UTStarcom Holdings Corp - Ordinary Shares (UTSI): Price and Financial Metrics

UTSI Price/Volume Stats

| Current price | $2.73 | 52-week high | $4.04 |

| Prev. close | $2.55 | 52-week low | $2.20 |

| Day low | $2.67 | Volume | 4,088 |

| Day high | $2.80 | Avg. volume | 3,616 |

| 50-day MA | $2.73 | Dividend yield | N/A |

| 200-day MA | $2.99 | Market Cap | 25.76M |

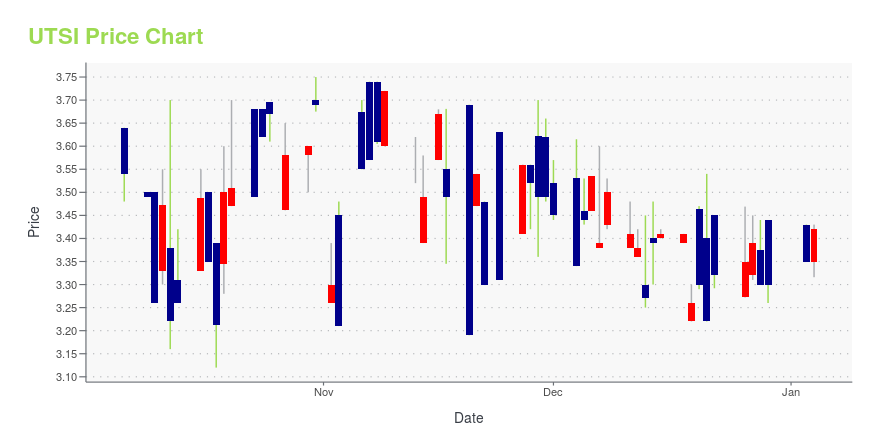

UTSI Stock Price Chart Interactive Chart >

UTStarcom Holdings Corp - Ordinary Shares (UTSI) Company Bio

UTStarcom Holdings Corp. operates as a telecom infrastructure provider to develop technology for bandwidth from cloud-based services, mobile, streaming, and other applications. The company was founded in 1991 and is based in Admiralty, Hong Kong.

Latest UTSI News From Around the Web

Below are the latest news stories about UTSTARCOM HOLDINGS CORP that investors may wish to consider to help them evaluate UTSI as an investment opportunity.

Here's Why We're Not At All Concerned With UTStarcom Holdings' (NASDAQ:UTSI) Cash Burn SituationThere's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com... |

UTStarcom Reports Unaudited Financial Results for First Half of 2023HANGZHOU, China, Aug. 30, 2023 (GLOBE NEWSWIRE) -- UTStarcom (“UT,” “UTStarcom” or the “Company”) (NASDAQ: UTSI), a global telecommunications infrastructure provider, today reported its unaudited financial results and a business update for the six months ended June 30, 2023 (“the first half”). Business Highlights: Progress with China Unicom Research Institute on development of the Disaggregated 5G Transport Network Solution. UT continued work on Phase 2 development that focuses on SRv6 functiona |

UTStarcom Files 2022 Form 20-FHANGZHOU, China, April 27, 2023 (GLOBE NEWSWIRE) -- UTStarcom (“UT” or the “Company”) (NASDAQ: UTSI), a global telecommunications infrastructure provider, today filed its Annual Report on Form 20-F for the year ended December 31, 2022 with the U.S. Securities and Exchange Commission. The Form 20-F report is available on the SEC EDGAR website at www.sec.gov or in PDF format at www.utstar.com/sec-filing. Interested parties also may request a hard copy of the report free of charge through written r |

UTStarcom Holdings Full Year 2022 Earnings: US$0.56 loss per share (vs US$0.65 loss in FY 2021)UTStarcom Holdings ( NASDAQ:UTSI ) Full Year 2022 Results Key Financial Results Revenue: US$14.0m (down 12% from FY... |

UTStarcom Reports Unaudited Financial Results for Second Half and Full Year 2022HANGZHOU, China, March 24, 2023 (GLOBE NEWSWIRE) -- UTStarcom (“UT,” “UTStarcom” or the “Company”) (NASDAQ: UTSI), a global telecommunications infrastructure provider, today reported its unaudited financial results for the six months and full year ended December 31, 2022, and provided a business update. Business Update Progress in Collaboration with China Unicom Research Institute on Development of 5G Transport Network Solution. Following the completion of NOS v.1.x Phase 2 development (announce |

UTSI Price Returns

| 1-mo | -3.87% |

| 3-mo | -0.72% |

| 6-mo | -8.70% |

| 1-year | -30.89% |

| 3-year | -49.07% |

| 5-year | -76.55% |

| YTD | -20.64% |

| 2023 | -3.10% |

| 2022 | 2.01% |

| 2021 | -36.96% |

| 2020 | -53.22% |

| 2019 | 8.46% |

Continue Researching UTSI

Want to do more research on Utstarcom Holdings Corp's stock and its price? Try the links below:Utstarcom Holdings Corp (UTSI) Stock Price | Nasdaq

Utstarcom Holdings Corp (UTSI) Stock Quote, History and News - Yahoo Finance

Utstarcom Holdings Corp (UTSI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...