Vishay Precision Group, Inc. (VPG): Price and Financial Metrics

VPG Price/Volume Stats

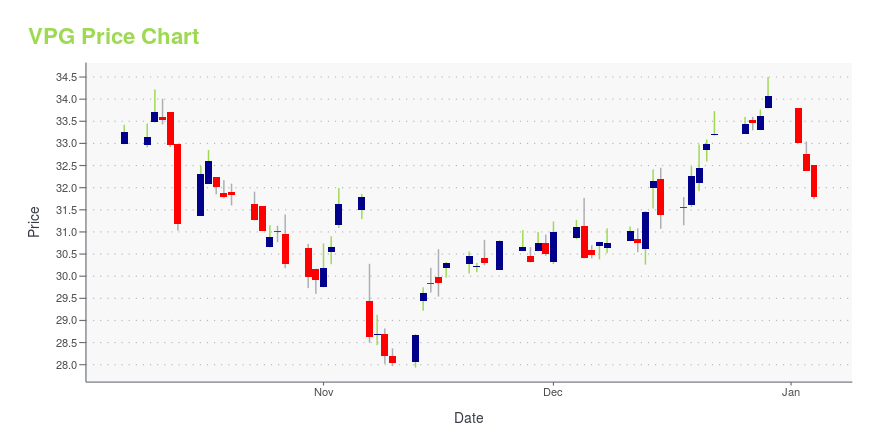

| Current price | $34.33 | 52-week high | $38.38 |

| Prev. close | $33.86 | 52-week low | $27.93 |

| Day low | $33.43 | Volume | 60,800 |

| Day high | $34.53 | Avg. volume | 56,269 |

| 50-day MA | $32.00 | Dividend yield | N/A |

| 200-day MA | $32.33 | Market Cap | 458.44M |

VPG Stock Price Chart Interactive Chart >

Vishay Precision Group, Inc. (VPG) Company Bio

Vishay Precision Group, Inc. designs, manufactures, and markets sensors, sensor-based measurement systems, specialty resistors, and strain gages based upon its proprietary technology in Asia, the United States, the United Kingdom, Israel, Europe, and Canada. The company is based in Malvern, Pennsylvania.

Latest VPG News From Around the Web

Below are the latest news stories about VISHAY PRECISION GROUP INC that investors may wish to consider to help them evaluate VPG as an investment opportunity.

Sidoti Events, LLC's Virtual December Small-Cap ConferenceNEW YORK, NY / ACCESSWIRE / December 5, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day December Small-Cap Conference taking place Wednesday and Thursday, December ... |

VPG to Participate in the Sidoti December 2023 Small-Cap Investor ConferenceMALVERN, Pa., Nov. 22, 2023 (GLOBE NEWSWIRE) -- Vishay Precision Group, Inc. (NYSE: VPG), a leader in precision measurement and sensing technologies, announced that the company will present at the Sidoti December 2023 Small-Cap Virtual Investor Conference on Thursday, December 7, 2023 at 10:45 a.m. ET. A live and on-demand webcast of VPG’s presentation will be available to the public and can be accessed from the following link: https://sidoti.zoom.us/webinar/VPG, or on VPG’s website: ir.vpgsenso |

Investors one-year losses continue as Vishay Precision Group (NYSE:VPG) dips a further 11% this week, earnings continue to declineIt's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make... |

Vishay Precision Group, Inc. (NYSE:VPG) Q3 2023 Earnings Call TranscriptVishay Precision Group, Inc. (NYSE:VPG) Q3 2023 Earnings Call Transcript November 7, 2023 Vishay Precision Group, Inc. misses on earnings expectations. Reported EPS is $0.47 EPS, expectations were $0.56. Operator: Hello, everyone, and welcome to the VPG’s Third Quarter Fiscal 2023 Earnings Call. My name is Nadia, and I’ll be coordinating the call today. [Operator […] |

Q3 2023 Vishay Precision Group Inc Earnings CallQ3 2023 Vishay Precision Group Inc Earnings Call |

VPG Price Returns

| 1-mo | 12.82% |

| 3-mo | 2.75% |

| 6-mo | 4.03% |

| 1-year | -7.34% |

| 3-year | -2.80% |

| 5-year | -17.00% |

| YTD | 0.76% |

| 2023 | -11.85% |

| 2022 | 4.12% |

| 2021 | 17.92% |

| 2020 | -7.41% |

| 2019 | 12.47% |

Continue Researching VPG

Want to do more research on Vishay Precision Group Inc's stock and its price? Try the links below:Vishay Precision Group Inc (VPG) Stock Price | Nasdaq

Vishay Precision Group Inc (VPG) Stock Quote, History and News - Yahoo Finance

Vishay Precision Group Inc (VPG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...