Wallbox N.V., (WBX): Price and Financial Metrics

WBX Price/Volume Stats

| Current price | $1.42 | 52-week high | $4.28 |

| Prev. close | $1.43 | 52-week low | $1.21 |

| Day low | $1.40 | Volume | 213,769 |

| Day high | $1.48 | Avg. volume | 413,063 |

| 50-day MA | $1.41 | Dividend yield | N/A |

| 200-day MA | $1.55 | Market Cap | 243.91M |

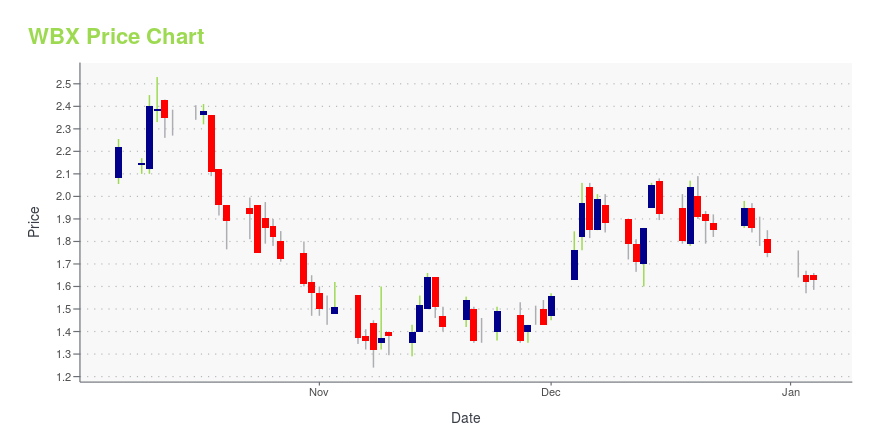

WBX Stock Price Chart Interactive Chart >

Wallbox N.V., (WBX) Company Bio

Wallbox N.V., a technology company, creates electric vehicle charging and energy management systems that redefine users' relationship to the grid. It provides a portfolio of charging and energy management solutions for residential, semi-public, and public use worldwide. The company was founded in 2015 and is headquatered in Barcelona, Spain.

Latest WBX News From Around the Web

Below are the latest news stories about WALLBOX NV that investors may wish to consider to help them evaluate WBX as an investment opportunity.

3 Millionaire-Maker Penny Stocks to Hold for 36 MonthsBuy these millionaire-maker penny stocks at their current, attractive levels. |

Best EV Charging Stocks 2024: 3 Names to Add to Your Must-Buy LIstInvestors eye the best EV charging stocks to buy at oversold levels for multibagger returns backed by positive industry tailwinds. |

WeaveGrid and Wallbox Partner to Give Customers Access to Wind-Powered EV Charging at Xcel EnergySAN FRANCISCO & MOUNTAIN VIEW, Calif., December 18, 2023--WeaveGrid, a software company that enables rapid electric vehicle (EV) adoption on the electric grid, and Wallbox (NYSE: WBX), a leading provider of electric vehicle charging solutions, today announced a partnership that will expand access to utility managed charging programs for North American Wallbox owners, beginning with Xcel Energy’s Charging Perks Program in Colorado, where Xcel Energy currently serve around 1.3M residential custome |

Wallbox Announces Educational Webcast on its DC Fast Charging Portfolio Hosted by Canaccord GenuityBARCELONA, Spain, December 06, 2023--Wallbox (NYSE:WBX), a leading provider of electric vehicle (EV) charging and energy management solutions worldwide, today announced its participation in an upcoming DC Fast Charging Webcast for the investor community. |

Generac and Wallbox Announce Strategic Investment and Commercial AgreementGenerac Power Systems, Inc. (NYSE: GNRC), a leading global designer and manufacturer of energy technology solutions and other power products, today announced it has made a minority investment in Wallbox (NYSE: WBX), a global leader in smart electric vehicle (EV) charging and energy management solutions. The minority investment includes adding a Generac seat on Wallbox's board of directors and a global commercial agreement to provide Generac's residential and commercial customers with the next ge |

WBX Price Returns

| 1-mo | 11.81% |

| 3-mo | -4.70% |

| 6-mo | -2.74% |

| 1-year | -62.63% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -18.86% |

| 2023 | -51.12% |

| 2022 | -78.09% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...