UTime Ltd. (UTME): Price and Financial Metrics

UTME Price/Volume Stats

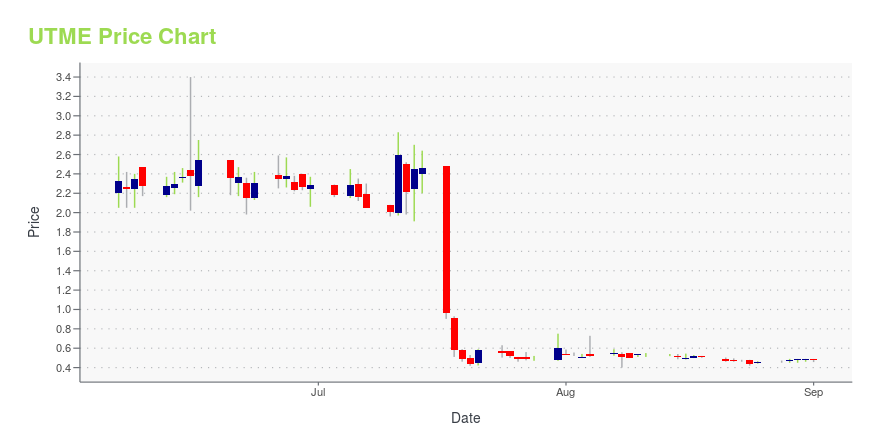

| Current price | $0.48 | 52-week high | $3.40 |

| Prev. close | $0.48 | 52-week low | $0.40 |

| Day low | $0.46 | Volume | 63,300 |

| Day high | $0.49 | Avg. volume | 642,635 |

| 50-day MA | $1.05 | Dividend yield | N/A |

| 200-day MA | $1.17 | Market Cap | 6.49M |

UTME Stock Price Chart Interactive Chart >

UTime Ltd. (UTME) Company Bio

UTime Ltd. engages in the design, development, production, sales and brand operation of mobile phones, accessories and related consumer electronics. The firm also provides Electronics Manufacturing Services, including Original Equipment Manufacturer and Original Design Manufacturer services, for well-known brands, such as TCL Communication Technology Holdings, Ltd., a subsidiary of TCL Corp., Haier Electronics Group Co., Ltd., a subsidiary of Haier Group Corp., and Quality One Wireless LLC, based in Orlando, Florida. The company operations are based in China whereas most of the products are sold globally, including India, Brazil, the United States, and other emerging markets in South Asia and Africa as well as Europe. It operates through two in-house brands, “UTime,” which is known as middle-to-high end label and targets middle class consumers from emerging markets; and “Do”, as low-to mid-end brand, is positioned to the majority of grassroots consumers and price-sensitive consumers in emerging markets. The company was founded by Minfei Bao, Junlin Zhou and Bo Tang in June 2008 and is headquartered in Shenzhen, China.

Latest UTME News From Around the Web

Below are the latest news stories about UTIME LTD that investors may wish to consider to help them evaluate UTME as an investment opportunity.

Fewer Investors Than Expected Jumping On UTime Limited (NASDAQ:UTME)UTime Limited's ( NASDAQ:UTME ) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now... |

UTime Receives Nasdaq Notification Regarding Minimum Bid Price DeficiencyNEW YORK, March 30, 2023 (GLOBE NEWSWIRE) -- UTime Limited (“UTime” or the “Company”) (Nasdaq: UTME), a mobile device manufacturing company committed to providing cost effective products and solutions to consumers globally and helping low-income individuals from established and emerging markets, have better access to updated mobile technology, today announced that the Company received a written notification (the “Notification Letter”) from the Nasdaq Stock Market LLC (“Nasdaq”) on March 24, 2023 |

UTime Announces Financial Results for The First Six Months of Fiscal Year 2023NEW YORK, March 24, 2023 (GLOBE NEWSWIRE) -- UTime Limited (“UTime” or the “Company”) (Nasdaq: UTME), a mobile device manufacturing company committed to providing cost effective products and solutions to consumers globally and helping low-income individuals from established and emerging markets, have better access to updated mobile technology, today announced its financial results for the first six months of fiscal year 2023 ended September 30, 2022. First Six Months of Fiscal Year 2023 Financia |

UTME Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -1.64% |

| 3-year | -93.68% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -66.57% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...