V.F. Corp. (VFC): Price and Financial Metrics

VFC Price/Volume Stats

| Current price | $16.39 | 52-week high | $21.17 |

| Prev. close | $16.07 | 52-week low | $11.00 |

| Day low | $16.01 | Volume | 4,213,099 |

| Day high | $16.41 | Avg. volume | 8,734,615 |

| 50-day MA | $13.73 | Dividend yield | 2.21% |

| 200-day MA | $15.33 | Market Cap | 6.38B |

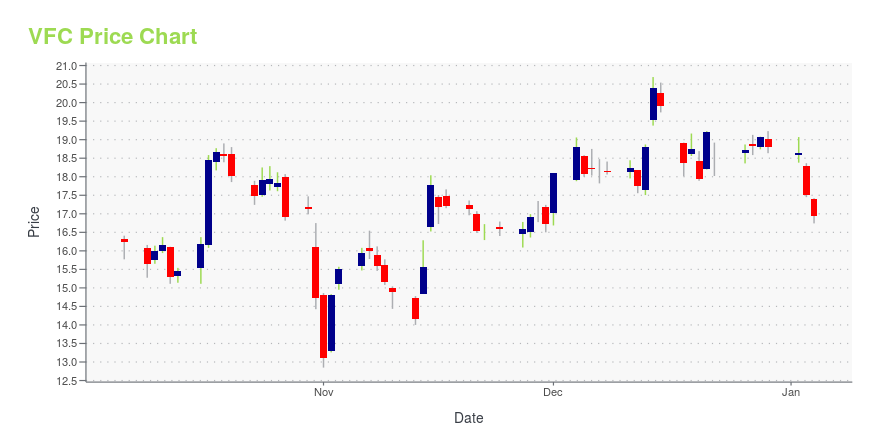

VFC Stock Price Chart Interactive Chart >

V.F. Corp. (VFC) Company Bio

VF Corporation (formerly Vanity Fair Mills until 1969) is an American global apparel and footwear company founded in 1899 and headquartered in Denver, Colorado. The company's 13 brands are organized into three categories: Outdoor, Active and Work. The company controls 55% of the U.S. backpack market with the JanSport, Eastpak, Timberland, and North Face brands. (Source:Wikipedia)

Latest VFC News From Around the Web

Below are the latest news stories about V F CORP that investors may wish to consider to help them evaluate VFC as an investment opportunity.

Industry Moves: Crocs Appoints John Replogle, Neeraj Tolmare to Its Board of Directors + More NewsWho's in, who's out, who's been promoted and who's been hired from across the footwear and fashion industry. |

3 Charts For Investors to Watch Tuesday: Enphase Energy, VF Corp., SLX ETFThese two stocks and one ETF are worth putting on your watchlist today. We look at the reasons why and identify important chart levels to watch. |

Vans and North Face Owner VF Corp. Tumbled Over 7%—Here's WhyVF Corp. (VFC) shares fell over 7% Monday after the owner of the Vans and North Face shoe and apparel brands warned that the company’s business operations were disrupted by a cyberattack. VF said in a regulatory filing Monday that the hacker encrypted some IT systems and stole data, including personal information. VF said the hack was first detected Dec. 13. |

S&P 500 Gains and Losses Today: Amazon Reportedly Aims To Expand Reach Into SportsThe S&P 500 advanced 0.5% on Monday, Dec. 18, 2023, carrying over good feelings about the economy and talk of interest rate cuts from last week. |

US STOCKS-Wall Street ends higher, extending rate-cut rallyU.S. stocks gained ground on Monday as market participants parsed mounting expectations of interest rate cuts from the Federal Reserve in the coming year and looked ahead to a week of crucial economic data. A broad but modest rally boosted the S&P 500 and the Nasdaq to solid gains, while the Dow ended flat. "Markets are heading in the direction of the Fed beginning to cut interest rates next year," said Tom Hainlin, national investment strategist at U.S. Bank Wealth Management in Minneapolis. |

VFC Price Returns

| 1-mo | 16.49% |

| 3-mo | 30.53% |

| 6-mo | -4.37% |

| 1-year | -12.28% |

| 3-year | -77.75% |

| 5-year | -78.01% |

| YTD | -11.74% |

| 2023 | -28.51% |

| 2022 | -60.38% |

| 2021 | -12.05% |

| 2020 | -12.00% |

| 2019 | 51.76% |

VFC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VFC

Want to see what other sources are saying about V F Corp's financials and stock price? Try the links below:V F Corp (VFC) Stock Price | Nasdaq

V F Corp (VFC) Stock Quote, History and News - Yahoo Finance

V F Corp (VFC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...