VerifyMe, Inc. (VRME): Price and Financial Metrics

VRME Price/Volume Stats

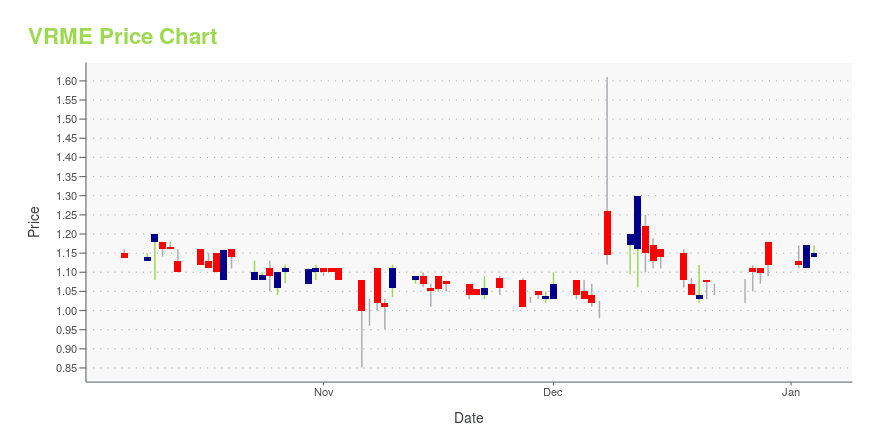

| Current price | $1.21 | 52-week high | $2.45 |

| Prev. close | $1.17 | 52-week low | $0.85 |

| Day low | $1.17 | Volume | 5,963 |

| Day high | $1.25 | Avg. volume | 33,269 |

| 50-day MA | $1.46 | Dividend yield | N/A |

| 200-day MA | $1.30 | Market Cap | 12.31M |

VRME Stock Price Chart Interactive Chart >

VerifyMe, Inc. (VRME) Company Bio

VerifyMe, Inc. provides software solutions. The Company designs and develops security software to safeguard against counterfeiting. VerifyMe serves consumers, companies and governments around the world.

Latest VRME News From Around the Web

Below are the latest news stories about VERIFYME INC that investors may wish to consider to help them evaluate VRME as an investment opportunity.

VerifyMe Reports Third Quarter 2023 Financial ResultsVerifyMe, Inc. (NASDAQ: VRME) together with its subsidiaries, Trust Codes Global Limited ("Trust Codes Global") and PeriShip Global LLC ("PeriShip Global"), (together "VerifyMe," "we," "our," or the "Company") provides brand owners time and temperature sensitive logistics, supply chain traceability, authentication, anti-counterfeiting, and data-rich brand enhancement services, announced today the Company's financial results for its third quarter ended September 30, 2023 ("Q3 2023"). |

VerifyMe to Report Third Quarter 2023 Financial Results on November 8, 2023VerifyMe, Inc. (NASDAQ: VRME) together with its subsidiaries, Trust Codes Global Limited ("Trust Codes Global") and PeriShip Global LLC ("PeriShip Global"), (together "VerifyMe," "we," "our," or the "Company") provides brand owners time and temperature sensitive logistics, supply chain traceability, authentication, anti-counterfeiting, and data-rich brand enhancement services, announced today that it will release its financial results for the third quarter ended September 30, 2023 on November 8, |

Amcor Demonstrating Connected Packaging at Pack Expo 2023 with VerifyMe, IncVerifyMe, Inc. (NASDAQ: VRME) together with its subsidiaries, Trust Codes Global Limited ("Trust Codes Global") and PeriShip Global LLC ("PeriShip Global"), (together "VerifyMe," "we," "our," or the "Company") provides brand owners time and temperature sensitive logistics, supply chain traceability, authentication, anti-counterfeiting, and data-rich brand enhancement services, announced today that they will be demonstrating their connected packaging solution in conjunction with Amcor at Pack Exp |

Leadership Team Leads $1.1 Million Convertible Note Capital RaiseVerifyMe, Inc. (NASDAQ: VRME) together with its subsidiaries, Trust Codes Global Limitd ("Trust Codes Global") and PeriShip Global LLC ("PeriShip Global"), (together "VerifyMe," "we," "our," or the "Company") provides brand owners time and temperature sensitive logistics, supply chain traceability and monitoring, authentication, anti-counterfeiting, and data-rich brand enhancement services, announced today that on Friday, August 25, 2023, it closed (the "Closing Date") a private placement (the " |

7 Stocks That Wall Street Is Ignoring (But Shouldn’t Be!)If you don’t mind going for the detour to seek out under-the-radar stocks to buy, these market ideas could be enticing. |

VRME Price Returns

| 1-mo | -11.03% |

| 3-mo | -27.54% |

| 6-mo | 11.01% |

| 1-year | 2.55% |

| 3-year | -68.89% |

| 5-year | -82.07% |

| YTD | 8.04% |

| 2023 | -3.45% |

| 2022 | -63.46% |

| 2021 | -11.81% |

| 2020 | 3.00% |

| 2019 | -68.15% |

Continue Researching VRME

Want to do more research on VerifyMe Inc's stock and its price? Try the links below:VerifyMe Inc (VRME) Stock Price | Nasdaq

VerifyMe Inc (VRME) Stock Quote, History and News - Yahoo Finance

VerifyMe Inc (VRME) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...