Vicor Corporation (VICR): Price and Financial Metrics

VICR Price/Volume Stats

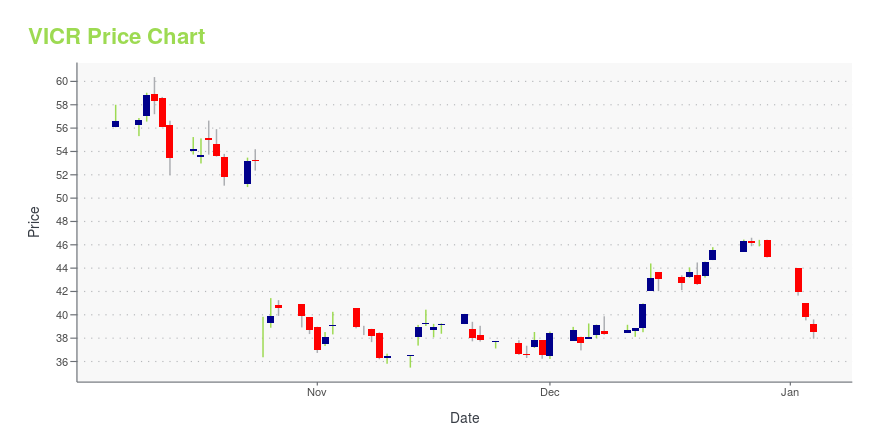

| Current price | $40.33 | 52-week high | $98.38 |

| Prev. close | $38.43 | 52-week low | $30.90 |

| Day low | $38.49 | Volume | 312,675 |

| Day high | $40.44 | Avg. volume | 236,964 |

| 50-day MA | $34.85 | Dividend yield | N/A |

| 200-day MA | $38.31 | Market Cap | 1.80B |

VICR Stock Price Chart Interactive Chart >

Vicor Corporation (VICR) Company Bio

Vicor Corporation designs, develops, manufactures, and markets modular components and complete systems for converting, regulating, and controlling electric current worldwide. The company was founded in 1981 and is based in Andover, Massachusetts.

Latest VICR News From Around the Web

Below are the latest news stories about VICOR CORP that investors may wish to consider to help them evaluate VICR as an investment opportunity.

Should You Investigate Vicor Corporation (NASDAQ:VICR) At US$37.62?Vicor Corporation ( NASDAQ:VICR ), is not the largest company out there, but it received a lot of attention from a... |

Top Technolgy Stocks for Q4 2023The top-performing technology stocks this quarter include Applied Optoelectronics Inc., EHang Holdings Ltd., and Cipher Mining Inc., which have more than tripled in value in the past year. |

Estimating The Fair Value Of Vicor Corporation (NASDAQ:VICR)Key Insights The projected fair value for Vicor is US$42.63 based on 2 Stage Free Cash Flow to Equity With US$39.25... |

VideoRay drives underwater exploration for the toughest aquatic missions using Vicor power modulesVicor Powering Innovation podcast discusses the proliferation of ROV applications and how VideoRay is responding to new underwater missions VideoRay VideoRay, a leading manufacturer of underwater remotely operated vehicles (ROVs), offers the safest and most effective way to maintain underwater security, support salvage efforts and explore the depths of the ocean. ANDOVER, Mass., Nov. 15, 2023 (GLOBE NEWSWIRE) -- Vicor Corporation, the leader in high‑performance power modules, speaks with VideoRa |

3 Russell 2000 Stocks That Are Growing Faster Than the S&P 500These three small-cap stocks are outperforming the S&P 500, making them great stocks to buy for the next year or two. |

VICR Price Returns

| 1-mo | 20.89% |

| 3-mo | 17.20% |

| 6-mo | 6.83% |

| 1-year | -57.61% |

| 3-year | -62.65% |

| 5-year | 32.10% |

| YTD | -10.26% |

| 2023 | -16.39% |

| 2022 | -57.67% |

| 2021 | 37.69% |

| 2020 | 97.39% |

| 2019 | 23.63% |

Continue Researching VICR

Want to see what other sources are saying about Vicor Corp's financials and stock price? Try the links below:Vicor Corp (VICR) Stock Price | Nasdaq

Vicor Corp (VICR) Stock Quote, History and News - Yahoo Finance

Vicor Corp (VICR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...