Vinci Partners Investments Ltd. (VINP): Price and Financial Metrics

VINP Price/Volume Stats

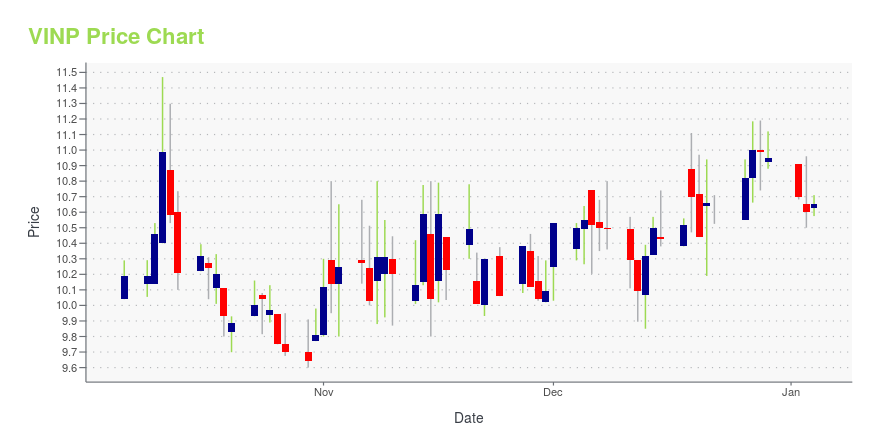

| Current price | $11.49 | 52-week high | $11.85 |

| Prev. close | $11.17 | 52-week low | $9.35 |

| Day low | $11.27 | Volume | 43,700 |

| Day high | $11.60 | Avg. volume | 56,095 |

| 50-day MA | $10.90 | Dividend yield | 6.11% |

| 200-day MA | $10.74 | Market Cap | 617.92M |

VINP Stock Price Chart Interactive Chart >

Vinci Partners Investments Ltd. (VINP) Company Bio

Vinci Partners Investments Ltd. operates as an asset management firm. The Company focuses on private equity, real estates, hedge funds, financial advisory, and other investment products. Vinci Partners Investments serves customers worldwide.

Latest VINP News From Around the Web

Below are the latest news stories about VINCI PARTNERS INVESTMENTS LTD that investors may wish to consider to help them evaluate VINP as an investment opportunity.

Brazil’s Maturing Private Markets Attract U.S. Investment FirmsBrazil’s private-capital industry continues to mature and is attracting U.S. asset managers looking to expand in new regions, as investment risks increase in other markets such as China. |

Q3 2023 Vinci Partners Investments Ltd Earnings CallQ3 2023 Vinci Partners Investments Ltd Earnings Call |

VINCI PARTNERS REPORTS THIRD QUARTER 2023 EARNINGS RESULTSVinci Partners Investments Ltd. (NASDAQ: VINP) ("Vinci Partners", "we", "us" or "our"), the controlling company of a leading alternative investment platform in Brazil, reported today its third quarter 2023 earnings results. |

Rithm (RITM) Beats Q3 Earnings and Revenue EstimatesRithm (RITM) delivered earnings and revenue surprises of 70.59% and 18.18%, respectively, for the quarter ended September 2023. Do the numbers hold clues to what lies ahead for the stock? |

VINCI PARTNERS TO ANNOUNCE THIRD QUARTER 2023 RESULTS AND HOST WEBCAST AFTER MARKET CLOSE ON WEDNESDAY, NOVEMBER 08, 2023Vinci Partners Investments Ltd. (NASDAQ: VINP) ("Vinci Partners," "we," "us," or "our"), the controlling company of a leading alternative investment platform in Brazil, announced today that it will release financial results for the third quarter 2023 after market close on Wednesday, November 08, 2023, and host a conference call via public webcast at 5:00 pm ET. |

VINP Price Returns

| 1-mo | 5.22% |

| 3-mo | 6.60% |

| 6-mo | 9.52% |

| 1-year | 20.66% |

| 3-year | 14.00% |

| 5-year | N/A |

| YTD | 8.52% |

| 2023 | 30.48% |

| 2022 | -9.34% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

VINP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...