Fresh Vine Wine, Inc. (VINE): Price and Financial Metrics

VINE Price/Volume Stats

| Current price | $0.49 | 52-week high | $1.06 |

| Prev. close | $0.50 | 52-week low | $0.28 |

| Day low | $0.46 | Volume | 156,900 |

| Day high | $0.50 | Avg. volume | 185,209 |

| 50-day MA | $0.56 | Dividend yield | N/A |

| 200-day MA | $0.65 | Market Cap | 7.90M |

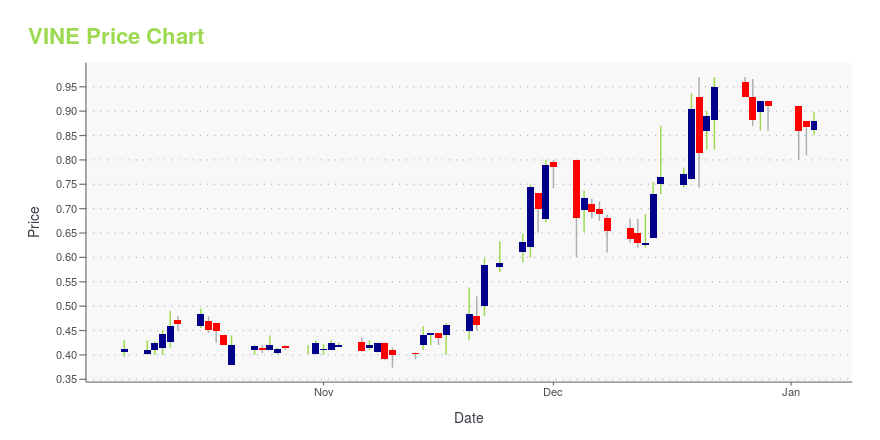

VINE Stock Price Chart Interactive Chart >

Fresh Vine Wine, Inc. (VINE) Company Bio

Fresh Vine Wine, Inc. produces and sells low-carb and low-calorie wines in the United States and Puerto Rico. Its wine varietals include cabernet sauvignon, pinot noir, chardonnay, and rose. The company offers its products through wholesale, retail, and direct-to-consumer channels, including online e-commerce sites and mobile applications, and retail stores. Fresh Vine Wine, Inc. was founded in 2019 and is based in Plymouth, Minnesota. Fresh Vine Wine, Inc. operates as a subsidiary of Nechio & Novak, LLC.

Latest VINE News From Around the Web

Below are the latest news stories about FRESH VINE WINE INC that investors may wish to consider to help them evaluate VINE as an investment opportunity.

Fresh Vine Wine, Inc. Enters Into Letter of Intent With Live Entertainment and Hospitality Company Notes Live, Inc.CHARLOTTE, N.C., Dec. 04, 2023 (GLOBE NEWSWIRE) -- Fresh Vine Wine Inc. (NYSE American: VINE) (“Fresh Vine”) today announced it has entered into a non-binding letter of intent for a business combination transaction with Notes Live, Inc. (“Notes Live"), the Colorado-based live entertainment and hospitality company that currently operates venues in Colorado Springs and the Atlanta metropolitan area. Notes Live is also in the process of developing the Sunset Amphitheatre, a luxury open-air music an |

Fresh Vine Wine, Inc. Receives Acceptance Letter from NYSE AmericanCHARLOTTE, N.C., Nov. 27, 2023 (GLOBE NEWSWIRE) -- On November 21, 2023, Fresh Vine Wine Inc. (NYSE American: VINE) (the “Company”) received notification (the “Acceptance Letter”) from NYSE American LLC (“NYSE American”) that the Company’s plan to regain compliance with NYSE American’s listing standards was accepted. As previously disclosed, on September 8, 2023, the Company received notice from NYSE American stating that the Company was not in compliance with the $4.0 million stockholders’ equi |

Fresh Vine Wine, Inc. Submits Plan of Compliance to NYSE AmericanCompany Continues to Explore Strategic OpportunitiesMINNEAPOLIS, Oct. 17, 2023 (GLOBE NEWSWIRE) -- Fresh Vine Wine, Inc. (NYSE American: VINE) today announced that it has submitted a plan of compliance to NYSE American LLC (“NYSE American”) addressing how the Company intends to regain compliance with NYSE American’s minimum stockholders’ equity requirements for continued listing. The Company previously announced that it had received notice from NYSE American that it was not in compliance with th |

Fresh Vine Wine, Inc. Receives NYSE American Noncompliance NoticeMINNEAPOLIS, Sept. 13, 2023 (GLOBE NEWSWIRE) -- Fresh Vine Wine Inc. (NYSE American: VINE) today announced that it received notice from NYSE American LLC ("NYSE American") on September 8, 2023 that it is not in compliance with the continued listing standard set forth in Section 1003(a)(ii) of the NYSE American Company Guide (the "Company Guide"). That section applies if a listed company has stockholders’ equity of less than $4 million and has reported losses from continuing operations and/or net |

Fresh Vine Wine, Inc. Announces Exploration of Strategic Opportunities to Maximize Shareholder ValueMINNEAPOLIS, Aug. 24, 2023 (GLOBE NEWSWIRE) -- Fresh Vine Wine Inc. (NYSE American: VINE) today announced that its board of directors has initiated an exploration of strategic opportunities by way of merger, acquisition, or any accretive strategic transaction to enhance shareholder value. “We believe it’s in the best interest of our shareholders to investigate a range of strategic alternatives. As we navigate this process, we will do our best to keep shareholders apprised to the best of our abil |

VINE Price Returns

| 1-mo | -14.60% |

| 3-mo | -19.67% |

| 6-mo | -43.02% |

| 1-year | -22.22% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -46.15% |

| 2023 | -7.05% |

| 2022 | -80.81% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...