Victory Capital Holdings, Inc. (VCTR): Price and Financial Metrics

VCTR Price/Volume Stats

| Current price | $53.45 | 52-week high | $54.94 |

| Prev. close | $52.67 | 52-week low | $28.66 |

| Day low | $53.14 | Volume | 295,368 |

| Day high | $54.07 | Avg. volume | 412,671 |

| 50-day MA | $50.46 | Dividend yield | 2.75% |

| 200-day MA | $40.58 | Market Cap | 3.46B |

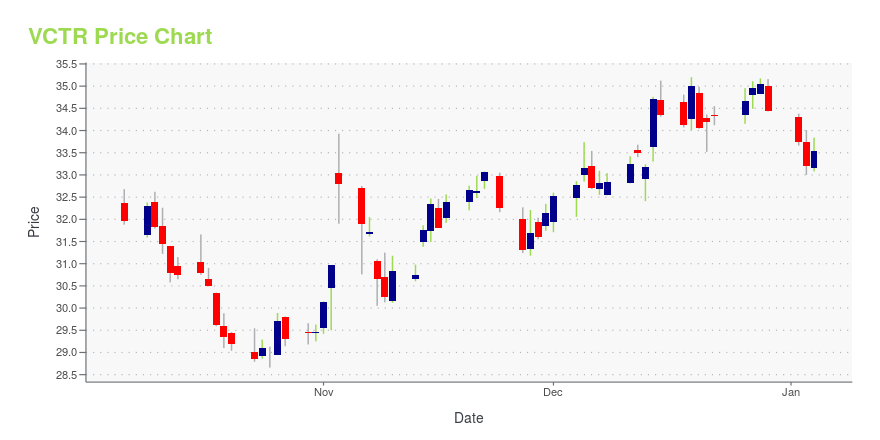

VCTR Stock Price Chart Interactive Chart >

Victory Capital Holdings, Inc. (VCTR) Company Bio

Victory Capital Holdings, Inc., operates as an independent investment management company in the United States. It offers investment advisory, fund administration, and distribution services through broker-dealers, retirement platforms, and registered investment advisor networks. As of September 30, 2017, its franchises and solutions platform managed a set of 70 investment strategies for a range of institutional and retail clients. The company was founded in 2013 and is based in Brooklyn, Ohio.

Latest VCTR News From Around the Web

Below are the latest news stories about VICTORY CAPITAL HOLDINGS INC that investors may wish to consider to help them evaluate VCTR as an investment opportunity.

Victory Capital Adds VictoryShares® Small Cap Free Cash Flow ETF to its ETF LineupSAN ANTONIO, December 21, 2023--SFLO seeks to provide investment results that track the performance of the Victory U.S. Small Cap Free Cash Flow Index. |

Victory Capital (VCTR) November AUM Increases 7.2% to $159.6BVictory Capital (VCTR) records an AUM balance of $159.6 billion for the end of November 2023, up 7.2% from the end of the previous month. |

Victory Capital Reports November 2023 Assets Under ManagementSAN ANTONIO, December 11, 2023--Victory Capital Reports November 2023 Assets Under Management of $159.6 Billion |

Victory Capital Holdings Inc's Dividend AnalysisVictory Capital Holdings Inc (NASDAQ:VCTR) recently announced a dividend of $0.32 per share, payable on 2023-12-22, with the ex-dividend date set for 2023-12-08. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Victory Capital Holdings Inc's dividend performance and assess its sustainability. |

Byline (BY) Rewards Shareholders With New Repurchase PlanByline's (BY) board of directors authorizes the repurchase of up to 1.25 million shares, starting Jan 1, 2024, through Dec 31, 2024. |

VCTR Price Returns

| 1-mo | 9.98% |

| 3-mo | 4.40% |

| 6-mo | 57.01% |

| 1-year | 66.70% |

| 3-year | 97.94% |

| 5-year | 221.52% |

| YTD | 57.69% |

| 2023 | 33.46% |

| 2022 | -23.85% |

| 2021 | 49.73% |

| 2020 | 19.73% |

| 2019 | 106.30% |

VCTR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VCTR

Want to do more research on Victory Capital Holdings Inc's stock and its price? Try the links below:Victory Capital Holdings Inc (VCTR) Stock Price | Nasdaq

Victory Capital Holdings Inc (VCTR) Stock Quote, History and News - Yahoo Finance

Victory Capital Holdings Inc (VCTR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...