Union Pacific Corp. (UNP): Price and Financial Metrics

UNP Price/Volume Stats

| Current price | $240.36 | 52-week high | $258.66 |

| Prev. close | $235.35 | 52-week low | $199.33 |

| Day low | $235.89 | Volume | 2,818,609 |

| Day high | $243.15 | Avg. volume | 2,313,758 |

| 50-day MA | $231.04 | Dividend yield | 2.17% |

| 200-day MA | $234.23 | Market Cap | 146.65B |

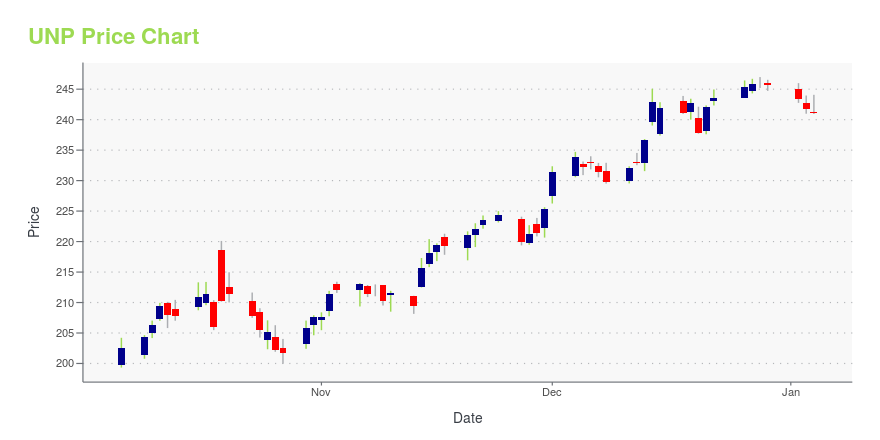

UNP Stock Price Chart Interactive Chart >

Union Pacific Corp. (UNP) Company Bio

The Union Pacific Corporation (Union Pacific) is a publicly traded railroad holding company. It was incorporated in Utah in 1969 and is headquartered in Omaha, Nebraska. It is the parent company of the current, Delaware-registered, form of the Union Pacific Railroad.

Latest UNP News From Around the Web

Below are the latest news stories about UNION PACIFIC CORP that investors may wish to consider to help them evaluate UNP as an investment opportunity.

Top 3 Industrial Stock Picks for the New YearThe industrial economy is set to rebound in the coming months, lining up with these industrial stock picks will put the odds in your favor. |

The 3 Best Industrial Stocks to Buy for 2024Industrial stocks present value despite short-term challenges. |

The Zacks Analyst Blog Highlights Novo Nordisk, Walmart, Advanced Micro Devices, Caterpillar and Union PacificNovo Nordisk, Walmart, Advanced Micro Devices, Caterpillar and Union Pacific are part of the Zacks top Analyst Blog. |

Top Analyst Reports for Novo Nordisk, Walmart & AMDToday's Research Daily features new research reports on 16 major stocks, including Novo Nordisk A/S (NVO), Walmart Inc. (WMT) and Advanced Micro Devices, Inc. (AMD). |

Why Investors Need to Take Advantage of These 2 Transportation Stocks NowThe Zacks Earnings ESP is a great way to find potential earnings surprises. Why investors should take advantage now. |

UNP Price Returns

| 1-mo | 7.49% |

| 3-mo | -0.44% |

| 6-mo | 1.08% |

| 1-year | 5.89% |

| 3-year | 17.98% |

| 5-year | 54.00% |

| YTD | -1.08% |

| 2023 | 21.61% |

| 2022 | -15.93% |

| 2021 | 23.31% |

| 2020 | 17.64% |

| 2019 | 33.70% |

UNP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching UNP

Want to do more research on Union Pacific Corp's stock and its price? Try the links below:Union Pacific Corp (UNP) Stock Price | Nasdaq

Union Pacific Corp (UNP) Stock Quote, History and News - Yahoo Finance

Union Pacific Corp (UNP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...