UMB Financial Corporation (UMBF): Price and Financial Metrics

UMBF Price/Volume Stats

| Current price | $99.38 | 52-week high | $99.75 |

| Prev. close | $97.72 | 52-week low | $57.91 |

| Day low | $98.04 | Volume | 294,800 |

| Day high | $99.75 | Avg. volume | 342,584 |

| 50-day MA | $85.21 | Dividend yield | 1.6% |

| 200-day MA | $79.59 | Market Cap | 4.84B |

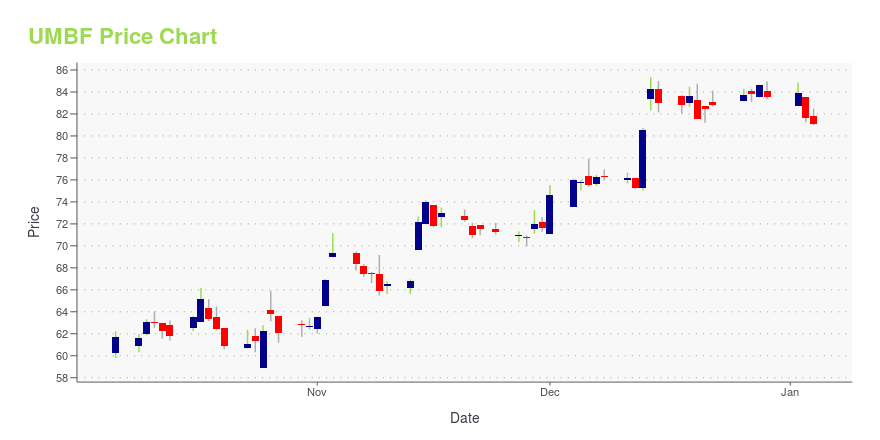

UMBF Stock Price Chart Interactive Chart >

UMB Financial Corporation (UMBF) Company Bio

UMB Financial provides various banking and other financial products and services in Missouri, Kansas, Colorado, Illinois, Oklahoma, Arizona, Nebraska, Pennsylvania, South Dakota, Indiana, Wisconsin, Utah, Texas, and Massachusetts states. The company was founded in 1967 and is based in Kansas City, Missouri.

Latest UMBF News From Around the Web

Below are the latest news stories about UMB FINANCIAL CORP that investors may wish to consider to help them evaluate UMBF as an investment opportunity.

Loan Growth Aids UMB Financial (UMBF) Amid Rising CostsUMB Financial's (UMBF) rising loan balances are likely to support its balance sheet position. Yet, rising operating expenses keep the bottom line under pressure. |

Strength Seen in First Busey (BUSE): Can Its 5.2% Jump Turn into More Strength?First Busey (BUSE) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions could translate into further price increase in the near term. |

UMB Financial Corp's Dividend AnalysisUMB Financial Corp (NASDAQ:UMBF) recently announced a dividend of $0.39 per share, payable on 2024-01-02, with the ex-dividend date set for 2023-12-08. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into UMB Financial Corps dividend performance and assess its sustainability. |

UMB Fund Services Assists StepStone Private Wealth with Flagship Fund Transition to Daily Admittance, Launch of New Infrastructure FundMILWAUKEE, November 30, 2023--UMB Fund Services, Inc. (UMBFS), a subsidiary of UMB Financial Corporation (NASDAQ: UMBF), announced today its service expansion for StepStone Group Private Wealth LLC, part of StepStone Group Inc. (NASDAQ: STEP), one of the largest asset managers focused exclusively on private markets. |

Why Is UMB (UMBF) Up 14.9% Since Last Earnings Report?UMB (UMBF) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

UMBF Price Returns

| 1-mo | 22.28% |

| 3-mo | 20.07% |

| 6-mo | 21.92% |

| 1-year | 44.63% |

| 3-year | 18.48% |

| 5-year | 60.43% |

| YTD | 20.08% |

| 2023 | 2.21% |

| 2022 | -19.97% |

| 2021 | 56.04% |

| 2020 | 2.64% |

| 2019 | 14.71% |

UMBF Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching UMBF

Want to see what other sources are saying about Umb Financial Corp's financials and stock price? Try the links below:Umb Financial Corp (UMBF) Stock Price | Nasdaq

Umb Financial Corp (UMBF) Stock Quote, History and News - Yahoo Finance

Umb Financial Corp (UMBF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...