View Inc. (VIEW): Price and Financial Metrics

VIEW Price/Volume Stats

| Current price | $0.33 | 52-week high | $28.80 |

| Prev. close | $0.51 | 52-week low | $0.33 |

| Day low | $0.33 | Volume | 2,060,100 |

| Day high | $0.43 | Avg. volume | 244,743 |

| 50-day MA | $1.30 | Dividend yield | N/A |

| 200-day MA | $4.95 | Market Cap | 1.34M |

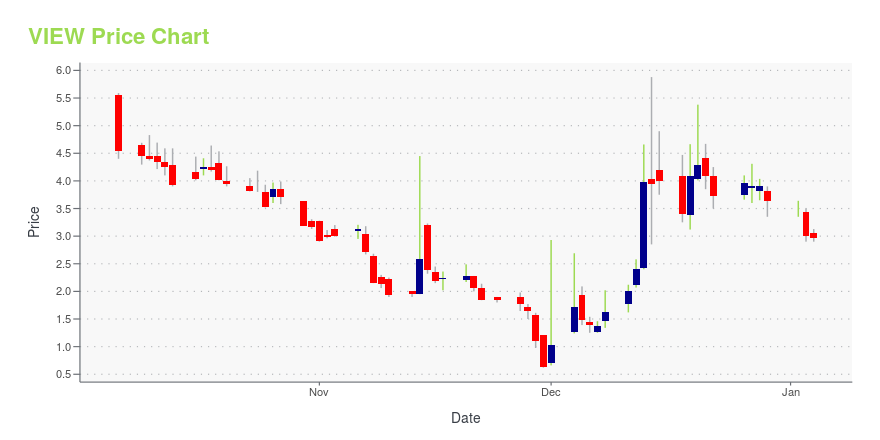

VIEW Stock Price Chart Interactive Chart >

View Inc. (VIEW) Company Bio

View, Inc. Class A Common Stock, also called View, is a technology company, which designs and offers smart windows and building. Its product smart windows provide access to natural light by reducing energy consumption to mitigate the effects of climate change. The company is headquartered in Milpitas, CA. The listed name for VIEW is View, Inc. Class A Common Stock.

Latest VIEW News From Around the Web

Below are the latest news stories about VIEW INC that investors may wish to consider to help them evaluate VIEW as an investment opportunity.

RXR Selects View Smart Windows for 89 Dekalb Avenue in Brooklyn, NY, the Second RXR Multifamily Development to Feature View89 Dekalb Avenue, Brooklyn, NY RXR Selects View Smart Windows for Multifamily Development in New York MILPITAS, Calif., Nov. 14, 2023 (GLOBE NEWSWIRE) -- View, Inc. (Nasdaq: VIEW) (“View”), the leader in smart building technologies, announced that its Smart Windows will envelop 89 Dekalb Avenue, RXR’s 324-unit multifamily development in Brooklyn, New York. This marks View’s second multifamily project with RXR, following Hamilton Green, a 684,000 square feet mixed-use development that will includ |

View Announces Q3 2023 EarningsMILPITAS, Calif., Nov. 14, 2023 (GLOBE NEWSWIRE) -- View, Inc. (Nasdaq: VIEW) (“View” or the “Company”), a leader in smart building platforms and technologies, today announced financial results for Q3 2023. Q3 2023 Financial Highlights Revenue Growth: Q3’23 revenue of $38 million grew 61% year-over-year compared to $24 million in Q3’22.Gross Margin Improvement: Higher quality revenue and lower fixed costs drove improving margins year-over-year: Gross Margin improved from ($25 million) in Q3’22 t |

View to Release Third Quarter 2023 Financial Results Tuesday, November 14thMILPITAS, Calif., Nov. 09, 2023 (GLOBE NEWSWIRE) -- View, Inc. (Nasdaq: VIEW) (“View” or the “Company”), the leader in smart building technologies, today announced that the Company plans to report Q3 2023 financial results after the market close on Tuesday, November 14th. View will host a conference call to discuss its financial results at 2:30 p.m. Pacific Time / 5:30 p.m. Eastern Time on Tuesday, November 14th. A live webcast of the call can be accessed on View’s Investor Relations website at |

View, Inc. Adds Tridium’s Niagara to View Secure Edge MarketplaceMILPITAS, Calif., Oct. 30, 2023 (GLOBE NEWSWIRE) -- View, Inc. (NASDAQ: VIEW) (“View”), the leader in smart building technologies, has announced its partnership with Tridium to deliver the most recent release of the Niagara Framework®, Niagara 4.13, on View Secure Edge. This collaboration will enable Tridium's innovative containerized Niagara to run within View Secure Edge, creating a transformative turn-key infrastructure solution for building operations. View’s partnership with Tridium broaden |

View Announces $50 Million Financing with Strategic Real Estate InvestorsMILPITAS, Calif., Oct. 16, 2023 (GLOBE NEWSWIRE) -- View, Inc. (Nasdaq: VIEW) (“View” or the “Company”) today announced $50 million financing in the form of a senior secured credit facility from an investor consortium comprised of strategic real estate investors Cantor Fitzgerald, RXR, Anson and Affinius. “Climate change is one of the pressing issues of our generation and the extreme weather events of this year are stark reminders of the threats we will continue to face as a society. For well ov |

VIEW Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -71.79% |

| 1-year | -97.00% |

| 3-year | -99.91% |

| 5-year | N/A |

| YTD | -90.93% |

| 2023 | -93.71% |

| 2022 | -75.32% |

| 2021 | -64.52% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...