Valaris Ltd. (VAL): Price and Financial Metrics

VAL Price/Volume Stats

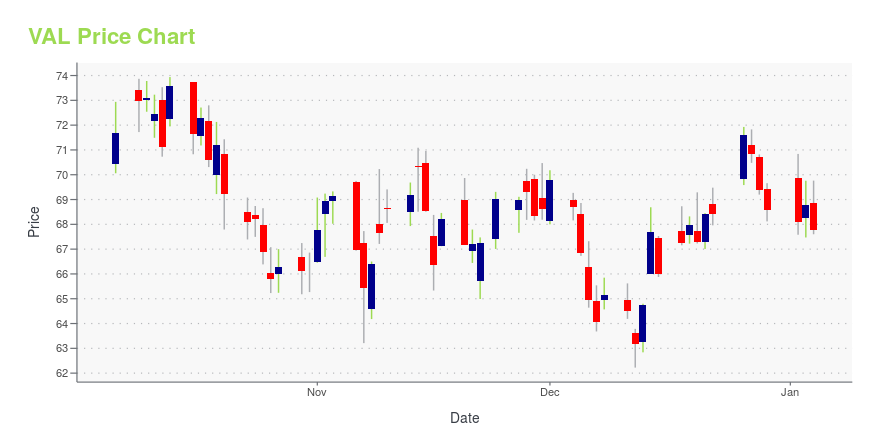

| Current price | $79.92 | 52-week high | $81.97 |

| Prev. close | $79.85 | 52-week low | $60.06 |

| Day low | $79.00 | Volume | 774,300 |

| Day high | $81.97 | Avg. volume | 928,308 |

| 50-day MA | $75.01 | Dividend yield | N/A |

| 200-day MA | $69.95 | Market Cap | 5.79B |

VAL Stock Price Chart Interactive Chart >

Valaris Ltd. (VAL) Company Bio

Valaris plc is an offshore drilling contractor headquartered in Houston, Texas, and incorporated in the UK. It is the largest offshore drilling and well drilling company in the world, and owns 61 rigs, including 45 offshore jackup rigs, 11 drillships, and 5 semi-submersible platform drilling rigs. In 2020, the company's largest customers were BP, Saudi Aramco, and Total S.A

Latest VAL News From Around the Web

Below are the latest news stories about VALARIS LTD that investors may wish to consider to help them evaluate VAL as an investment opportunity.

Valaris Reports Third Quarter 2023 ResultsHAMILTON, Bermuda, November 07, 2023--Valaris Limited (NYSE: VAL) ("Valaris" or the "Company") today reported third quarter 2023 results. |

Valaris Issues Fleet Status ReportHAMILTON, Bermuda, November 01, 2023--Valaris Limited (NYSE: VAL) ("Valaris" or the "Company") today issued a Fleet Status Report that provides the current status of the Company’s fleet of offshore drilling rigs along with certain contract information for these assets. The Fleet Status Report can be found on the "Investors" section of the Company’s website www.valaris.com. |

Valaris Announces Financing for Kingdom 1 and 2 Newbuild JackupsHAMILTON, Bermuda, October 26, 2023--Valaris Announces Financing for Kingdom 1 and 2 Newbuild Jackups |

Valaris Schedules Third Quarter 2023 Earnings Release and Conference CallHAMILTON, Bermuda, October 24, 2023--Valaris Limited (NYSE: VAL) ("Valaris" or the "Company") will hold its third quarter 2023 earnings conference call at 9:00 a.m. CST (10:00 a.m. EST) on Tuesday, November 7, 2023. The earnings release will be issued before the New York Stock Exchange opens that morning. |

Valaris Announces Contract Awards and Fleet Status UpdatesHAMILTON, Bermuda, September 11, 2023--Valaris Limited (NYSE: VAL) ("Valaris" or the "Company") announced today new contracts and contract extensions, with associated contract backlog of approximately $65 million, awarded subsequent to issuing the Company’s most recent fleet status report on August 1, 2023. Contract backlog excludes lump sum payments such as mobilization fees and capital reimbursements. |

VAL Price Returns

| 1-mo | 9.46% |

| 3-mo | 15.49% |

| 6-mo | 16.64% |

| 1-year | 5.52% |

| 3-year | 196.55% |

| 5-year | N/A |

| YTD | 16.55% |

| 2023 | 1.40% |

| 2022 | 87.83% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...