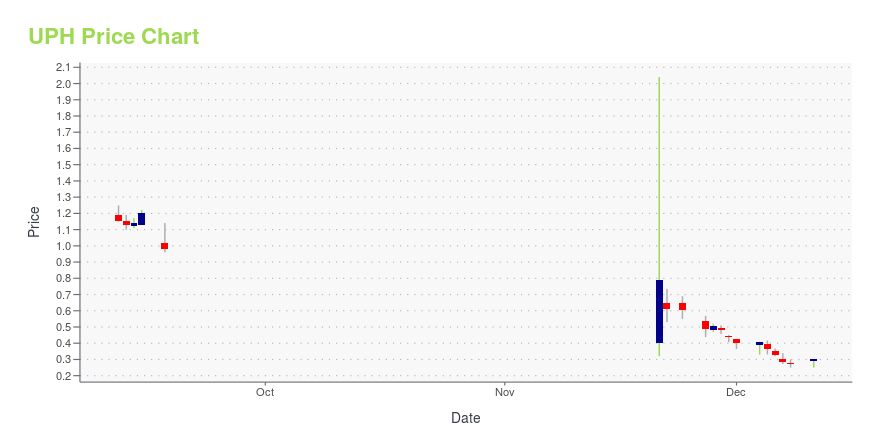

UpHealth, Inc (UPH): Price and Financial Metrics

UPH Price/Volume Stats

| Current price | $0.30 | 52-week high | $3.19 |

| Prev. close | $0.27 | 52-week low | $0.25 |

| Day low | $0.25 | Volume | 348,700 |

| Day high | $0.30 | Avg. volume | 121,201 |

| 50-day MA | $1.09 | Dividend yield | N/A |

| 200-day MA | $1.70 | Market Cap | 5.33M |

UPH Stock Price Chart Interactive Chart >

UpHealth, Inc (UPH) Company Bio

UpHealth, Inc. operates as a digital health services company. The company provides patient-centric digital health platform and tech-enabled services to manage health and integrate care. It serves empowering providers, health systems, health plans and governments, employers, and educational institutions. The company is based in Delray Beach, Florida.

UPH Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -40.24% |

| 5-year | -97.08% |

| YTD | N/A |

| 2024 | N/A |

| 2023 | 0.00% |

| 2022 | -27.23% |

| 2021 | -79.54% |

| 2020 | N/A |

Loading social stream, please wait...