Verb Technology Company, Inc. (VERB): Price and Financial Metrics

VERB Price/Volume Stats

| Current price | $0.09 | 52-week high | $3.30 |

| Prev. close | $0.09 | 52-week low | $0.09 |

| Day low | $0.09 | Volume | 3,534,752 |

| Day high | $0.09 | Avg. volume | 16,603,918 |

| 50-day MA | $0.13 | Dividend yield | N/A |

| 200-day MA | $0.19 | Market Cap | 9.42M |

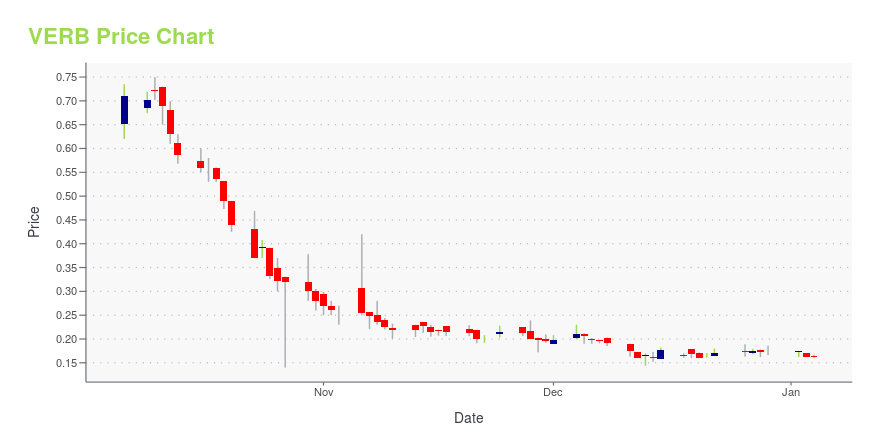

VERB Stock Price Chart Interactive Chart >

Verb Technology Company, Inc. (VERB) Company Bio

Verb Technology Company, Inc. designs and develops application software. The Company offers customer relationship management, lead generation, and video marketing software applications. Verb Technology serves clients in the United States.

Latest VERB News From Around the Web

Below are the latest news stories about VERB TECHNOLOGY COMPANY INC that investors may wish to consider to help them evaluate VERB as an investment opportunity.

VERB's CEO Addresses Stockholders in Year-End LetterLOS ALAMITOS, Calif. and LAS VEGAS, Dec. 27, 2023 (GLOBE NEWSWIRE) -- Verb Technology Company, Inc. (Nasdaq: VERB) ("VERB" or the "Company"), the company behind MARKET.live, the innovative multi-vendor, multi-presenter livestream social shopping platform, announces today that VERB CEO Rory J. Cutaia has issued a year-end letter to its stockholders, published in its entirety below. Dear Verb Stockholders As the year draws to a close, I wanted to take this opportunity to thank you all for your con |

VERB's MARKET.live Adds Twenty More Retailers to Its Livestream Social Shopping PlatformContinues Impressive Retailer Growth Through Q4 And The Holiday Season Expansion Expected To Accelerate Through 2024LOS ALAMITOS, Calif. and LAS VEGAS, Dec. 26, 2023 (GLOBE NEWSWIRE) -- Verb Technology Company, Inc. (Nasdaq: VERB) ("VERB" or the "Company"), the company behind MARKET.live, the innovative multi-vendor, multi-presenter livestream social shopping platform, announces twenty more dynamic new brands have joined the MARKET.live platform. The recent completion of the Company's tech integ |

VERB's MARKET.live Launches National TV Campaign to Promote Its Exciting New Drop Ship ProgramHighly Respected Branded Response Agency, SmartMedia Technologies Engaged To Develop and Execute Campaign Launching December 18LOS ALAMITOS, Calif. and LAS VEGAS, Dec. 13, 2023 (GLOBE NEWSWIRE) -- Verb Technology Company, Inc. (Nasdaq: VERB) ("VERB" or the "Company"), the company behind MARKET.live, the innovative multi-vendor, multi-presenter livestream social shopping platform, announces a national television campaign, launching December 18, 2023, to promote its exciting new Drop Ship Program. |

VERB's MARKET.live Adds Five More Retail Brands to Its Livestream Social Shopping PlatformLOS ALAMITOS, Calif. and LAS VEGAS, Dec. 12, 2023 (GLOBE NEWSWIRE) -- Verb Technology Company, Inc. (Nasdaq: VERB) ("VERB" or the "Company"), the company behind MARKET.live, the innovative multi-vendor, multi-presenter livestream social shopping platform, announces five more dynamic new brands have joined the MARKET.live platform this week. The recent completion of the Company’s tech integrations with the ecommerce solutions powering thousands of vendors’ existing ecommerce stores are continuing |

VERB's MARKET.live WELCOMES CardCash TO ITS LIVESTREAM SOCIAL SHOPPING PLATFORMPREMIUM BRAND DISCOUNT GIFT CARDS INCLUDING APPLE, MACY’S, NIKE, CALLAWAY, TOP GOLF, and BUILD-A-BEAR AVAILABLE NOW Shop the CardCash live presentation on MARKET.live scheduled for December 13th at 9 am PST LOS ALAMITOS, Calif. and LAS VEGAS, Dec. 11, 2023 (GLOBE NEWSWIRE) -- Verb Technology Company, Inc. (Nasdaq: VERB) ("VERB" or the "Company"), the company behind MARKET.live, the innovative multi-vendor, multi-presenter livestream social shopping platform, announces an exciting new collaborati |

VERB Price Returns

| 1-mo | -22.48% |

| 3-mo | -40.67% |

| 6-mo | -37.89% |

| 1-year | -92.04% |

| 3-year | -99.91% |

| 5-year | -99.89% |

| YTD | -47.70% |

| 2023 | -97.38% |

| 2022 | -86.77% |

| 2021 | -24.85% |

| 2020 | 6.45% |

| 2019 | -67.40% |

Loading social stream, please wait...