Unilever’s new chief executive Hein Schumacher, who has set out to streamline the consumer goods giant’s portfolio following investor pressure to boost growth. Schumacher, who stepped into the role in July this year, said in a recent trading update that he would focus on improving the profitability of Unilever’s top 30 brands that make up 70 per cent of group revenues. |

Unilever to sell portfolio that includes Q-tips, NoxzemaUnder a newly arrived chief executive, the consumer products giant also unloaded Dollar Shave Club earlier this year. |

UL Price Returns

| 1-mo | 9.07% |

| 3-mo | 19.51% |

| 6-mo | 27.73% |

| 1-year | 17.72% |

| 3-year | 19.82% |

| 5-year | 18.44% |

| YTD | 27.44% |

| 2023 | -0.21% |

| 2022 | -2.86% |

| 2021 | -7.64% |

| 2020 | 9.00% |

| 2019 | 12.84% |

UL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching UL

Here are a few links from around the web to help you further your research on Unilever Plc's stock as an investment opportunity:Unilever Plc (UL) Stock Price | Nasdaq

Unilever Plc (UL) Stock Quote, History and News - Yahoo Finance

Unilever Plc (UL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...