U.S. Bancorp (USB): Price and Financial Metrics

USB Price/Volume Stats

| Current price | $45.46 | 52-week high | $45.85 |

| Prev. close | $45.09 | 52-week low | $30.47 |

| Day low | $45.06 | Volume | 5,680,463 |

| Day high | $45.66 | Avg. volume | 8,582,407 |

| 50-day MA | $40.85 | Dividend yield | 4.3% |

| 200-day MA | $40.32 | Market Cap | 70.94B |

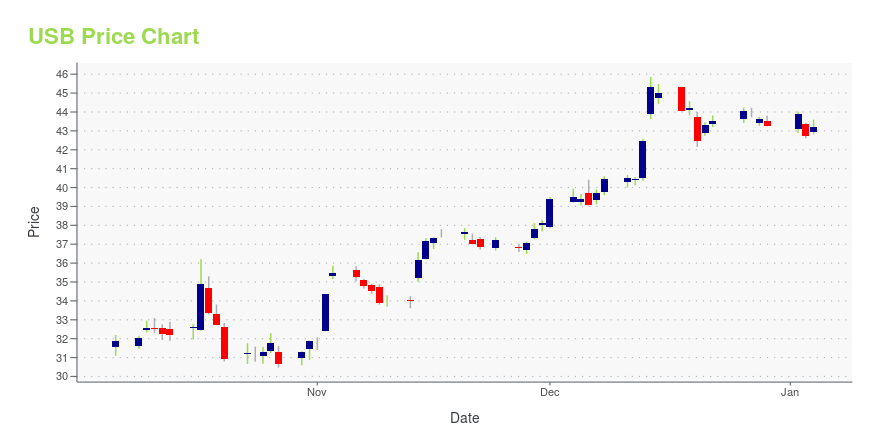

USB Stock Price Chart Interactive Chart >

U.S. Bancorp (USB) Company Bio

U.S. Bancorp (stylized as us bancorp) is an American bank holding company based in Minneapolis, Minnesota, and incorporated in Delaware. It is the parent company ofU.S. Bank National Association, and is the fifth largest banking institution in the United States. The company provides banking, investment, mortgage, trust, and payment services products to individuals, businesses, governmental entities, and other financial institutions. It has 3,106 branches and 4,842 automated teller machines, primarily in the Western and Midwestern United States. It is ranked 117th on the Fortune 500, and it is considered a systemically important bank by the Financial Stability Board. The company also owns Elavon, a processor of credit card transactions for merchants and Elan Financial Services, a credit card issuer that issue credit card products to U.S. Bank and other financial institutions. (Source:Wikipedia)

Latest USB News From Around the Web

Below are the latest news stories about US BANCORP that investors may wish to consider to help them evaluate USB as an investment opportunity.

3 Hidden Champions: The ‘Stealth Wealth’ Stocks Set to Soar in 2024Various hidden gem stocks are available with USB, SBSW, and LVMH looking best-in-class amid their overlooked value stock attributes. |

Serving Veteran Business Owners Through Care and ConnectionU.S. Bank partners with the Veteran Business Outreach Center of the Dakotas to bring together veteran business owners NORTHAMPTON, MA / ACCESSWIRE / December 28, 2023 / U.S. Bank Originally published on U.S. Bank company blog U.S. Bank and the Veterans ... |

LA Affordable Housing Developments Receive Support From Impact FinanceAdams Terrace and Jordan Downs, located in historical neighborhoods, are closing the wealth gap and creating homes for hundreds of residents NORTHAMPTON, MA / ACCESSWIRE / December 27, 2023 / U.S. Bank Originally published on U.S. Bank company bllow-to-moderate-incomeog ... |

U.S. Bancorp's Dividend AnalysisU.S. Bancorp (NYSE:USB) recently announced a dividend of $0.49 per share, payable on 2024-01-16, with the ex-dividend date set for 2023-12-28. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into U.S. Bancorp's dividend performance and assess its sustainability. |

Dividend Contenders List Ranked By Yield: Top 25In this article, we discuss top 25 dividend contenders according to yields. You can skip our detailed analysis of dividend stocks and their previous performance, and go directly to read Dividend Contenders List Ranked By Yield: Top 10. Dividend contenders typically refer to companies that have consistently increased their dividends for at least 10 consecutive […] |

USB Price Returns

| 1-mo | 15.91% |

| 3-mo | 11.94% |

| 6-mo | 9.18% |

| 1-year | 23.09% |

| 3-year | -7.36% |

| 5-year | -2.39% |

| YTD | 7.56% |

| 2023 | 4.79% |

| 2022 | -19.13% |

| 2021 | 24.32% |

| 2020 | -17.85% |

| 2019 | 33.62% |

USB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching USB

Want to do more research on Us Bancorp's stock and its price? Try the links below:Us Bancorp (USB) Stock Price | Nasdaq

Us Bancorp (USB) Stock Quote, History and News - Yahoo Finance

Us Bancorp (USB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...