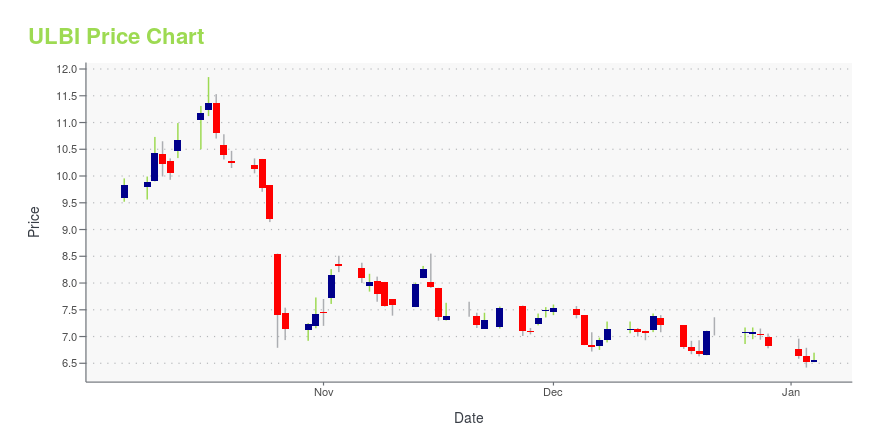

Ultralife Corporation (ULBI): Price and Financial Metrics

ULBI Price/Volume Stats

| Current price | $11.02 | 52-week high | $13.39 |

| Prev. close | $10.91 | 52-week low | $6.31 |

| Day low | $10.69 | Volume | 88,430 |

| Day high | $11.23 | Avg. volume | 89,052 |

| 50-day MA | $10.94 | Dividend yield | N/A |

| 200-day MA | $9.16 | Market Cap | 183.17M |

ULBI Stock Price Chart Interactive Chart >

Ultralife Corporation (ULBI) Company Bio

Ultralife Corporation designs, manufactures, installs, and maintains power and communications systems for government, defense, and commercial sectors worldwide. The company operates through two segments, Battery & Energy Products and Communications Systems. The company was founded in 1990 and is based in Newark, New York.

Latest ULBI News From Around the Web

Below are the latest news stories about ULTRALIFE CORP that investors may wish to consider to help them evaluate ULBI as an investment opportunity.

The Ultralife Corp (ULBI) Company: A Short SWOT AnalysisUnveiling the Strengths, Weaknesses, Opportunities, and Threats of Ultralife Corp (ULBI) |

Ultralife Corporation (NASDAQ:ULBI) Q3 2023 Earnings Call TranscriptUltralife Corporation (NASDAQ:ULBI) Q3 2023 Earnings Call Transcript October 26, 2023 Ultralife Corporation reports earnings inline with expectations. Reported EPS is $0.1 EPS, expectations were $0.1. Operator: Good day, and thank you for standing by. Welcome to the Ultralife Corporation Third Quarter 2020 Results Conference Call. All participants are in a listen mode. After the […] |

Ultralife Corp (ULBI) Reports Q3 2023 Earnings: Revenue and Gross Profit RiseStrong demand from government/defense and medical customers drives sales growth |

Ultralife Corporation Reports Third Quarter ResultsNEWARK, N.Y., Oct. 26, 2023 (GLOBE NEWSWIRE) -- Ultralife Corporation (NASDAQ: ULBI) reported operating results for the third quarter ended September 30, 2023 with the following highlights: Sales of $39.5 million representing an 18.8% year-over-year increaseOperating income of $2.1 million versus a loss of $0.6 million for the 2022 third quarterAdjusted EPS of $0.10 compared to a loss of $0.03 for the 2022 third quarterAdjusted EBITDA of $3.5 million representing a 177.3% year-over-year increase |

Ultralife Corporation to Report Third Quarter Results on October 26, 2023NEWARK, N.Y., Oct. 12, 2023 (GLOBE NEWSWIRE) -- Ultralife Corporation (NASDAQ: ULBI) will report its third quarter results for the period ended September 30, 2023 before the market opens on Thursday, October 26, 2023. Ultralife’s Management will also host an investor conference call and simultaneous webcast at 8:30 AM ET on October 26, 2023. Please see the call-in procedures which follow below. NOTE TO THOSE PLANNING TO PARTICIPATE BY PHONE: To ensure a fast and reliable connection to our invest |

ULBI Price Returns

| 1-mo | 6.68% |

| 3-mo | -3.25% |

| 6-mo | 52.84% |

| 1-year | 46.54% |

| 3-year | 32.77% |

| 5-year | 26.38% |

| YTD | 61.58% |

| 2023 | 76.68% |

| 2022 | -36.09% |

| 2021 | -6.65% |

| 2020 | -12.45% |

| 2019 | 9.48% |

Continue Researching ULBI

Want to see what other sources are saying about Ultralife Corp's financials and stock price? Try the links below:Ultralife Corp (ULBI) Stock Price | Nasdaq

Ultralife Corp (ULBI) Stock Quote, History and News - Yahoo Finance

Ultralife Corp (ULBI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...