Village Bank and Trust Financial Corp. (VBFC): Price and Financial Metrics

VBFC Price/Volume Stats

| Current price | $46.50 | 52-week high | $49.44 |

| Prev. close | $46.42 | 52-week low | $36.08 |

| Day low | $46.50 | Volume | 100 |

| Day high | $46.50 | Avg. volume | 1,440 |

| 50-day MA | $43.26 | Dividend yield | 1.48% |

| 200-day MA | $46.02 | Market Cap | 69.52M |

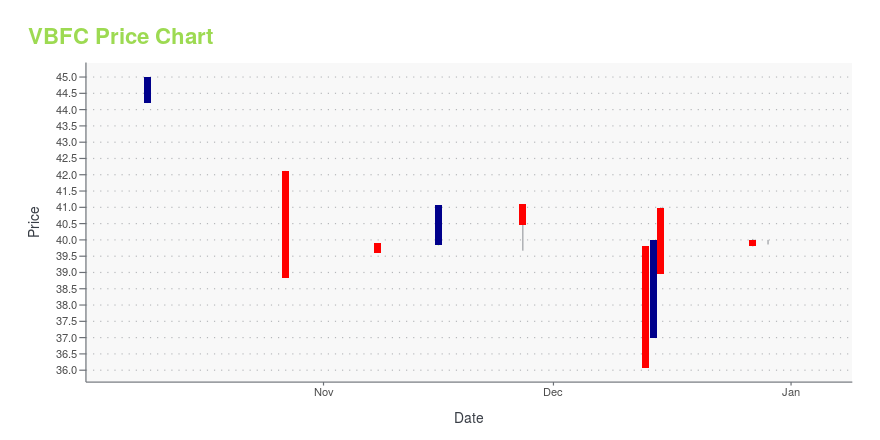

VBFC Stock Price Chart Interactive Chart >

Village Bank and Trust Financial Corp. (VBFC) Company Bio

Village Bank and Trust Financial Corp. operates as the bank holding company for Village Bank that provides banking and related financial products and services to small and medium sized businesses, professionals, and individuals. It operates through two segments, Traditional Commercial Banking and Mortgage Banking. The company accepts checking, savings, money market, and individual retirement accounts, as well as certificates of deposit and other depository services. It also provides secured and unsecured commercial loans to small-and medium-sized businesses for various purposes, such as funding working capital needs, business expansion, and purchase of equipment and machinery; loans for acquiring, developing, constructing, and owning commercial real estate properties; and secured and unsecured consumer loans for financing automobiles, home improvements, education, and personal investments, as well as originates mortgage loans, real estate construction, and acquisition loans for sale in the secondary market. In addition, the company offers online banking, mobile banking, and remote deposit capture services for business clients. It provides its products and services through 9 banking offices and 1 mortgage loan production office in Central Virginia in the counties of Chesterfield, Hanover, Henrico, Powhatan, and James City. The company was founded in 1999 and is headquartered in Midlothian, Virginia.

Latest VBFC News From Around the Web

Below are the latest news stories about VILLAGE BANK & TRUST FINANCIAL CORP that investors may wish to consider to help them evaluate VBFC as an investment opportunity.

There's A Lot To Like About Village Bank and Trust Financial's (NASDAQ:VBFC) Upcoming US$0.18 DividendRegular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Village Bank... |

Village Bank and Trust Financial Corp. (NASDAQ:VBFC) Looks Like A Good Stock, And It's Going Ex-Dividend SoonRegular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Village Bank... |

Investors in Village Bank and Trust Financial (NASDAQ:VBFC) have seen respectable returns of 62% over the past three yearsBy buying an index fund, investors can approximate the average market return. But if you pick the right individual... |

There's A Lot To Like About Village Bank and Trust Financial's (NASDAQ:VBFC) Upcoming US$0.16 DividendVillage Bank and Trust Financial Corp. ( NASDAQ:VBFC ) is about to trade ex-dividend in the next 4 days. Typically, the... |

Village Bank and Trust Financial's (NASDAQ:VBFC) Upcoming Dividend Will Be Larger Than Last Year'sVillage Bank and Trust Financial Corp.'s ( NASDAQ:VBFC ) dividend will be increasing from last year's payment of the... |

VBFC Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 10.35% |

| 1-year | 2.78% |

| 3-year | N/A |

| 5-year | 39.88% |

| YTD | 17.66% |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | N/A |

| 2020 | 0.00% |

| 2019 | 21.88% |

VBFC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...