Vivos Therapeutics Inc. (VVOS): Price and Financial Metrics

VVOS Price/Volume Stats

| Current price | $6.97 | 52-week high | $7.95 |

| Prev. close | $6.82 | 52-week low | $1.97 |

| Day low | $6.30 | Volume | 481,781 |

| Day high | $7.40 | Avg. volume | 436,060 |

| 50-day MA | $3.08 | Dividend yield | N/A |

| 200-day MA | $3.35 | Market Cap | 41.05M |

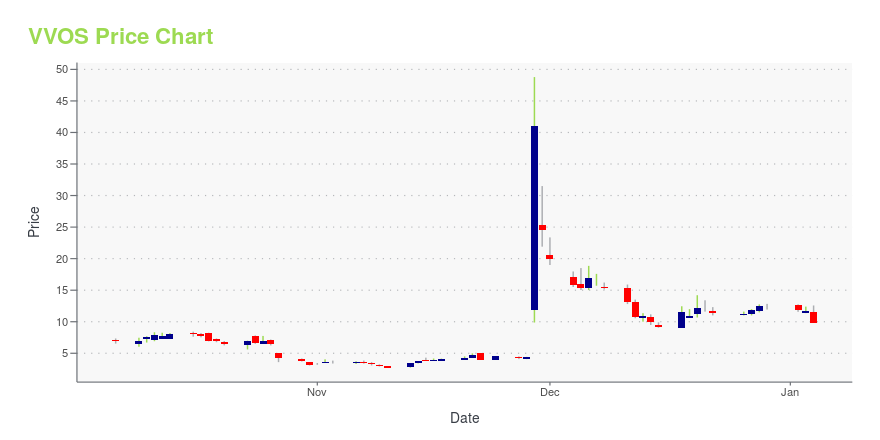

VVOS Stock Price Chart Interactive Chart >

Vivos Therapeutics Inc. (VVOS) Company Bio

Vivos Therapeutics, Inc., a medical technology company, engages in the development and commercialization of technology solutions for patients with sleep disordered breathing (SDB) comprising mild-to-moderate obstructive sleep apnea (OSA). The company's solutions cover proprietary alternatives for treating mild-to-moderate OSA; craniofacial and anatomical anomalies that are associated with mild-to-moderate OSA. Its treatment for OSA involves specially designed and customized oral appliances and treatment protocols. The company, through its Vivos Integrated Healthcare Network, provides access to healthcare providers for delivering care for patients suffering from sleep disordered breathing, including mild-to-moderate OSA. Vivos Therapeutics, Inc. also licenses its intellectual property to third-party manufacturers, which fabricate appliance devices for healthcare professionals. It caters to general dentists, medical doctors, myofunctional therapists, chiropractors, healthcare providers, and patients in the United States and Canada. Vivos Therapeutics, Inc. was founded in 2007 and is based in Highlands Ranch, Colorado.

VVOS Price Returns

| 1-mo | 225.70% |

| 3-mo | 218.26% |

| 6-mo | 36.13% |

| 1-year | 148.04% |

| 3-year | -80.23% |

| 5-year | N/A |

| YTD | 62.47% |

| 2024 | -65.51% |

| 2023 | 23.78% |

| 2022 | -82.13% |

| 2021 | -61.93% |

| 2020 | N/A |

Loading social stream, please wait...