Verra Mobility Corporation (VRRM): Price and Financial Metrics

VRRM Price/Volume Stats

| Current price | $30.39 | 52-week high | $31.03 |

| Prev. close | $30.00 | 52-week low | $17.04 |

| Day low | $30.15 | Volume | 838,256 |

| Day high | $30.63 | Avg. volume | 1,059,435 |

| 50-day MA | $27.64 | Dividend yield | N/A |

| 200-day MA | $23.72 | Market Cap | 5.06B |

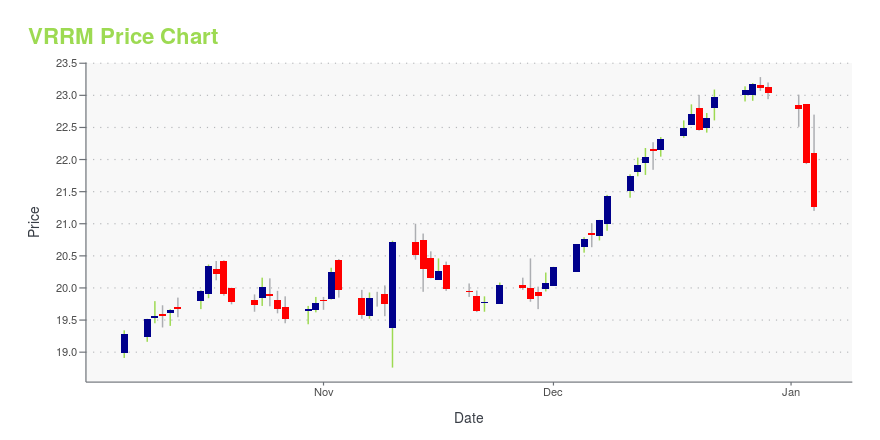

VRRM Stock Price Chart Interactive Chart >

Verra Mobility Corporation (VRRM) Company Bio

Verra Mobility Corporation designs and develops mobility software. The Company offers speed, bus lane, railroad crossing, and school bus top arm enforcement and enforcement ticketing, as well as crash reports and video-enabled crime data analysis solutions. Verra Mobility serves customers worldwide.

Latest VRRM News From Around the Web

Below are the latest news stories about VERRA MOBILITY CORP that investors may wish to consider to help them evaluate VRRM as an investment opportunity.

Chart Of The Day: Verra Mobility Provides Smart Mobility Technology SolutionsVerra Mobility Corporation provides smart mobility technology solutions and services in the United States, Australia, Canada, and Europe. |

Estimating The Fair Value Of Verra Mobility Corporation (NASDAQ:VRRM)Key Insights Using the 2 Stage Free Cash Flow to Equity, Verra Mobility fair value estimate is US$25.09 With US$20.82... |

Thanksgiving weekend traffic data shows red-light running is most prevalent on WednesdaysVerra Mobility Corporation (NASDAQ: VRRM), a leading provider of smart mobility technology solutions, released data from its proprietary U.S. traffic safety systems showing the most red-light violations during the holiday weekend occurred on the Wednesday before Thanksgiving, while the most speeding violations occurred on Thanksgiving Day. |

Verra Mobility to Participate at the UBS Global Technology ConferenceVerra Mobility Corporation (NASDAQ: VRRM), a leading provider of smart mobility technology solutions, announced today that David Roberts, President and Chief Executive Officer and Craig Conti, Chief Financial Officer, are scheduled to participate in a fireside chat at the UBS Global Technology Conference on Tuesday, November 28, 2023 at 10:15am MT (12:15pm ET). The Company's presentation will be posted on the Company's investor relations website at ir.verramobility.com on the morning of the sche |

Should You Be Excited About Verra Mobility Corporation's (NASDAQ:VRRM) 20% Return On Equity?One of the best investments we can make is in our own knowledge and skill set. With that in mind, this article will... |

VRRM Price Returns

| 1-mo | 10.59% |

| 3-mo | 25.42% |

| 6-mo | 28.94% |

| 1-year | 51.95% |

| 3-year | 98.63% |

| 5-year | 117.85% |

| YTD | 31.96% |

| 2023 | 66.52% |

| 2022 | -10.37% |

| 2021 | 14.98% |

| 2020 | -4.07% |

| 2019 | 43.34% |

Continue Researching VRRM

Want to do more research on VERRA MOBILITY Corp's stock and its price? Try the links below:VERRA MOBILITY Corp (VRRM) Stock Price | Nasdaq

VERRA MOBILITY Corp (VRRM) Stock Quote, History and News - Yahoo Finance

VERRA MOBILITY Corp (VRRM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...