UroGen Pharma Ltd. - Ordinary Shares (URGN): Price and Financial Metrics

URGN Price/Volume Stats

| Current price | $16.35 | 52-week high | $24.13 |

| Prev. close | $16.36 | 52-week low | $8.77 |

| Day low | $15.99 | Volume | 314,800 |

| Day high | $16.78 | Avg. volume | 470,222 |

| 50-day MA | $15.30 | Dividend yield | N/A |

| 200-day MA | $14.71 | Market Cap | 383.47M |

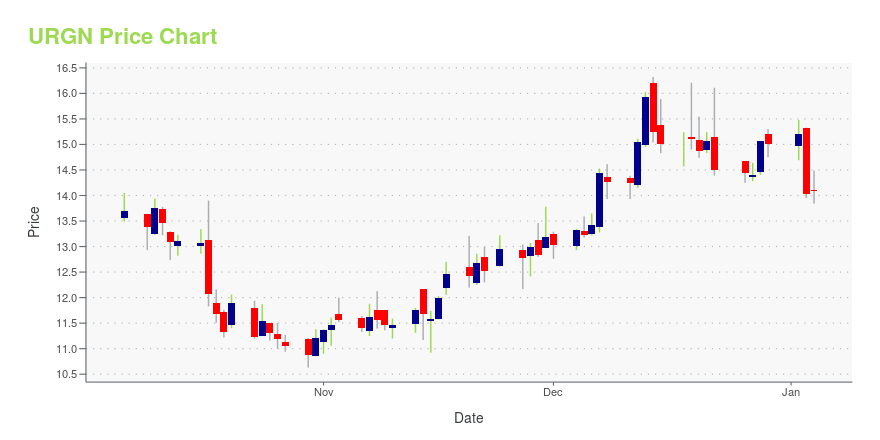

URGN Stock Price Chart Interactive Chart >

UroGen Pharma Ltd. - Ordinary Shares (URGN) Company Bio

UroGen Pharma Ltd., a clinical stage biopharmaceutical company, focuses on developing therapies for urological pathologies. The company is developing its product candidates as chemoablation agents, which are designed to remove tumors by non-surgical means, to treat several forms of non-muscle invasive urothelial cancer, including low-grade upper tract urothelial carcinoma, and low-grade bladder cancer. The company was founded in 2004 and is based in Raanana, Israel.

Latest URGN News From Around the Web

Below are the latest news stories about UROGEN PHARMA LTD that investors may wish to consider to help them evaluate URGN as an investment opportunity.

UroGen Pharma Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)PRINCETON, N.J., December 08, 2023--UroGen Pharma Ltd. (Nasdaq: URGN), a biotech company dedicated to developing and commercializing innovative solutions that treat urothelial and specialty cancers, today announced the grants of inducement restricted stock units ("RSUs") to 17 new employees in connection with their employment with UroGen. These new team members will support the ongoing commercial launch of Jelmyto® (mitomycin) for pyelocalyceal solution, UroGen’s first approved product, and the |

Shareholders in UroGen Pharma (NASDAQ:URGN) are in the red if they invested five years agoUroGen Pharma Ltd. ( NASDAQ:URGN ) shareholders should be happy to see the share price up 17% in the last month. But... |

UroGen Pharma Ltd. (NASDAQ:URGN) Q3 2023 Earnings Call TranscriptUroGen Pharma Ltd. (NASDAQ:URGN) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Good morning, ladies and gentlemen, and thank you for standing by, and welcome to the UroGen Pharma Q3 2023 Earnings Call. Please be advised that today’s conference is being recorded. I would now like to hand the conference over to your speaker […] |

UroGen Pharma Ltd (URGN) Reports Growth in Q3 Revenue and Progress in Clinical TrialsNet Revenue Rises as Company Advances with UGN-102 Clinical Development |

UroGen Pharma Reports Third Quarter 2023 Financial ResultsPRINCETON, N.J., November 14, 2023--UroGen Pharma Ltd. (Nasdaq: URGN), a biotech company dedicated to developing and commercializing innovative solutions that treat urothelial and specialty cancers, today announced financial results for the third quarter ended September 30, 2023, and provided an overview of recent developments. |

URGN Price Returns

| 1-mo | -3.65% |

| 3-mo | 15.55% |

| 6-mo | 1.43% |

| 1-year | -27.69% |

| 3-year | 4.61% |

| 5-year | -49.35% |

| YTD | 9.00% |

| 2023 | 69.11% |

| 2022 | -6.73% |

| 2021 | -47.23% |

| 2020 | -46.00% |

| 2019 | -22.50% |

Loading social stream, please wait...